CPO price hits historical high - Koon Yew Yin

Koon Yew Yin

Publish date: Thu, 03 Mar 2022, 07:18 AM

As reported by TheEdge (Feb 18): Malaysian crude palm oil (CPO) futures prices rose past RM6,000 a tonne for the first time to their all-time high on Thursday evening (Feb 17) after climbing as much as RM87 to RM6,054 in Bursa Malaysia’s extended trading session between 9pm and 11:30pm in what analysts describe as a palm oil industry super cycle amid supply constraints during seasonal low production in the first half of the year when demand is also expected to grow ahead of Hari Raya Aidilfitri in May 2022.

CPO price chart below:

At 10:55am on Friday, March 2022 CPO price rose RM33 to RM6,000 a tonne after the commodity was traded at between RM5,986 and RM6,054 so far on Friday. March 2022 CPO, which opened at RM6,000 a tonne at 9am, registered bid and ask prices of RM6,000 and RM6,002 respectively.

Public Investment Bank Bhd analyst Chong Hoe Leong wrote in a note on Friday that the palm oil industry witnessed an unprecedented super cycle with CPO futures topping RM6,000 a tonne on Thursday for the first time.

"We turn bullish on the sector as we expect a strong earnings trajectory for the plantation companies. We think CPO prices will remain strong in the first half of 2022 given the tight global vegetable oil supplies and also supply constraints for palm oil in the top two producing countries.

As a result, all plantation stock prices shot through the roof in the last few weeks. For example: as shown on SOP price chart below. SOP price was Rm 3.55 on 27 Jan and close at Rm 6.48 today, an increase of 83% in the last 5 weeks.

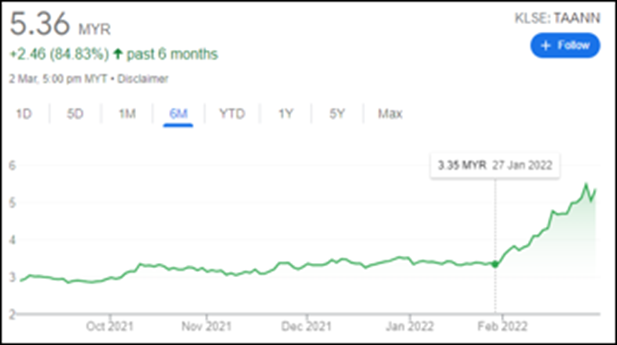

Another example is Ta Ann. As shown on its price chart below, it was traded at Rm 3.35 on 27 Jan and closed at Rm 5.36 today, an increase of Rm 2.00 or 60% within 5 weeks

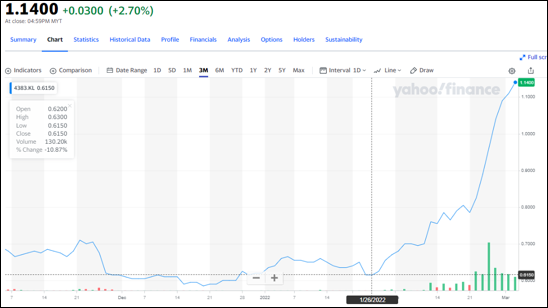

Another example is Jaya Tiasa which is my old favourite stock. As shown on the price chart, it was traded at 81 sen on 27 Jan and closed at Rm 1.14 today, an increase of 33 sen or 45% within 5 weeks.

If you have not bought plantation stocks a few weeks ago, it is risky to chase. It is safer to wait for the price correction. CPO price cannot continue to go up higher and higher. Nevertheless, I believe CPO price will soon correct to a lower level which is still very profitable for all plantation companies to record increasing profit in the next few quarters. In any case, I believe plantation stocks will continue to go up higher and higher.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Dec 26, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offi..

Created by Koon Yew Yin | Dec 13, 2024

Indonesia remains committed to start implementing a 40% mandatory biodiesel mix with palm oil-based fuel, or B40, on Jan 1 next year, its chief economic minister said. Indonesia, the world's largest..

Created by Koon Yew Yin | Dec 12, 2024

Indonesia is the world's largest producer of palm oil, producing an estimated 46 million metric tons in the 2022/23 marketing year. Indonesia also exports over 58% of its production, making it the w..

Created by Koon Yew Yin | Dec 03, 2024

Indonesia is the largest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offi..

Created by Koon Yew Yin | Nov 25, 2024

My younger brother who was a dentist had bipolar disorder. Unfortunately, he committed suicide about 12 years ago.

Created by Koon Yew Yin | Nov 22, 2024

All plantation companies are reporting better profit for the quarter ending September when CPO price was about RM 3,800 per ton.

Created by Koon Yew Yin | Nov 21, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offici

Created by Koon Yew Yin | Nov 20, 2024

Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry official said recently, lifting prices of the vegetable oil...

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Discussions

All plantation stks are moni printing machine. No belief is required.

Just sapu any plantation stk U like.

2022-03-03 11:16

Please no cut your plantation profit.

Glove stks ... oredi veri, veri old bulls with chronic diseases

Tech stks ... matured bulls

Plantation stks ... young n growing bulls

It is still earli to wallop some plantation stks to make some moni to buy kopi n nasi lemak.

2022-03-03 17:14

wheat has little replacement as food alternative. sugar has artificialso......... replacement.

2022-03-03 18:29

Is KYY pulling a "Supermax" on unsuspecting investors? For those who are unaware, expect the following "gem" articles from KYY.

1. Plantation counters are too high, investors should not chase.

2. I have purchased plantation1 two weeks ago. You can call my remisier at 60X-XXX-XXXX.

3. I have moved on to plantation2. Plantation1 EPS is trash compared to 2.

As price of plantation counters fall...

4. Investors should continue to buy and hold plantation2, look at its EPS relative to tech1, tech2,...

5. Investors should hold plantation2. People need palm oil for their roti canai and nasi lemak.

6. Look at these charts, demand for roti canai and nasi lemak are rising. Investor must have faith that CPO price will rebound

7. My very clever niece told me to buy Maybank, I purchased them two months ago, and sold them last week to buy plantation2. Investor should not be misled with Maybank's share price. Buy plantation2.

8. I have sold plantation2 three weeks ago. Investors should do the same.

2022-03-03 18:47

have a longer view, patience is part of luck.

https://www.theedgemarkets.com/article/how-strength-soybean-prices-linked-black-sea-conflict-%E2%80%94-braun

2022-03-05 12:06

If Ukraine Crisis can be resolved commodity prices will come down

If not at worst WW3 all will go Holland together

2022-03-05 12:14

Commodities like grains, edible oil and metals are already high due to many other factors before Russia-Ukraine war. The war and the sanctions will have longer term damage to production recovery. Logistic and trading hiccups will last for some time. So, don?t expect a big correction to come anytime soon.

2022-03-05 16:00

It is NOT a correction !

It is chip buying opportunity for us to sapu some plantation stks to make esi moni !

If we miss it or wait, then we got to pay higher prices later on.

2022-03-05 19:19

" We think CPO prices will remain strong in the first half of 2022 given the tight global vegetable oil supplies and also supply constraints for palm oil in the top two producing countries. "

May be we add some plantation stks n keep them during the first half of 2022 ?

2022-03-05 19:46

" 8. I have sold plantation2 three weeks ago. Investors should do the same. "

Some not so smart player cut the plantation profit 3 wk ago ! when the plantation bull is so young n is still a growing bull.

We should dump old bulls with chronic disease like glove n tech stks.

2022-03-05 19:58

k3nthiew

Deep analyst.......

2022-03-03 10:10