Chinwel: People expecting too much from realised and unrealised gain on forex

letitgoletitgo

Publish date: Sun, 10 Jan 2016, 05:21 PM

First of all, congratulation for all of the Chinwel holders. The share price have been jumped from RM1.69 to RM2.24 in less than 2 months time.

Sorry to tell you, you will be dissapointed with what i will say in this article. I am not biased to anyone who are holding Chinwel.

I using this example to show to other that for the coming quarter, the company such as Chinwel, Sam, Flbhd will be affected due to currently alot of investor over estimated the profit for this company.

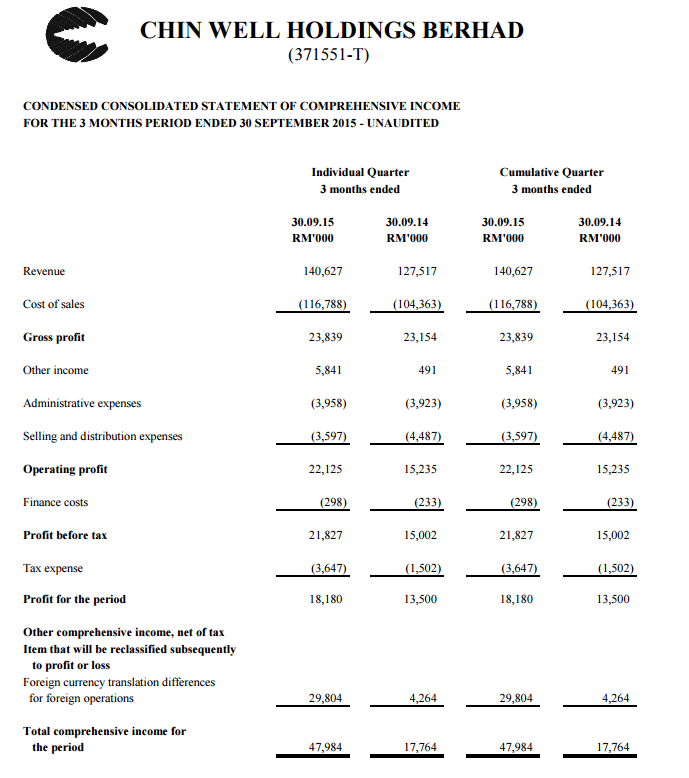

First of all, let see on the profit and loss account for Chinwel.

From the profit and loss about, if you observe carefully, the gross margin for Chinwel have been almost same with last year. The main increased in profit for the period is contributed from other income.

From the note B5, you can see there are unrealised gain on foreign exchange and realised gain on foreign exchange. Many people dont know or misunderstanding the meaning of unrealised gain on foreign exchange and realised gain on foreign exchange.

So what is really unrealised gain on foreign exchange?

Unrealised gain on foreign exchange mainly is adjustment to balance sheet item such as trade debtor, trade payable, borrowing, cash and bank balances which is denominated in US dollar.

There are such unrealised gain on foreign exchange due to the currency for US dollar closed at RM4.40 during 30 September 2015. When they are recording trade debtor, trade payable, borrowing or cash and bank balances, it is much more lower than RM4.40. Some of the trade debtor might be recorded at RM3.7, RM3.8, RM3.9 or RM4.0 during the period of 1 July 2015 to 30 September, hence adjustment will be made on 30 September 2015 so that all of the trade debtor, trade payable, borrowing or cash and bank balances will be stated as USD1 = RM4.40

Example show as below:

Sales incurred on 1 Jul 2015, US dollar RM10,000. Rate as per 1 Jul 2015 closed at USD1 = RM3.77. Hence total RM37,700 will be recorded in the trade debtor.

During 30 Sep 2015, the rate closed at USD1 = Rm4.40. Hence the trade debtor will adjusted to USD1 = RM4.40. Hence adjustment of unrealised gain on foreign exchange will be RM44,000 (RM4.4 x USD10,000) minus RM37,700 equal to RM6,300.

Then what is realised gain on foreign exchange?

For realised gain on foreign exchange, it is the different between the payment to the balance recorded.

Example during 30 Jun 2015, sales have been recorded as USD1= RM3.66. Assume that the total sales is USD10,000. Hence the amount will be recorded at Rm36,600 in trade debtor.

Assume that the payment paid on 30 Sep 2015. As the amount received are USD10,000, but as the currency rate at that day is USD1=RM4.40. Hence the company will received RM44,000 during 30 Sep 2015. Realised gain of RM7,400 will be incurred.

For the unrealised gain and realised gain on foreign exchange, it will only incurred one time and i will not happen against at least for this coming quarter as the currency rate for USD dollar closed at USD1 = RM4.29. In fact, forex loss will be incurred for this company. Hence the impact will be huge.

I am not recommending to buy Chinwel. Why?

1) Profit margin did not increase although the currency exchange rate increased, Although the average exchange rate for US dollar have been increased from USD1=RM3.36 to USD1=RM4.05, the profit margin (excluding realised and unrealised gain on foreign exchange) have been decreased.

30/9/2014

Revenue = RM127,517K

Profit for the period (excluding forex exchange impact) = RM13,500k+RM384k=RM13,884k

Profit margin - 10.88%

30/9/2015

Revenue = RM140,627K

Profit for the period (excluding forex exchange impact) = RM18,180k-RM4,744k=RM13,436k

Profit margin - 9.55%

From the calculation above, you can see the profit margin did not improved although the average rate of US dollar against Malaysia ringgit increased.

Hence we can also concluded that Chinwel did not have any pricing power or competitor advantages against other similiar suppliers as their product easily to replace by other competitor.

2) Chinwel's share price currency at RM2.24. For the profit after taxation, if you excluded the effect of unrealised and realised gain on forex exchange of RM4.7mil, the profit after taxation only at RM13.4mil, which is almost the same with last year. Although the revenue have been increased compare to last year, the profit seem the same with last year.

3) I agreed that the company net cash position have been improved to RM30mil. The fundamental is solid. However, keep in mind that the share price will only move up if the profit or projected profit will increased in the future. As the share price have been appreciated 32% since result came out. Hence if you buy now, you paying 32% more expensive then the people bought before the share price up.

4) The acquisition of 40% of Asia Angel Holdings Limited did not bring any positive impact to Chinwel in term of earning per shares as the acquisition paid by issue of shares. It will diluted the earning per share for Chinwel.

5) If you look at the EPS for 31Mar 2015, the profit increased year by year due to gain on forex. However, the EPS have been decrease at Jun 2015. Why this happen? It is because the acquisition of 40% of Asia Angel Holdings Limited did not bring any positive impact to the shareholder in term of earning per share.

So when i should buy Chinwel?

Unless the profit margin for Chinwel improved significantly next quarter or currency rate for US dollar appreciated alot during next quarter, if not I will not recommending anyone to hold this shares.

The calculation above applied to all of the company who have alot of unrealised and realised gain of exchange rate during last quarter. I used Chinwel as a example as it is the best example to verify my view on unrealised and realised gain of exchange rate.

The suggestion I provided above is just for sharing purpose. I will not responsible for any gain on loss for Chinwel. I will also did not have any intention to buy Chinwel. Buy and sell at your own risk

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on All about stock

Discussions

core profits or not is analysts short cut,

big funds looks at 3 things....management is good, business model is good and the figures are good. trust your own judgement.

< Posted by fayeTan > Jan 10, 2016 08:10 PM | Report Abuse

Letitgo, in such case one should look at core net profit... Which means exclude out all forex gain or loss... And all other one off items..>

2016-01-10 22:15

on Vietnam wages., recently I gooogled the ILO wages report. I was totally fascinated.

Vietnam wages at 1/3 of Malaysia and China average wages actually already higher than Malaysia.

fascinating stuff.

I love it when Malaysian companies go to Vietnam to expand...get involved in the fastest growing economy in the world...like Latitude Tree, This Chinwell, Keinhin....many many others... This are the smart guys.

If you can tap into the growing Vietnam market, even better.

2016-01-10 22:23

too much focus on forex gain, core profits etc....not enough focus on what is really going on....ie margin expansions, management and business model is the downfall of lazy analysts.

<Posted by YOLOOOO > Jan 10, 2016 10:20 PM | Report Abuse

Thank you for your hardwork Mr.Letitgo>

2016-01-10 22:28

Mr. letitgo, is chinwel only company experiencing wages hikes in the world? Can't they increase their pricing for making up the hikes? As long as the RM vs US is staying above RM4.00, there is no reason why chinwel & other export counters to will not do well. This stock has no debt denominated in U.S. Dollar which will otherwise worry me.

You can argue whatever point you want. Ultimately, the prevailing share price post next QE will decide who is right and who is wrong I think you better rename your article title to "Chinwel: I missed the boat, I hate it when I see its share prices going up, up & up".

2016-01-11 00:41

wow...too much in-depth accounting thingy...just a few greenhorn questions:

1) chinwell doesnt do any hedging at all to prevent whatever u mentioned from happening?

2) For Q2 (oct-dec), usd-myr has increased close to 20% quarter-to-quarter (3.5 to 4.2 in average). Will it help to improve its revenue as well as margin purely due to this forex effect?

Appreciate advice from fellow sifus.

2016-01-11 00:54

my advice. If you are expert, do your own expert analysis. If not expert, take a free ride on KYY.

Posted by chl1989 > Jan 11, 2016 12:54 AM | Report Abuse

wow...too much in-depth accounting thingy.

2016-01-11 01:16

Me personally is very optimistic about the coming quarter result after reading the qr since 2011 and I have found one interesting thing which is when reading the B3 statement which is the "Prospect", I have found that the management is very careful in using the "word" like shown in the 2015 Nov qr.

It is stated that:

Barring any unforeseen circumstances, the Group anticipates satisfactory performance and "growth" in the "next coming quarter".

It is not "the current financial year" or "for the financial year end 27 Aug 2016"

You can view the B3 statement from qr 2011 to 2015 and referring to the each quarter result

2016-01-11 07:09

comcorp has low profit margin. Its is also main beneficiary of strong USD like chinwwell flb latitud...

2016-01-11 08:15

I think chinwell profit will slightly higher in coming quarter. sales in USD around RM 4.20. while in previous quarter only RM4.00. The unrealised loss only adjustment on balance sheet item ie bank and debtors or creditors.Low raw material cost will increase its profit margin

2016-01-11 08:23

Veim82k6: gross profit will improve by abit. But the main point is realised and unrealised portion will gone in next quarter and replace by realised loss. Hence the profit will go back to square in next quarter.

Currently the share price have go up by 32percent since release of last quarter result. Imagine next quarter result come out, the profit same with last year, what is the impact to share price?

Think carefully

2016-01-11 08:48

Refer AR page 63, Chinwel got around RM12 million forward exchange contract (hedging)

2016-01-11 10:12

I will buy 'future' of chinwell as thier buss is globalized n longterm should be good.future n monoplies the screw mkt will coz price shoot up

2016-01-11 11:40

chl1989, I think that the forward exchange contract will help to reduce the impact of the above mentioned issue. Management is not stupid

2016-01-11 11:59

Forex... Forex... Forex....

Getting all excited over the effects of forex over a quarter or three..

Nobody cares about maintainable core profitability over 3 to 5 years anymore??

2016-01-11 12:06

One quarter didn't reflect the whole pictures of Chinwell. Why focus on chinwell only? All exports are the same like comcorp, Flbhd,sam , Homeriz and others.

2016-01-11 20:39

Please read the annual report of chinwell from 2011 to year 2015. Chinwell has high foreign exchange gain for those years.

2016-01-11 21:00

is your problem of not buying to buy chinwel. But dont talk like as if you know everything from just extract pages of income statement. Fool post.

2016-01-11 22:54

I think the writer of this article sold chinwel too early or jealous on those people who are holding chinwel. if not why he is so interested in spending so much time doing so much work on chinwel to post this article. There are so many goods stocks, Why want keep writing on sth bad on dun spend the time on researching on those potential stocks.

2016-01-12 08:53

Letitgo, good insight. I do share the same thoughts as you, some people are just blindly rushing into the "export play theme" without checking out the core performance of the company

2016-01-12 08:54

Just admit it, most if not all of the people here are punters/speculators and not investors. How many will care to read the details?

2016-01-12 12:09

i dont know what is he trying to write!! When a margin can be maintained, a profit of US$ 10,000 is worth RM 44,000 if USDMYR maintained at 4.4, so the margin in RM term will be higher when compared with USDMYR 3.80. As far as gross margin is concerned, a weak Ringgit will make Chinwell attractive.

2016-01-12 12:41

The party for those exporters counters will over sooner or later. Whoever the last will be crying with no tears to hold the baby!Everyone should be thanking letitgo for reminding.

2016-01-12 14:03

some people see a company from a mere static point of view, some people analyse a company on dynamic, developing point of view, so the conclusion drawn is very much different.

for investors who aim for future growth, and benefit from such growth,is the aim of investment.If you only see a static world and pessimistic about it ,then no point invest.

2016-01-12 14:07

that letitgo is so ignorant and yet so opinionated. People here have to be careful

<914601117 i dont know what is he trying to write!!>

2016-01-12 17:01

the way he dragged FLBhd in without any figures to the above findings on Chinwell is not good...that's all I can say..

2016-01-13 13:19

letitgo, do not care about some people here. This is a good article... After all, you only find out who is swimming naked when the tide goes out.

But, I believe your explanation is clear enough to tell everyone to beware of such unsustainable growth...

They don't care about gross margin/net profit margin/ROE/ROIC and etc. To them, "investment" is just as simple as looking at EPS.

However, if chinwell continues to remain same profit margin and revenue, is it going to grow? The answer is NO. Opps, it might grow provided USDMYR continue to go higher, 1:5???

However, that's good enough to them :) Efficiency of a company just a joke to them :)

Probability, you are right that FLBHD is not the same with ChinWell. At least, the growth margin is extra 5% higher. This is the "growth" I observed but how could it have 300% of profit increase with 5% of gross margin increase? It is again due to strong USD. However, revenue growth of FLBHD still play a part. If I discounted away "other operating income", its profit still increase by 2m+ compared to last year... So, FLBHD is still fine but it is not 300% like what you actually see... But you need to beware if the revenue growth is due to what reasons.(again, due to USD???hmmm... then you might see its bottleneck after a year..)

2016-01-18 22:31

The author is talking about efficiency of a company and further growth of a company...he had pointed out so clearly that the "increase of profit is mainly due to OTHER OPERATING INCOME"... how do you expect the other operating income to increase further if USD didn't go strong forever??? A growing company needs to have its gross margin to continue improve as well as its revenue... Do you see this in the latest qtr result? At least I don't... Is it going to be forever like this? We don't know... The author is just telling you the truth... do not expect too much...

Perhaps, he is just talking too far away while you guys are talking about ~1 year... if chinwell is able to make up their price, then they wont be maintaining the same/similar gross margin over a year...

=========================================================

buddyinvest Mr. letitgo, is chinwel only company experiencing wages hikes in the world? Can't they increase their pricing for making up the hikes? As long as the RM vs US is staying above RM4.00, there is no reason why chinwel & other export counters to will not do well. This stock has no debt denominated in U.S. Dollar which will otherwise worry me.

You can argue whatever point you want. Ultimately, the prevailing share price post next QE will decide who is right and who is wrong I think you better rename your article title to "Chinwel: I missed the boat, I hate it when I see its share prices going up, up & up".

2016-01-18 22:39

Hi letitgo, Thanks for your sharing. I do have one question and hope you can share your thought so that I can learn more. I am not sure how realized/unrealized gain will impact on topline revenue or bottomline. Please see my simple example below:

Using 3 quarter as comparison, occurrence of realized/unrealized gain and their impact on profit:

1st Quarter

USD 1 = RM3

Sold product at USD300 = RM900

Hence In income statement, we will see revenue = RM900

2nd Quarter, USD appreciated by 10%

USD 1 = RM3.3

Sold product at USD300 = RM990

Profit automatically improved by RM90

At this point, Unrealized gain will occur, as trade receivable at the beginning = RM900 based on USD1=RM3, but further improved by 10% after USD1=RM3.3. Unrealized gain= (RM3.3 – 3)*300 = RM90

3rd Quarter, USD remain the same as 2nd quarter

USD 1 = RM3.3

Sold product at USD300 = RM 990

Unrealized gain = (RM3.3-3.3)*300 = RM0

Whether there is realized or unrealized gain, it does not impact the revenue (see Q2 VS Q3), if currency remain flat, their profit is still RM990, 10% increased VS Q1 of RM900. If we assume cost of sales & other expenses remain the same, PBT should still increase by 10% as well. Seems to me that it does not erode the profit?

Please help me to learn more, TQ

2016-01-18 23:41

Your analysis on Chinwell totally wrong..look at latest the quarterly report.

2016-02-26 18:26

Write wrong analysis still want to laugh ppl at geshen forum . Please withdrawn your articles go back learn again.

2016-02-27 15:36

letitgoletitgo

From huge forex gain to forex loss. What is the impact? U calculate yourself.

2016-01-10 22:09