A Stock Pitch to Koon Yew Yin - Lay Hong Berhad

steelman88

Publish date: Sat, 01 Sep 2018, 01:11 PM

On 24 August 2018, I have posted an article, "Why LIONIND Coming QR's Profit Will Be Lower?" (The link is attached below). Long story short, my forecast was correct, profit was down by more than 50% compared to last quarter. I believe some shareholders, may be including Mr. Koon Yew Yin disposed some or all of their shares after reading.

Source: https://klse.i3investor.com/blogs/lionind88/170807.jsp

LayHong's share price has dropped by near to 50% recently, What's Next?

To understand about the company's fundamentals & prospect, you may refer to the recent articles posted by Chicken King - most of his information is accurate and sharp.

Sources:

Layhong Part I - https://klse.i3investor.com/blogs/ckinginvest/172144.jsp

Layhong Part II - https://klse.i3investor.com/blogs/ckinginvest/172147.jsp

Apart from fundamentals, do allow me to share my opinions on Why the Worst could be Over for LayHong Berhad.

1. Panic Selling ahead of Quarterly Result

With some people who have access to the information (on egg prices, feed prices and etc.) by knowing that the coming quarterly profit would be bad, they sold the shares ahead of the result. As a result, information will spread to more people, and lead to more intense selling. At the same time, margin holders would be panic and joined the panic selling too. This has mainly contributed to the sharp drop of the share price - Panic Selling. Most of the short-term or margin shareholders will be OUT ALREADY.

2. Unfavorable Short Term Price Fluctuations - Feed and Egg Prices

Bad things don't last forever. Egg prices have recovered since June 2018 and the cost of raw materials dropped (corn and soybean prices crashed since June). Moving forward, the profitability would recover and I expect a much better result ahead.

3. Bear Fruits from Expansion - Plants will be ready in September and December 2018

A new further processed food plants will be ready by September 2018. A new liquid eggs plant will be ready by December 2018. As a result, the profitability will be increased and more sales would be generated.

4. Competent Management Team - Bring LayHong to the Next Level from time to time

As an investment, we should not only focus on predicting coming quarterly results, but also the competency and trustworthy of management team who will drive the company in a long run - buy and hold strategy to win big for shareholders. In the last 10 years, Lay Hong was able to show consistent growth and bring the company to the next level. Moving forward, the new plants will be ready and JV with NH Foods which will bring the company to the next level.

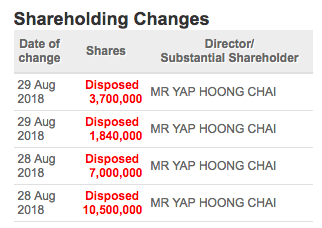

5. Is Disposal of Warrants by Yap a Concern? - They are Off-Market Transactions.

As you can see, Yap who is the Chairman disposed more than 20 million of shares through off-market. Off-market - means there is a specific group of private investors who WANT to buy them from Yap. So, why does Yap want to sell?

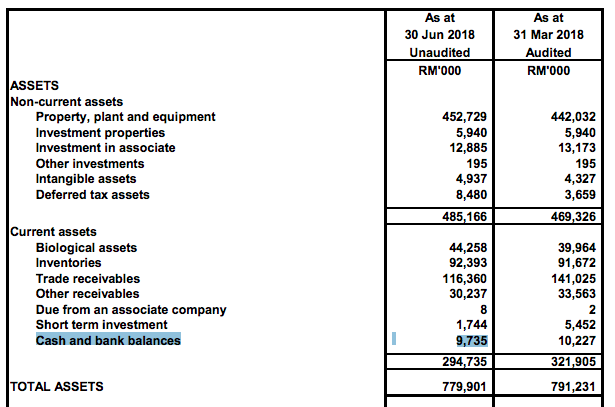

If you look at their balance sheet, they have less than RM10 million cash in banks. With expansion - setting up new plants etc, they would need to spend more on capital expenditure to fund the expansion. They have been using internally generated funds and borrowings to fund their expansion. Therefore, they need MORE funds for expansion.

According to the team, they are not considering rights issue or private placement - to avoid dilution. Please attend LayHong's AGM on 28 Sept 2018 to clarify yourself. Therefore, I have good reasons to believe the warrants are disposed to friendly private investors who have intention to convert them into mother shares to fund the expansion.

There are some people who panic and keep on saying the founder is selling, the founder is selling!! Don't worry bro, founder will have access to information on their own company, if he knows that the coming quarterly profit will drop that much, why not he disposed it earlier but now?

So, what's their cost of this group of private investors? Average selling price of the 20 million of shares is around RM0.23. Exercise Ratio is RM0.40.

Cost Price for Private Investors: RM0.23 + RM0.40 = RM0.63 per share

Cost Price for Lay Hong's Directors and Employees: ESOS exercised at RM0.58 on 16 August 2018 = RM0.58 per share

The share price as of last Friday: RM0.535

Please do your own judgement and do your own due diligence. It looks very attractive to me at such price. With their excellent track record and expansions moving forward, this will be my long term investment - to WIN BIG. Good luck.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Steel Man

Discussions

Uncle Koon, come here and be chicken promoter lar. If this counter shoot up, then you can cover your losses in Lionind and Jaks.

2018-09-01 15:17

another stupid article.layhong directors are selling the warrants like no tomorrow,means they have no confidence in the company.so u think u the smart did that's smarter than the people whom runs the company?funny.

2018-09-01 15:20

Competent management ? Acquire warrants and disposed within a month looks more like a failure to plan. Integrity is also questioned.

2018-09-01 16:18

the story is not convincing la. No major shareholders want to sell their shares on the cheap if is under value

all human, just greedy for more

2018-09-04 09:39

probability

wei..pity the oldman la...just now only got eaten half by Lion...u want him to become Chicken feed kah? kiki

2018-09-01 13:17