Dayang: why it dropped 24 sen? - Koon Yew Yin

Koon Yew Yin

Publish date: Mon, 27 May 2019, 09:36 AM

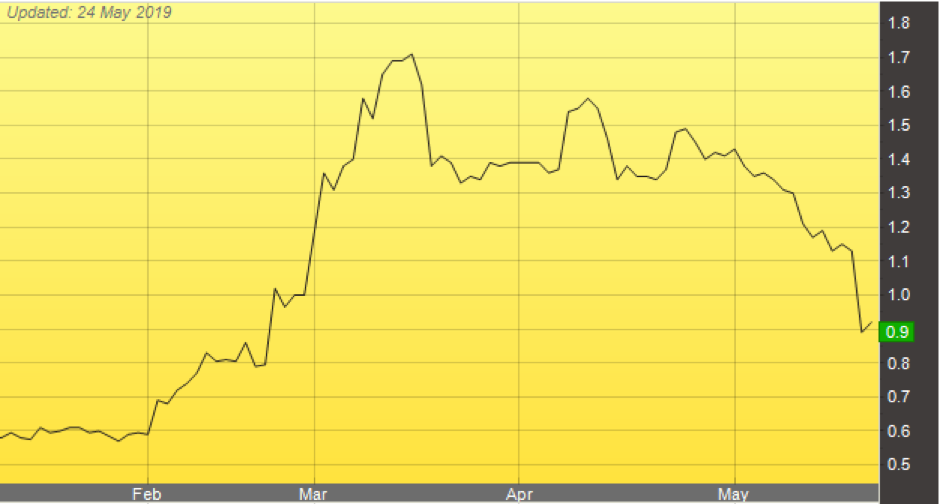

On last Thursday Dayang dropped 24 sen due to its 1st quarter small loss, partly caused by interest charges and foreign exchange loss. Its loss is less than the corresponding quarter of last year. The SE monsoon during the 1st quarter, exasperated the loss.

Investors over reaction

From my long experience in watching the stock market, investors always over react due to good or bad news. When investors see some good news, they will rush to buy aggressively. In this case, even the loss is small, shareholders dumped their shares as quickly as soon as possible; it is better to cut loss. They are so fearful. They cannot control their emotion to think logically.

As a result, the price dropped 24 sen on last Thursday. Most of the sellers were weak holders, stupid or uninformed investors who did not know the real quality of the company and many had to sell to meet margin call.

Fortunately, on Friday, the price rebounded and it went up 3 sen. This will encourage many investors to buy back. This increased share price will definitely reduce forced selling. I hope it is the pivoting point when it changes its down trend to uptrend which is the best time to buy. Nevertheless, I believe the worst is over.

Good profit growth prospect

I agree with our famous Mr Ooi Teik Bee that the next few quarters will show good profit growth which is the most powerful catalyst to move share prices.

Note: My aim for writing this article is honourable. I am not asking readers to buy to support the share price because the daily volume is tens of million shares change hands and whether you buy or sell will not make any difference.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Nov 25, 2024

My younger brother who was a dentist had bipolar disorder. Unfortunately, he committed suicide about 12 years ago.

Created by Koon Yew Yin | Nov 22, 2024

All plantation companies are reporting better profit for the quarter ending September when CPO price was about RM 3,800 per ton.

Created by Koon Yew Yin | Nov 21, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offici

Created by Koon Yew Yin | Nov 20, 2024

Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry official said recently, lifting prices of the vegetable oil...

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 25, 2024

The group is expected to deliver better profits and revenue from its pipe coating, engineering, and bioenergy segments.

Created by Koon Yew Yin | Oct 14, 2024

Today I read the article by Murray Hunter titled “A Visit to the Malaysian Communist Party tunnels in Betong, Thailand”, which is an important part of Malaysia’s history.

Created by Koon Yew Yin | Oct 04, 2024

KSL is still the cheapest based on a 4.4 PE ratio, which means its share price should continue to go up. Unfortunately, there are a few small investors who always queue to sell at cheaper prices...

Created by Koon Yew Yin | Oct 04, 2024

KSL is still the cheapest based on a 4.4 PE ratio, which means its share price should continue to go up. Unfortunately, there are a few small investors who always queue to sell at cheaper prices...