Traders’ Almanac - S&P 500 Index: Bearish Divergence, Pullback Ahead

kltrader

Publish date: Sat, 25 Apr 2020, 10:40 AM

- S&P 500 INDEX – Testing critical resistance

- THRIVEN – BUY, CL: MYR0.210, R1: MYR0.280, R2: MYR0.320

- SIGGAS – BUY, CL: MYR0.850, R1: MYR0.935, R2: MYR0.980

- SCABLE – BUY, CL: MYR0.345, R1: MYR0.420, R2: MYR0.450

- LUXCHEM – BUY, CL: MYR0.500, R1: MYR0.565, R2: MYR0.590

- CRUDE PALM OIL – Technical rebound ahead

- KLCI INDEX FUTURES – Consolidation within support

Market Overview

The FBMKLCI Index tumbled 10.05pts yesterday on the back of heavy selling across the large cap stocks. The benchmark index closed at 1,632.24 led by declines in HLFG, PETGAS, DIGI and PETDAG. Market breadth remained negative with losers outnumbering gainers 669 to 225. A total of 2.68b shares worth MYR1.95b changed hands yesterday. Local market sentiment is likely to turn more cautious due to the relatively weaker ringgit and crude oil price, along with another negative performance in the US market overnight. Technically, we expect the FBMKLCI to range between 1,620 and 1,650 today. Downside supports are at 1,615 and 1,600.

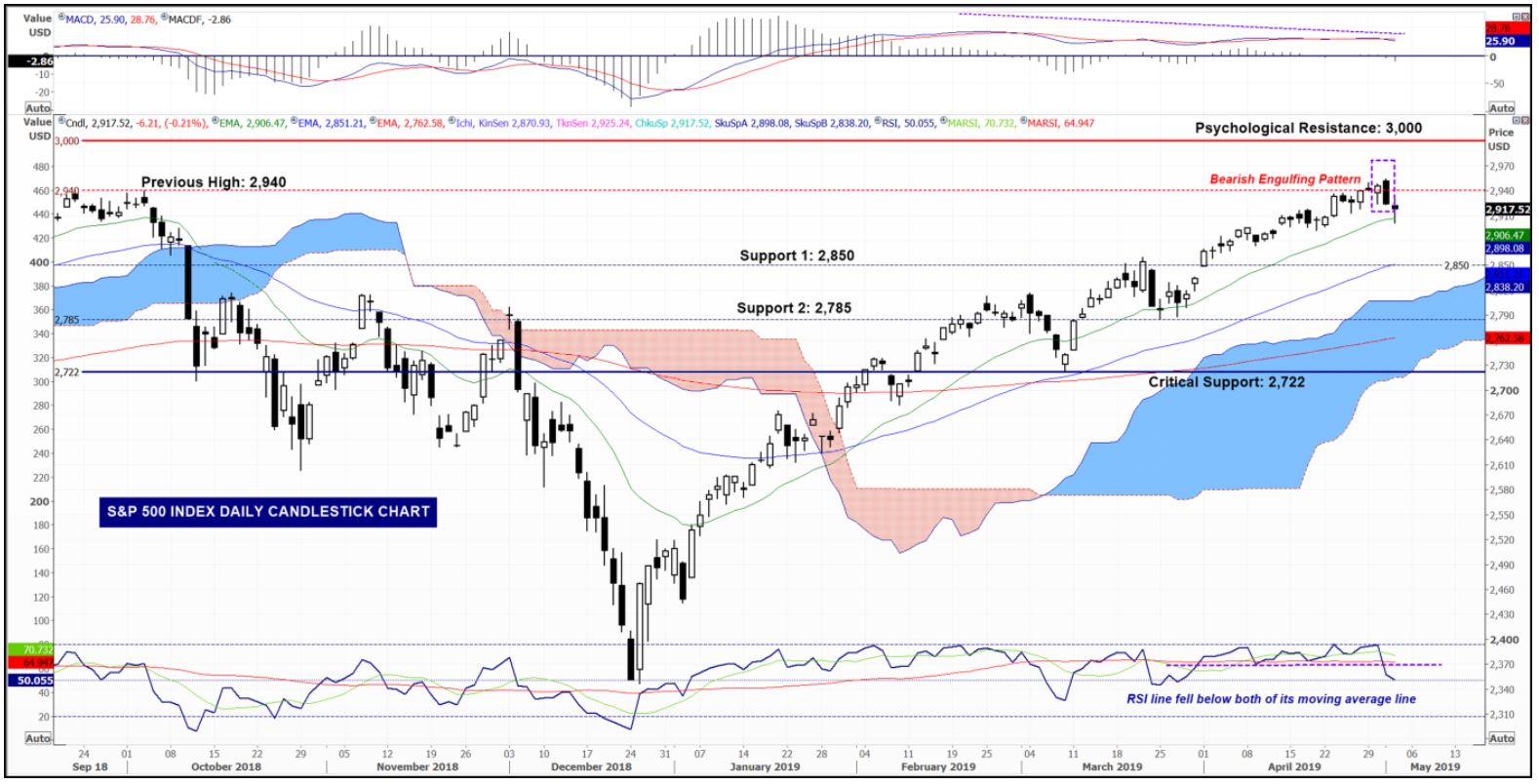

TODAY’S HIGHLIGHT – S&P 500 INDEX DAILY CANDLESTICK CHART, POTENTIAL PULLBACK AHEAD

Following a rebound from the low of 2,722 and 50-day EMA line on 8th Mar 2019, the S&P 500 Index (SPX) has continued to ride the uptrend along both the 20 and 50-day EMA lines, as well as the “Ichimoku Cloud”. This week, the SPX Index finally broke above the previous high of 2,940 and registered a new high at 2,954. As the index approaching psychological resistance at 3,000, we notice a few reversal signals that could drag the index lower near-term. The reversal signals are: 1) Bearish divergence between index price and MACD line; 2) Bearish engulfing candlestick pattern formed last Wednesday; and 3) The index falling below its RSI and MARSI line support. As such, we expect a short-term pullback toward two possible levels at 2,850 and 2,785. The overall trend, however, remains positive. We expect the current pullback to be a temporary setback.

Source: Maybank Research - 25 Apr 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on KL Trader Investment Research Articles

Created by kltrader | Apr 12, 2024