Traders’ Almanac - KLFIN Index Technical: Challenging Critical Resistance

kltrader

Publish date: Sat, 25 Apr 2020, 10:26 AM

- RCECAP – BUY, CL: MYR1.60, R1: MYR1.75, R2: MYR1.83

- LIIHEN – BUY, CL: MYR2.55, R1: MYR2.78, R2: MYR2.92

- HOKHENG – BUY, CL: MYR0.550, R1: MYR0.680, R2: MYR0.750

- CRUDE PALM OIL – Support broken

- KLCI INDEX FUTURES – Bias remains upward

Market Overview

The FBMKLCI Index rose 4.89pts last Tuesday following a rebound in banking related stocks. The benchmark index closed a 1,642.29 led by gains from HLFG, DIGI, MAY and MISC. Broader market sentiment remained negative with losers continued outnumbering gainers by 473 to 326. A total of 2.36b shares worth MYR2.24b changed hands yesterday. Investors are mostly standing aside this week accessing the impact of T+2 implementation along with the mid-week break. The Malaysian equities market sentiment is likely to stay volatile as earnings season has started. Technically, we expect the FBMKLCI to range between 1,630 and 1,660 today. Downside supports are at 1,615 and 1,600.

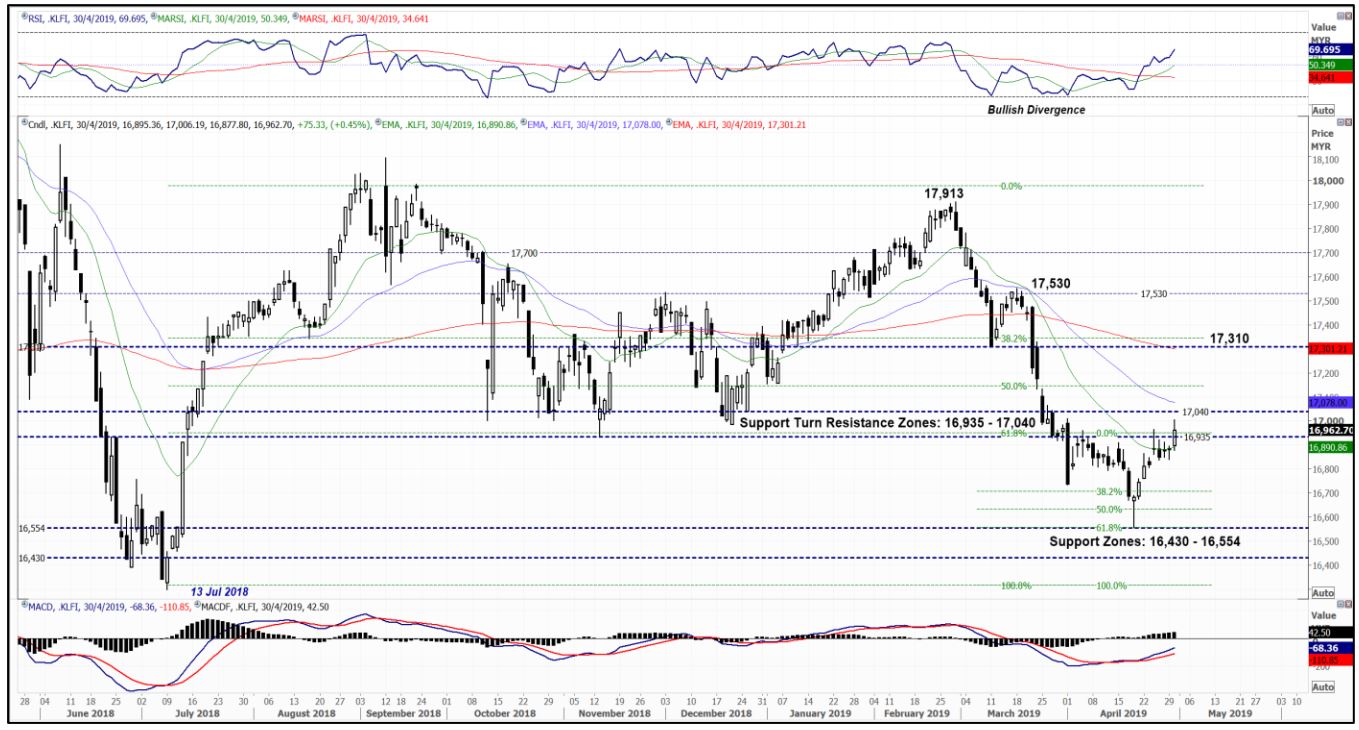

TODAY’S HIGHLIGHT – KUALA LUMPUR FINANCIAL INDEX (KLFIN) DAILY CHART, TESTING MAJOR RESISTANCE

Previously, we wrote that we expected the KLFIN Index to test lower support zones between 16,935 to 17,040 (refer to Traders’ Almanac dated 22nd Mar 2019). The index indeed hit those support levels and continued to decline further. The downward move in the KLFIN Index only halted after it staged a reversal move from the low of 16,554 and fractal Fibonacci retracement zone of 61.8%. The current recovery has lifted the index back toward critical support-turn-resistance zones of 16,935 to 17,040 and has a decent chance to continue based on positive reads in both RSI and MACD. A breakout above 17,040 level could prolong the current rebound toward the next resistance at 17,310. On the flip side, support is at 16,554.

Source: Maybank Research - 25 Apr 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on KL Trader Investment Research Articles

Created by kltrader | Apr 12, 2024