LIIHEN Part 1 : The Real Shenanigans Behind Lii Hen 2004 Debacle

harveylai313

Publish date: Thu, 22 Aug 2013, 03:57 PM

Game On

Bursa Malaysia-listed Main Market issuer, Lii Hen Industries Berhad (LIIHEN stock code 7089) had on August 21, 2013 announced to the stock exchange that it has been served with a writ of summons (High Court of Muar, Johor, Suit No. : 22NCVC-63-07/2013) initiated by a shareholder seeking to, inter alia, annul and void the outcome of the 19th Annual General Meeting.

Little detail have been disclosed in the said announcement. We believe it may be linked to the recent posting of some videos in Youtube with regards to the annual general meeting in question. The videos have since gone viral on the internet and they can be viewed under the namesake of Lii Hen itself.

That arouse our animal instincts in wanting to know more about Lii Hen. The tiger has since smelled blood.

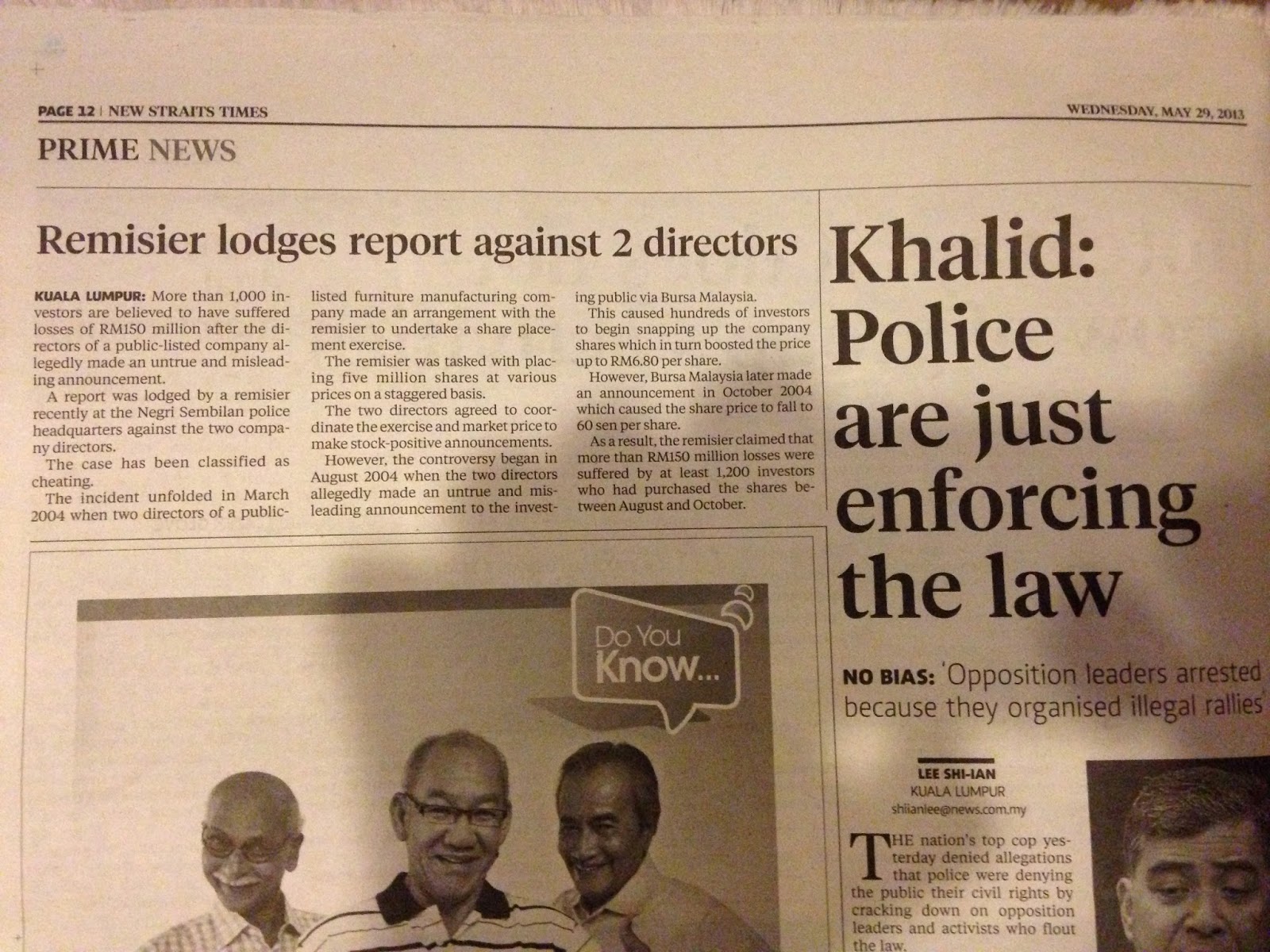

On May 29, 2013, the Prime News section of the New Straits Times reported that a remisier had lodged a complaint with the Commercial Crime Department of the Negeri Sembilan Police Contingent against 2 directors of a public listed company, alleging some fraudulent misconduct. None of the name of the directors nor the name of the particular public listed company was mentioned in the said article, however. The contents of the article somehow drawn some similarity to the identity of Lii Hen.

It is believed that a concerned shareholder has written to Lii Hen seeking clarification on the news report. No admission nor denial was provided as there was no company announcement made through Bursa Malaysia. That leads to the fracas in the 19th Annual General Meeting of Lii Hen on June 25, 2013, consequently the Youtube videos.

It is apparent in the said general meeting that the chairman of the board of directors of Lii Hen finally admitted that it is Lii Hen that was the company named in the news report. He said that a new law firm (Messrs Cheang & Ariff) was recently appointed to look into this matter. Our check with the inside source of Lii Hen revealed that the law firm was only appointed after a "special" board meeting was convened on June 7, 2013.

The 2012 annual general meeting circular that was despatched to the shareholders was dated June 3, 2013. In the said circular, the full office bearers for the financial year 2012 was clearly printed. But there is no Messrs Cheang & Ariff in it. All we have was a Messrs KH Tan & Co as the company solicitors. That is to say Messrs Cheang & Ariff has no business to be in the vicinity of the 19th Annual General Meeting that was held. What more when a Mr. Brian Foong from that law firm spoke ruthlessly in the meeting. The provisions in the Company Act 1965 is very clear in that no non-member nor non-proxy are to partake in a general meeting. On this breach alone, we are convinced that the concerned shareholder who had filed the summons may be thrashing the entire outcome of the 19th Annual General Meeting of Lii Hen and a new one will have to be called, inevitably.

The ramifications of the general meeting being outlawed will have an adverse effect on Lii Hen. First that came to our mind will be its irreparable integrity damage. It may also set a record, albeit an unwelcome one, for being the very first public listed company that has got its books thrown out by a court of law. We believe more will pull out their knives when this happens. They may be the bankers, suppliers or creditors to Lii Hen. Would you want to do business with Lii Hen any more, now that all its resolutions in the general meeting, including but not limited to, the audited accounts are now declared illegalis by the court?

The annulment of the said annual general meeting will put the corporate governance aspects of Lii Hen into a very awkward and precarious situation. It may even spells trouble as regulators and investigators will be thronging the corporate office and place of business of Lii Hen in Muar, Johor for sure, looking for any sign of wrong doing or malpractice. They looked inept and maladroit if they do not do so.

As always, the stock market will be heaping on a "shoot first, ask later" rationale if the concerned shareholder succeeds in his quest to render the annual general meeting null and void. Conservatively, it will not be a surprise if we see a double limit down on the stock price of Lii Hen when this happened.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on The Real Shenanigans Behind Lii Hen 2004 Debacle

Discussions

I fully agree. We have here a company that pays dividends dutifully to its shareholders 4 times a year. The directors have done well and has increased the EPS by leaps and bounds. To fault and bring down this company over a small technicality is I think frivolous. There are companies that have done much worst than Liihen. I am NOT selling my shares.

2013-08-26 15:07

sense maker

This article is really far-fetched, frivolous even, seemingly coming from someone who desperately hopes to push down Liihen share price by fair means or foul. The management of Liihen has imrpoved by leaps and bounds with increasing dividend especially since last year, to be fair. Investors should focus on the fundamentals of its business which has improved by a great deal. As said earlier, those who bought in and did not sell during 2004 share rally have only themselves to blame as they did not pay heed to the obvious fact that the price then was bought up to a level disconnected from its fundamentals. I went through the announcements made in 2004 and there were nothing wrong with them. If the directors colluded with the remisier in question in manipulating share price, then they would face the laws in their personal capacity. It has nothing to do with the company proper. So, I find it vert funny that some bear a grudge against Liihen, the company, to the extent of magnifying neglible administrative routines during the recent AGM beyond all proportion.

2013-08-22 18:48