业务

- 制造和维修老虎机(slot machine)

RGB(RGB国际,0037,主板贸服股),成立于1986年,并于2004年1月13日上市当年的MESDAQ,过后于2008年转至主板。

RGB的前生为DGATE(Dream Gate,梦城机构),于2010年6月4日易名RGB。

总部设在槟城的RGB,其创办人为拿督蔡金城,核心业务主要集中在角子机(俗称老虎机)及相关设备的销售、市场行销和生产。它也为游戏机提供特许经营项目,以及技术支援管理服务。

该公司的收入来源主要有两种:-

- 代理销售老虎机给予娱乐中心、俱乐部或赌场,以及提供维修服务

- 出租老虎机或将老虎机置放在俱乐部或赌场内,以收取租金或分享利润

目前该公司的市场主要以东盟国家为主,如马来西亚、柬埔寨、菲律宾和寮国。该公司也有意进军印度和斯里兰卡。

RGB自2004年上市至今,有过一段大起大落的悲壮经历。曾遇受到重大挫折由盛转衰,过后又站稳脚步一路走到现在。

2003年,RGB进军柬埔寨,把所有主力都集中在当地,当时可说是该公司最鼎盛的时期是2007年,当年的净利达到3830万令吉。

之后,传来噩耗。

2009年2月,柬埔寨政府禁止在该国的娱乐场所设置老虎机,RGB顿时从天堂掉到地狱。

公司当时在柬埔拥有超过2000部老虎机,这一项禁令除了让该公司收入减少外,还需要任列减值费用,甚至还需要承担大笔借贷利息,进而使得公司面对亏损。2009年,RGB由盈转亏,面对高达5800万令吉的巨额亏损。

这对RGB简直就是致命打击,让RGB泥足深陷了3年。2011年,公司的累计亏损已经扩大到4833万令吉,净负债也高达7367万令吉。

之后,公司转移阵地至菲律宾,把所有闲置的老虎机都搬到当地,并与有菲律宾政府支持的企业和赌场合作,终于取得了成果。

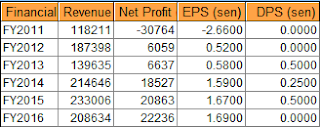

2012年,RGB终于转亏为盈,此后该公司年年写下佳绩,而且其净利已经连续5年取得增长(如下图)。

|

| 2016年的业绩还第四季未公布 |

如今,RGB已经蜕变成一家净现金公司,拥有6760万令吉的净现金。此外,该公司已经注销所有的累计亏损,并且拥有1479万令吉累计盈利。

以目前的股价计算,本益比12倍,属于合理。但是如果公司未来能够继续成长,或者恢复到2007年的鼎盛水平,那么以目前的价格来看,的确相当吸引人。

sostupid

A good recommendation because this is a good stock to buy. Go for this is good for you but check the accounting part first by yourself to see near term risks. Accounting tells you near term risk accounting do not tell you long term risks. If you do something that is very obvious right now it is going to be something that is going to be very unobvious in the future but the opposite of this statement is going to make you the money. That is what is making this stock a good buy. All men are born equal whether you believe in yourself or not as the only criteria for you to succeed in life. Rare business with good management is going to make the business a success. For long term, management's criteria is the only element that is important.

What is the third element for you, you have to figure out the third element by yourself, that is : what it is that is going to make the management what to do what you want the management to surely do for you.

The forth element: how hardworking your are loh? Spend some time to understand the company competitiveness, new opportunity for this company, old track record for this company to capture the new opportunity.

Good Luck to Ah Boon's stock buyers.

2016-12-18 09:54