MARCO HOLDING BERHAD- HIDDEN GEM WHICH STRONGLY BENEFICIAL FROM STRENGTHENING OF RINGGIT

lewis27wong

Publish date: Mon, 04 Apr 2016, 11:04 AM

When talk about watches, what is the first brand that you ever think of? Rolex? Omega??? Tag Heur???

Now look at your wrist, your spouse’s wrist, your husband’s wrist, your children’s wrist, your friend’s wrist. What watch you/they are wearing? I can guaranty you that at least 1 out of 5 will be wearing a Casio brand watch. It can also either be a G-shock, Baby-G, Sheen, Edifice, Protrek and some other sub-line up of the Casio brand.

Now, if you are the 80’, 90’s and even 00’s. There is one type of calculator you definitely recognise, it’s the Casio FX-570 series scientific calculator. Why? Because you are using them so frequently in your math class, tapping on its buttons to help you solve your algebra, unknowns equations, differentiation, integration ………

So why am I highlighting this? Because Marco is the official distributor of the Casio products in Malaysia!!! Could you imagine how good their business are? Well, let have a look on their 5 years P/L and you will know it better.

*Continuous profit earning throughout 5 years.

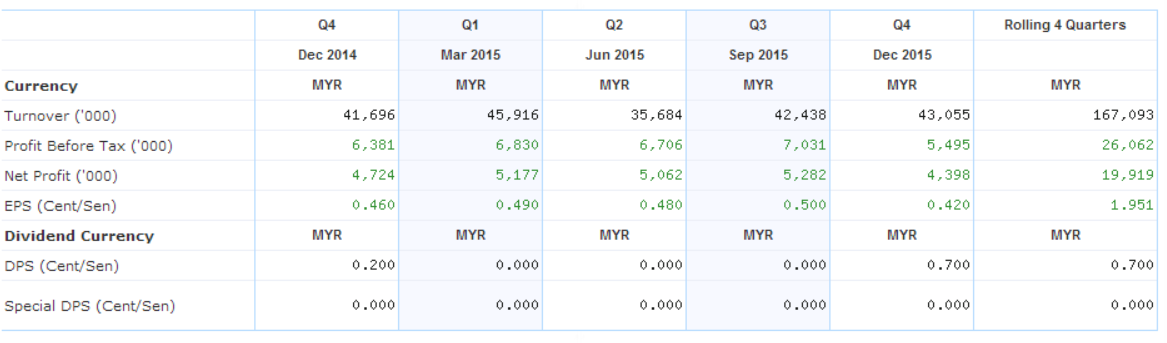

Now look at the rolling 4 quarters:

EPS is improved as compared to previous financial year,

Just recently proposed a dividend of 0.7 cent/share. Buy now and you can enjoy a 4.5% dividend better than FD when the EGM pass the proposal.

Now here is the spice. With strengthening of ringgit, the company shall enjoy a good earning from their retail business. Why?

Since 2015 the company has make 2-3 continuous hike of price for the products that they distributes which translate to roughly a 20% increment of their products price tag. Where I get the source? Well I am a G-shocks lover and also a reseller for casio timepiece and I collect watches and thus I am wide alert with the price changing. With the price comparison of DW-6900AC-2 (Retail price at Jan 2015= RM339.00, Retail price at March 2016=RM409 [already exclusive 6% GST]) Since the MYR/USD is peak somewhere around 4.42, thus I will use this figure to compare with Jan 2015 ringgit value which is about 3.50, the depreciation of ringgit is about 26%. So it make a good sense for the group to take up such move.

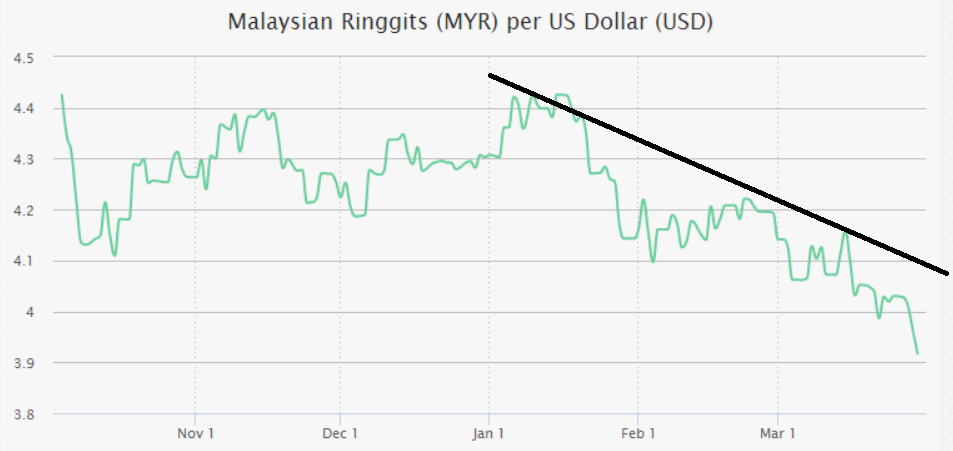

Now let see what have happened to our Ringgit in the past three months.

Ringgit is strengthening!! Appreciation is more than 10%! If the bullish sign continue we will likely to retest 3.80 level. By reviewing the annual report of 2014, you will know that the group conduct their stock purchase with USD. And the report do highlighted that If the Ringgit Malaysia strengthened by 5% against the following currency, this will result in a further increase/(decrease) in the Group’s profit and equity. From what I know, the company has not make any revision on the price tag of their goods. Thus, you can assume that the appreciation value will be all pocket by the company and translate into the company’s profit!

On my personal point of view, I am bullish on Marco. Based on the rule of thumb, PE=10, Marco group deserve a target price of 19.5 cent/share by referring to current rolling 4 quarters. Since the appreciation of ringgit factor has not been accounted, I personally thinks that it deserve a target price higher than that, I will use a PE=12 as a reference and set my target price as 0.23 cent/ share.

Disclaimer: Please do your own due diligence before you conduct your own trading. At the end of the day, you are the one who press the buy button. You yourself should responsible for the risk associated to your trading decision.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Lewis Trading Write Up

Created by lewis27wong | Dec 21, 2016

Discussions

Watches are not sunset business. Now watches are treated as accessories. Look at how G-shock and Baby-G watches are continuing provide new hype to the watch-lover. You simply search something like "G-shock lovers" & "G-shock community" in facebook. You will find numerous of groups exists. And many are Malaysian. Just a few simply research you will know how good their business.

Calculator, no one actually pay attention to. but look at the secondary students. Almost everyone are carry one scientific calculator. And what brand they are using? Casio

Marco is the distributor of casio in malaysia. They are behind of all these.

2016-04-04 11:21

Lol... Marco get high sales for their g-shock and baby-g watches which most are digital and ana-digi. Smart watch? They do come out with smart watch as well. Capable with any android phone and iphone somemore

2016-04-04 12:02

7% proposed dividend = RM0.007/share. Not 0.7 sen per share as quoted in the article.

2016-04-04 12:21

one (1) share is 10 sen (par value), 7% 0f 10 sen share is 7/100 *10 sen = 0.7 sen/share.

2016-04-04 13:27

one (1) share is 10 sen (par value), 7% 0f 10 sen share is 7/100 *10 sen = 0.7 sen/share or it is equal to RM0.007/share. Current a share is sell at RM0.15 or 15 sen, so it is equal to 0.7/15 * 100 = 4.67% (the dividend yield based on current market price is 4.67%).

2016-04-04 13:31

Hi ,JT Yeo ,we will be grade if you could give more deeper analysis on this counter since your analysis always useful and logical .thanks so much if you could give out your 2 cents on this...

2016-04-04 17:25

Well. Lets see the upsides versus the downsides. Downside is limited and there is rooms for upsides. So why not to buy?

If recommend only when it has already up a lot, people say you hourse after canon.

Now is a good chance to look into it. Upcoming result will be resilent, no joke.

2016-04-04 18:06

A few years ago, I looked at Marco and wondered, why is this gem continued to be unpolished? Something must be wrong. Then I looked at a post from Felicity dated 2012. Then it makes sense to me why the price is still stagnant.

http://www.intellecpoint.com/2012/07/if-you-want-to-pit-your-trading-skill.html

2016-04-04 21:46

More write up on this stock is pending. Will put more coverage on it soon.

2016-04-05 00:22

The problem is, i use casio fx 570 calculator for 10 years only replace for a new same model. This thing hard like nokia 3310. G-shock is also like 3310. Can keep on using just by changing battery. Compare with Swatch watch. every 2-3 years died. Swatch engineers are too professional.

2016-05-07 23:25

Anyone go agm ask what short term fund are purchased? is about 35 million cash. A half of the accumulated cash for so many years.

2016-05-07 23:28

.png)

lewis27wong

Do you know that Casio has the highest market share in digital watches around the globe?

Look at how crazy people are buying g-shock and baby-g. You will know.

Analog watches are still in good selling man. Casio also come out with analog smart watch with gps,bluetooth technology embedded.

2016-04-04 11:09