That behaviour of mine is going to affect traditional retailing as I can really see the effects that Jack Ma and Jeff Bezos are impacting the traditional business lines.

Anyway, the reason why companies like DKSH may probably not be enjoying very good growth for this year is due to the prolonged impact of GST as well as weak Malaysian currencies. In fact, the blame on GST I think is not as correct, but most probably the weak Malaysian currencies as well as reduction of subsidies are really affecting many people on the streets. This as mentioned is going to affect DKSH who is distributing goods such as milk, cheese and pharmaceutical products.

On the other hand, I am putting my money on Tune Protect which has dropped from circa RM1.60 to now RM1.12. I am also putting more money into Ekovest.

The reason I am putting money into Tune Protect is because it is largely tied to how well Airasia's volume performance. IT IS TRUE that Tune Protect is affected by the ruling to bar automatic add-ons by Malaysian Aviation, however I felt that the price dropped is already compensated by that ruling.

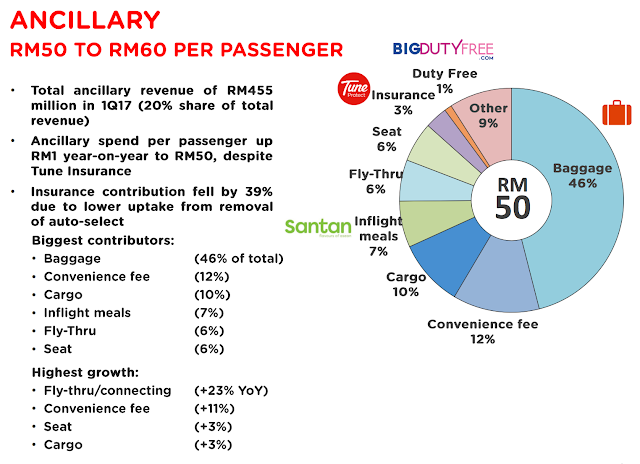

The general thought is that with the barring of that automatic add-ons, it has affected Tune's revenue by some 35% - 40%. The below graph by Airasia in its slide presentation says that it has dropped by 39% on a per passenger contribution basis.

With that drop, Tune Protect's travel insurance business should hence start from this piece of situation. I believe that it is now growing in tandem with Airasia's passenger volume growth which is low double digit - from 2017 onward. In the long run, as long as the travel insurance business is tied to Airasia's growth - it should be above average.

Tune Protect is also building its other parts of insurance business i.e. motor, personal accident etc. The deregulation of the motor insurance rates may provide opportunities for Tune Protect to be more aggressive and winning market shares as its business model is less complex against the more traditional insurers whom have been around for a longer period.

Anyway, lets see as I purchase 8000 units of Tune Protect for this portfolio.

I have also added 5000 units of Ekovest as I feel that the impact of IWCITY - whom may not be bidding for the Bandar Malaysia will be minimal towards Ekovest. I felt that the drop in its price is an opportunity for me to add-on to the company - and this also follows my thoughts of having Airasia, WCE and Ekovest as my 3 main holdings.

One should note that the contract that Ekovest has is for the upmost long term - up to 50 to 60 years. As in any country, once a contract has commenced - it will be almost impossible to terminate them - be it there is a government change.

The case of IWCITY and Bandar Malaysia is different as it was not effective yet - although my initial propagation was that it was not going to be terminated.

Anyway, as I can see for Ekovest it is now completing half of DUKE 2 and has already commenced Setiawangsa-Pantai Expressway.

Those will be the main revenue generator for the group in the long term to come. I also do not think the market is putting any value towards its new projects such as River of Life and the proposed highway to Klang.

Jonathan Keung

quite well said. Ekovest projects are different from Bandar Malaysia ( IWH ) Both are tied to the same principals but operate separately. One is a pure property township developer whereas Ekovest is quite diversified into road construction and toll concession. Termination of IWH ( Bandar Malaysia ) has already factor inEkovest drop. Now with the River of Life project. Ekovest should move past that stage. Just my personal thoughts

2017-07-26 16:56