EPF Keen To Add More Highway Assets (StarBizWeek)

moneySIFU

Publish date: Sat, 01 Oct 2016, 10:21 AM

THE Employees Provident Fund (EPF) is set to acquire more highway assets in Malaysia in the near future as part of a major shift in its investment policy, sources tellStarBizWeek.

It is believed that the EPF is keen on acquiring highway assets that are still at a growth phase and have yet to experience strong traffic growth. They include highways that are located in the Klang Valley as well as intercity expressways in other states.

Instead of investing in public listed companies whose subsidiaries own highway assets as in the past, the fund is said to be opting for direct ownership in the operators instead. This ensures that the earnings derived from the highway operations will flow directly to the fund as opposed to their holding companies.

The shift comes amid low returns in the stock market and low yields due to the prospect of a prolonged slowdown in economic growth globally.

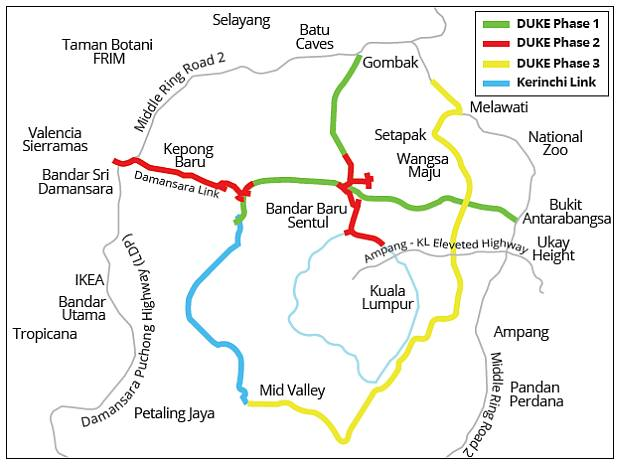

The fund is in the process of acquiring a 40% stake in the Nuzen Corp Sdn Bhd fromEkovest Bhd in a RM1.13bil deal. Nuzen is the parent company of Konsortium Lebuhraya Utara-Timur (KL) Sdn Bhd which holds the concession for the DUKE highway.

It is worth noting that DUKE, the Cheras-Kajang Highway and NNKSB are considered mature assets with resilient traffic performance.

“Operators of highways now command a significantly higher value compared to several years ago due to the strong cash flows inherent in the highways and a steady growth rate. The intention is to reduce the risk of volatility and achieve steady returns in a low yield market environment,” says an infrastructure sector analyst for a research house

Earlier this week, the fund’s chief executive officer Datuk Shahril Ridza Redzuan was quoted as saying that the EPF plans to invest more in private equity, property and infrastructure assets so they account for 10% of its total assets compared to 6% presently, Bloomberg reported.

The shift towards alternative asset classes will ensure greater stability for the fund’s financial performance as it seeks to maintain its dividend payout which has topped 6% per annum over the past five years.

“We are constantly on the lookout for infrastructure projects that best meet our risk-return expectations while offering strong cash flow, and each investment proposal will be scrutinised in detail for their sustainability,” the EPF said in a reply to StarBizWeek.

The fund added that it expects to boost investments in the alternative asset classes so they account for 10% of total assets under management over the next three to four years.

However, it did not elaborate on whether it is adding to its portfolio of highway assets in the meantime.

A rebalancing of its vast portfolio of RM690bil is necessary as the majority of the funds are invested in equities and fixed income instruments.

The fund reported a 26% drop in investment income to RM8.44bil during the second quarter ended June 30, 2016 (Q2FY16) owing to weaker equity prices.

It has previously acknowledged that maintaining returns from its fixed income investments will be a major challenge due to the low interest rate environment. The fund was also adversely impacted by the tepid performance of its holdings in Malaysian equities with the FBM KLCI declining by 2.4% to date.

Fully maturing highway assets are a reliable source of profits and provide a good hedge against upheavals in the capital markets. To give one example, Lingkaran Trans Kota Holdings Bhd, which operates the Damansara-Puchong Expressway, boasted a net profit margin of 41% in its latest full financial year.

The EPF already has a good track record in investing in highway assets. Aside from a 49% stake in PLUS Malaysia Bhd, it has a 49% stake in the concession holder of the Cheras-Kajang Highway and another 37.5% stake in the concession holder of the New North Klang Straits Bypass Expressway (NNKSB).

With a big player such as the EPF in the market for highway assets, it may make sense for existing owners to cash out.

At present, parent companies of tolled road operators, which tend to be conglomerates with other business segments, tend to encumbered by high debt loads required to finance the highways.

Servicing the interest payments on the debts puts pressure on the companies’ cash pile.

“Disposing the assets would reduce leverage and unlock immediate cash to undertake other ventures. A prominent fund such as the EPF have the means to endure long gestation periods and wait until the assets finally mature,” says an investment banker.

Source: http://www.thestar.com.my/business/business-news/2016/10/01/epf-keen-to-add-more-highway-assets/

More articles on 财务自由梦想 = 资金 + 自律 + 知识 + 毅力

Created by moneySIFU | Feb 17, 2022

Created by moneySIFU | Mar 11, 2017

Created by moneySIFU | Jan 18, 2017

Created by moneySIFU | Jan 06, 2017

Created by moneySIFU | Jan 03, 2017

Created by moneySIFU | Nov 22, 2016

probability

EPF...aiya...no need to look far..just buy all EKOVEST-WA & convert to mother shares within a years time would do! he he..

2016-10-01 14:00