Malaysia’s economy will grow faster than expected - Koon Yew Yin

Koon Yew Yin

Publish date: Mon, 26 Feb 2024, 10:53 AM

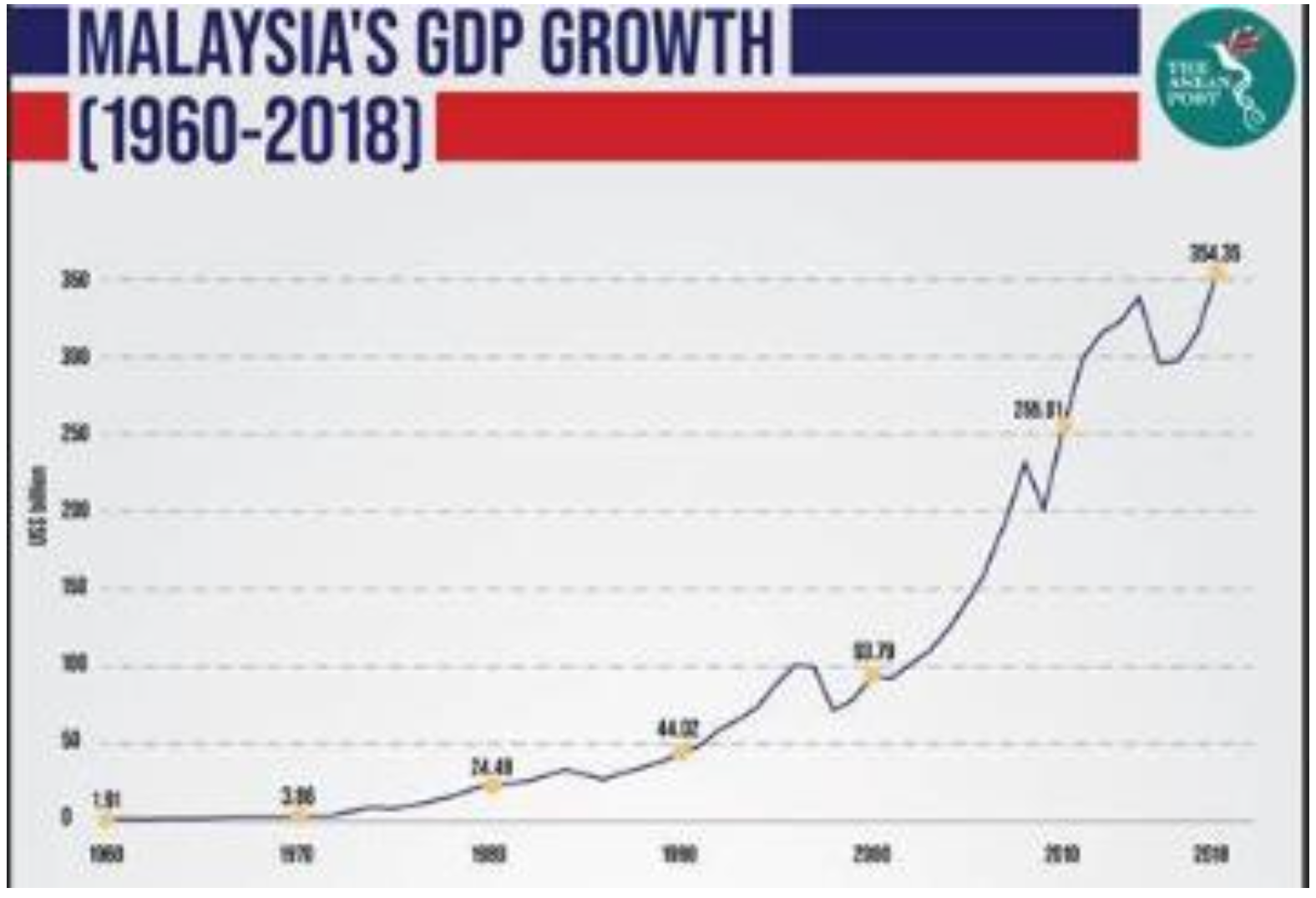

Several economists and local industry representatives are confident that Malaysia’s gross domestic product (GDP) growth will strengthen this year, despite easing in the final quarter of last year.

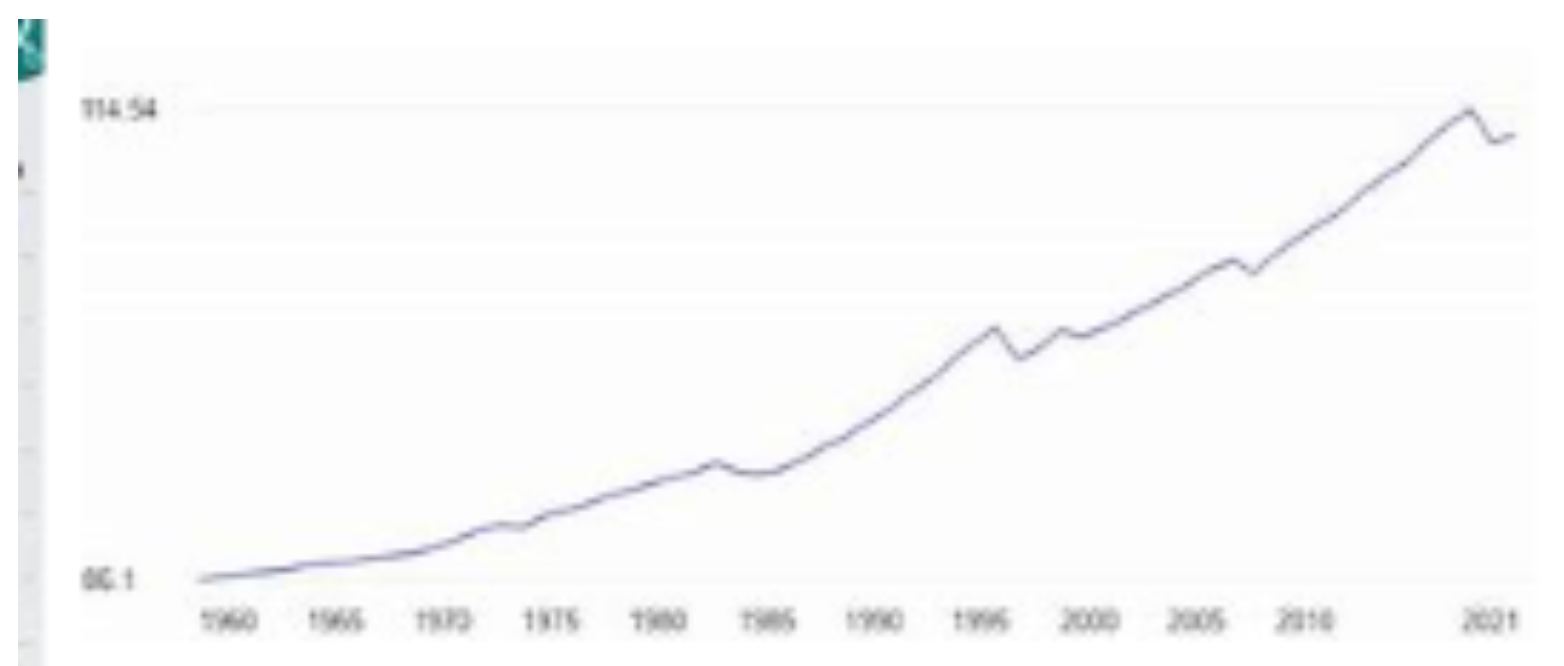

Malaysia’s GDP per capita is increasing rapidly as shown below:

According to the official data from the World Bank, the GDP of Malaysia in 2022 was $407.03 billion US dollars, which represents 0.17 percent of the world economy. This was the highest annual growth recorded in 22 years, exceeding the estimate of 6.5 percent - 7.0 percent made in October 2022. The strong GDP growth of 8.7 percent for 2022 shows the recovery of consumer, business and investor confidence in the national economy.

Universiti Kuala Lumpur (UniKL) Business School economic analyst associate professor Aimi Zulhazmi Abdul Rashid said the lower growth reported was not cause for panic.

He said Malaysia’s Q4 GDP growth was in line with its Asean neighbours such as Singapore, Thailand, and Indonesia that also reported sluggish growth for the same period.

“To boost the economy and to avoid the slow growth, the government would need to apply cash injection initiatives to immediately reduce income tax and corporate tax.

“This initiative could also attract more private sector investments from both domestic and foreign,” he said when contacted by Malay Mail recently.

Aimi Zulhazmi explained that Malaysia‘s corporate tax rate of 24 per cent is among the highest in the region, especially when foreign income is now taxable.

“Reducing personal income tax and postponing the increase of the 8 per cent sales and service tax (SST) will certainly result in additional cash in the consumers’ pocket.

“Reduction of the overnight policy rate (OPR) from the current 3 per cent to a lower one will reduce the cost of funds to businesses and stimulate consumer activities,” he said, adding that such a move would boost property and automotive sales, which are big ticket items in the domestic economy.

Despite the advantages of a reduced tax rate for individuals, South Johor SME Association adviser Teh Kee Sin told the Malay Mail that the government should also focus on providing financial assistance to targeted industries in an effort to boost the economy.

He said the general sentiments of small medium enterprises (SME) is still positive with businesses that are seeking to diversify or even expanding during such times.

“So, by providing grants or soft loans to assist SME with business expansion plans will in turn boost the GDP,” he said.

Socio-Economic Research Centre (SERC) executive director Lee Heng Guie shared his view that consumer spending must be encouraged to drive the economy.

He said last year’s growth was below expectations due to lower global demand for electrical-electronic exports and lower consumer spending.

“At the same time a reduction in post Covid-19 revenge spending and inflation had caused consumers to spend cautiously for last year,” he said to Malay Mail when contacted recently.

Lee said the government needs to continue its subsidy rationalisation plans and cash aid schemes at targeted groups to encourage consumer spending.

“The subsidy programmes are already in place and will depend on the data from the national Central Database Hub (Padu) by March.

“Once the Padu database is completed, it will ensure a fairer subsidy distribution and minimise on the people’s anxieties,” he said.

Lee added that the government needs to also plan out the timing of its subsidy withdrawal in order to avoid burdening the people.

He said reform measures in subsidies is welcomed, but there is a need to sequence it properly to minimise impact.

For economist Nungsari Ahmad Radhi, investments are seen as an integral and necessary factor for a rebound in the economy.

He said that investments, both private and public, are a source of growth and will determine future capacity.

Nungsari said that investments are necessary as without it there will be no new capacity and capabilities.

He explained that the investments are not only for hard infrastructure and technology, but also includes capabilities and human capital.

“To have more meaningful public investments, there is a need to develop some fiscal space which means optimising the expenditure side while also broadening the revenue side,” he said when contacted by the Malay Mail.Overall, Nungsari said while consumption moderated for last year, there were still good numbers on investments, which he saw as a promising sign going forward.

“While external demand may remain challenging for this year, I’m keeping an eye on the investments trend.

“If that continues, it augurs well for the economy when external demand recovers,” he said.

Lee pointed out that to draw investments, the government must continue to improve its pro-business approach.

“There is a need to have a proper engagement of policies before undertaking any type of investments,” he said, adding that it was important to clear any uncertainties from prospective investors.

On the tourism industry, several of those polled placed tourism as an important factor in terms of revenue for the country.

It was previously reported that Tourism Malaysia is confident of achieving a target of 27.3 million foreign tourist arrivals for this year.

Aimi Zulhazmi said that Malaysia’s tourism industry is currently experiencing a boom.He said additional budget allocations and incentives must be provided to boost the industry from the first quarter onwards.

“The move will boost the domestic economy as well as strengthening the declining value of ringgit,” he said.

Teh also called on the government to take advantage of the weaker ringgit to promote and boost the tourism industry.

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Nov 21, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offici

Created by Koon Yew Yin | Nov 20, 2024

Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry official said recently, lifting prices of the vegetable oil...

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 25, 2024

The group is expected to deliver better profits and revenue from its pipe coating, engineering, and bioenergy segments.

Created by Koon Yew Yin | Oct 14, 2024

Today I read the article by Murray Hunter titled “A Visit to the Malaysian Communist Party tunnels in Betong, Thailand”, which is an important part of Malaysia’s history.

Created by Koon Yew Yin | Oct 04, 2024

KSL is still the cheapest based on a 4.4 PE ratio, which means its share price should continue to go up. Unfortunately, there are a few small investors who always queue to sell at cheaper prices...

Created by Koon Yew Yin | Oct 04, 2024

KSL is still the cheapest based on a 4.4 PE ratio, which means its share price should continue to go up. Unfortunately, there are a few small investors who always queue to sell at cheaper prices...

Created by Koon Yew Yin | Sep 06, 2024

Water pollution is a huge challenge for freshwater in the UK, impacting our rivers, streams, and lakes and the wildlife that call them home.

Created by Koon Yew Yin | Sep 03, 2024

State housing and local government committee chairman Datuk Mohd Jafni Md Shukor said demand for properties in Johor has gone up since last year’s announcement about the SEZ.