| TAMBUN | FY15Q2 | FY15Q1 | FY14Q4 | FY14Q3 | FY14Q2 |

| Revenue | 60.0 | 130.4 | 110.1 | 116.8 | 128.0 |

| Gross Profit | 28.0 | 47.6 | 38.8 | 43.8 | 38.1 |

| Gross% | 46.7 | 36.5 | 35.2 | 37.5 | 29.8 |

| PBT | 22.2 | 41.3 | 35.1 | 34.8 | 33.1 |

| PBT% | 37.0 | 31.7 | 31.9 | 29.8 | 25.9 |

| PAT | 17.1 | 29.9 | 25.9 | 25.5 | 25.4 |

| Total Equity | 417.1 | 427.5 | 397.0 | 377.9 | 351.0 |

| Total Assets | 733.7 | 667.5 | 661.8 | 636.8 | 676.1 |

| Trade Receivables | 125.0 | 146.0 | 118.0 | 117.0 | 106.8 |

| Prop dev cost | 67.6 | 59.5 | 72.5 | 83.9 | 57.2 |

| Inventories | 2.2 | 2.2 | 2.4 | 0.3 | 0.3 |

| Cash | 143.4 | 116.0 | 131.5 | 151.1 | 194.4 |

| Total Liabilities | 314.0 | 237.1 | 262.4 | 256.6 | 323.0 |

| Trade Payables | 104.2 | 95.9 | 103.9 | 93.1 | 102.0 |

| ST Borrowings | 39.2 | 30.9 | 35.2 | 13.8 | 38.3 |

| LT Borrowings | 165.0 | 119.1 | 117.7 | 133.2 | 164.7 |

| Net Cash Flow | 12.0 | -12.3 | 17.7 | 37.3 | 80.6 |

| Operation | 3.6 | 28.8 | -5.5 | 3.0 | -23.1 |

| Investment | -28.3 | -11.6 | -12.8 | 8.5 | 2.4 |

| Financing | 36.7 | -29.6 | 36.0 | 25.8 | 101.3 |

| Dividend paid | 12.6 | 12.6 | 26.8 | 26.8 | 7.9 |

| EPS | 4.05 | 7.10 | 6.24 | 6.22 | 6.34 |

| NAS | 0.99 | 1.01 | 0.94 | 0.92 | 0.86 |

| D/E Ratio | 0.15 | 0.08 | 0.05 | Net cash | 0.02 |

After a pleasant surprise in FY15Q1, Tambun posts another surprise in FY15Q2, but this time it's a negative surprise.

FY15Q2's revenue (RM60mil) and PATAMI (RM17mil) drop 54% and 43% respectively QoQ.

I don't expect FY15Q2 to match FY15Q1's result but I actually expect a PATAMI of RM20-25mil.

At 1H15, revenue and PATAMI drop 21% and 7.3% respectively compared to 1H14.

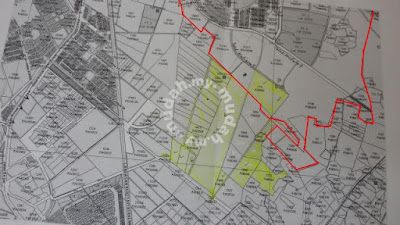

Net debt/equity ratio increases to 0.15 as it has completed acquisition of land worth RM39.4mil in Bukit Mertajam in Jun15.

Besides, another surprise is about its new sales achieved in FY15Q2 which is just RM25mil. It is a far cry from RM146.3mil a quarter ago.

According to Tambun, the reason for poorer FY15Q2 is because of the timing of billing, in which a few projects are near completion while 2 new projects launched in end of 2014 are in early stage of construction.

Pearl Avenue shop offices have got its OC in mid Aug while Pearl Residence, Permai Residence & Pearl Harmoni should follow very soon.

The 2 new projects launched in end 2014 mentioned here should be Raintree Park 1 and Pearl Avenue 2.

Construction of Pearl Avenue 2 is running quite well but progress of Raintree Park 1 is rather slow and is still at very early stage.

Average projects take-up rate is at a good 89.2% which is not a surprise to me, while unbilled sales at end of 1H15 drops from RM443.6mil to RM408.1mil.

Tambun has started to sell other new projects in Pearl City such as high-rise Avenue Garden (2 blocks), Pearl Tropika (DST) and Raintree Park 2 some time ago.

It seems like these projects are still yet to be approved by local authority but most of the units have already been snatched up by buyers.

From a visit to Tambun's sales office, I think these projects should register at least 70% take-up rate, especially Avenue Garden.

Earthwork and piling have already started at the site of Avenue Garden, and the show houses of Raintree Park 2 are being constructed now.

When these projects are approved later, then new sales figure is likely to jump.

Avenue Garden & Raintree Park 2 are said to have a combined GDV of RM300mil.

According to the latest Pearl City master plan, there are a few new additions to its residential projects such as Pearl Botanik (gated & guarded) and non-gated Pearl Saujana I, II, III & Pearl Impiana.

I expect these projects to be launched in 2016.

After this, vacant land in Pearl City will be about half the size when Tambun started its first project Pearl Garden here in 2009.

However, high-rise projects such as apartment and retirement village in the future will help to boost its GDV.

Avenue Garden

In June last year, Tambun Indah announced that it planned to acquire 27 parcels of land measuring 209.54 acres south of its Pearl City for RM150mil.

The land is still on sale at the moment.

Which developer will get the land finally?

I have toured the school and I would say that I am quite impressed.

It has 2 sports complex halls with 3 & 2 badminton courts respectively, 2 swimming pools, 2 basketball courts, a futsal court and a football field.

Other facilities are standard such as library, study corners, play corners, outdoor corners, dance room, music room, science labs, black box theater etc.

There is a meal plan designed by dietitian as well.

Annual school fees range from RM24,000 to RM40,000, excluding books, uniform, resource fee, exam fee, meal plan etc.

GEMS

I heard that there are already 170 students enrollment 2 weeks ago. I think it should get at least 200 students when the school starts next week.

According to earlier analyst report by RHB, the rental for the first 8 years will be fixed at 8% of construction cost plus 4% of land value. The rental will increase by 2% annually from ninth year onward.

The construction cost for the school is reported as RM38mil earlier by RHB. If the 8-acre (350k sq ft) land is valued at RM35psf, then the potential gross annual rental will be RM3.5mil, which represents a good yield of 7%.

From latest cash flow statement, there is an addition of investment properties worth RM29.3mil and I believe that it should be the cost for GEMS International School construction.

So, Tambun will start to get full contribution from this rental income from FY15Q3.

Tambun has 50% shares in the operation of the mall as it is a 50:50 JV with a mall operator based in Kedah who also operates Amanjaya Mall in Sg Petani.

The construction cost for phase 1 (170k sq ft) is about RM45-50mil and could potentially offer a yield of 8% according to RHB analyst.

So in year 2016, Tambun will add another asset to its book.

Meanwhile, the construction of Jit Sin SPS branch is progressing rather slowly due to shortage of fund. It is expected to start student intake in 2017.

For me, it remains the most important catalyst for residential demand in Pearl City.

Everyone is concern about the slow down in property market.

In Penang, some may worry that the launch of so many affordable projects by the state government may affect developers who build affordable homes.

I'm not too worry though, as Seberang Perai Selatan is booming and Tambun mainly sells landed houses.

Though I won't define a DST selling at RM450k is affordable, it may still looks relatively cheap when Eco World launch its DST at Eco Meadows later.

If you visit Pearl City sales office, you can see that their new projects still sell very well.

Of course we won't expect Tambun to grow at the same pace like it did since 2010. Its earning may even fall in year 2016.

Like any other developers, Tambun needs to purchase more land to sustain its earning in the future.

Personally I'm still optimistic that Tambun's net profit in FY15 can reach RM100mil.

Tambun's share price has dropped quite a lot in the past one month. With this kind of quarterly result, it will surely succumbed to more selling pressure.

I just consider myself a "business owner" in Tambun who develops Pearl City and who now owns a 20-acre land in the bustling Song Ban Kheng road in BM.

ongkkh

Hello are you from Bukit Mertajam? Have chance would like to meet up with you....

2015-08-28 22:33