Why MALAYSIA SMELTING CORPORATION will be my largest exposure of stocks in 2017 (paperplane2016)

moneySIFU

Publish date: Wed, 16 Nov 2016, 08:14 PM

I'm NOT the author of this article. This article was first publised at paperplane's personal blog & is now published here with permission from paperplane. Minor alignment & slight amendments have been made for better presentation purposes. Please don't invest if you are not sure about the business or its future.

First, I normally don't recommend stocks. But this rare gem really worth our studies. I share with all here the studies I have done and it is for references purposes only and it doesn't serve as any recommendation to buy or sell.

Why Malaysia Smelting Corporation Bhd (MSC) get my attention? A few reasons:

1. This stock is owned by one of the most famous value investors - Dr.Neoh.

2. Strong Cash Flow

3. TIN PRICE rally!

4. Selling of lands in Penang factory to unlock value??

5. Price recover back past 2-year record at RM4 range?

1. This stock is owned by one of the most famous value investors-Dr.Neoh.

From annual report 2015, he owns around 1.40%, another famous fund managers-ICAP owns around 2.90%

10.NEOH CHOO EE & COMPANY SDN BERHAD- 800,000 units=0.80%

13.DYNAQUEST SDN BERHAD-600,000 units=0.60%

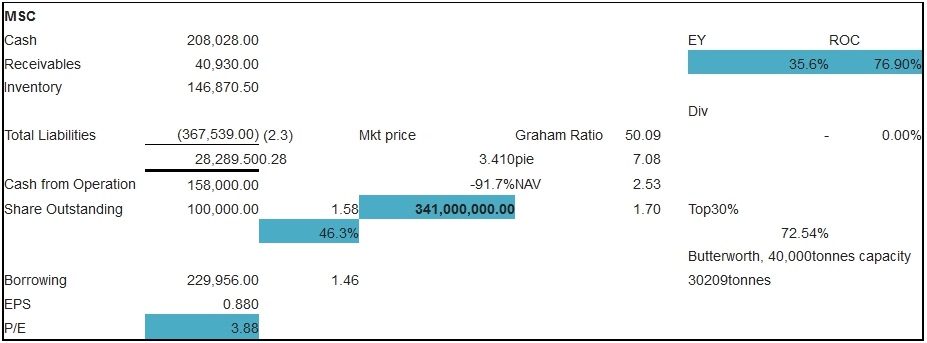

The shares are easy to calculate as it has share outstanding structure of 100mil exact. From the 2015 Annual Report, Top 30 shareholders had owned around 72.54% of the shares, making most circulating outside in market estimated to be only 27%

2. Strong Cash Flow

Look at Q2 2016 result, a one-off RM30mil write-off on associates occur. Without this, the company is actually in profit for 1H 2016.

A further reading under notes, it states as such:

6. Share of results of associates and joint ventures

The Group’s share of results of associates and joint ventures recorded a net share of losses of RM30.53 million in 1H 2016 compared with a net share of profit of RM0.35 million in 1H 2015. This was mainly due to higher share of losses from KM Resources, Inc. arising from the provision of additional prior years tax liabilities

Without such one-off items, we can estimate the EPS to be around RM0.88 per year. Which makes its P/E look attractive at around 4 now.

Its strong cashflows generation of around 79mil YTD is even more fastinating. Making its EY, ROC at marvellous status.

Its liability is manageable with its strong cashflows generation, while the cash yielding is one of the craziest I have seen recent years beside the earlier identified KESM!

It is yielding even crazier than KESM when I notice it. KESM was yielding near 30% when I discover it in 2015 end. MSC is now yielding around 46% and can even be MORE due to recent TIN price rally, coupled with weakening currency of MYR.

3. TIN PRICE rally!

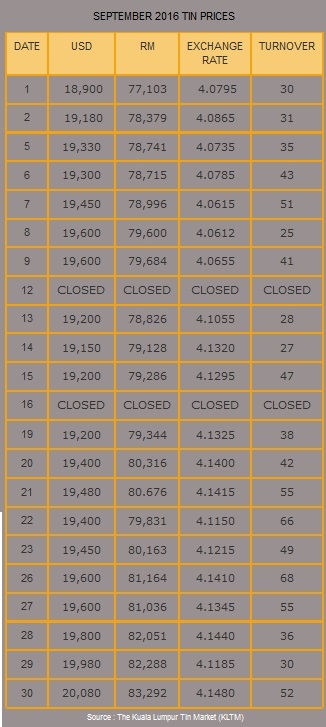

The most fundamental reason I am positive about MSC is due to recent rally in Tin Price.

Look at AR 2015, the company keep good track record on Tin prices for few years as below. Tin prices traded around range of USD 20,000 actually recent years. But a crash on prices happen in 2015.

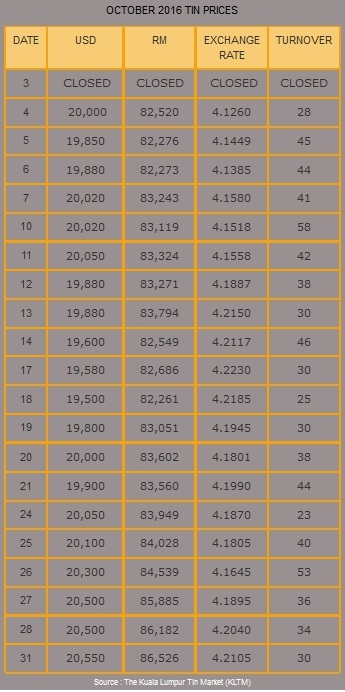

Tin price has since recover in 2016. As below for 2016

http://www.mtpma.org.my/index.

It has recently recover to above USD 21,000 which is why I am positive on their near future earnings.

4. Selling of lands in Penang factory to unlock value??

5. Price recover back past 2-year record at RM4 range?

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on 财务自由梦想 = 资金 + 自律 + 知识 + 毅力

Created by moneySIFU | Feb 17, 2022

Created by moneySIFU | Mar 11, 2017

Created by moneySIFU | Jan 18, 2017

Created by moneySIFU | Jan 06, 2017

Created by moneySIFU | Jan 03, 2017

Created by moneySIFU | Nov 22, 2016

Discussions

Your RGB & Johontin W are doing crazy, now bank security guards also know you

2016-11-17 01:27

Ezra_Investor, I don't judge people whether they know or don't know, not even judging them that they don't know what they don't know. Don't think you are so superior to think other people don't know & you are the only one to know.

I am here to look for investment opportunity to make money, not here to teach people. You go ahead with your life purpose but don't ever think all others are stupid. You are also kind of stupid to think you are clever than above all.

2016-11-17 07:55

Ezra_Investor, you are so right, don't try to teach people when people never ask you to teach, or else you make yourself looked stupid OR too ego.

2016-11-17 07:59

wah! just know that paper also know write article. Always blow cow only but this time really blow with fact.

Good job!

2016-11-17 08:00

Ezra_Investor, I will be so pleased to see you to remove your posts, you are making right move to rectify yourself. If you really want to teach people, do like what KC do, write more article to teach people, let those interested to be taught to read your articles(s).

2016-11-17 08:02

Look at Q2 2016 result, a one-off RM30mil write-off on associates occur. Without this, the company is actually in profit for 1H 2016.

A further reading under notes, it states as such:

6. Share of results of associates and joint ventures

The Group’s share of results of associates and joint ventures recorded a net share of losses of RM30.53 million in 1H 2016 compared with a net share of profit of RM0.35 million in 1H 2015. This was mainly due to higher share of losses from KM Resources, Inc. arising from the provision of additional prior years tax liabilities

Without such one-off items, we can estimate the EPS to be around RM0.88 per year. Which makes its P/E look attractive at around 4 now.

Its investment in associates as noticed in latest quarter result report is RM49.78mil, compared with Dec15 RM84.47mil. MSC, come and write off the balance. So the price can go further down and next year it will boom like mad.

Technically the RM30.53 million was not a write off but MSC taking up its share of loss in KM Resources, Inc.

Taxes in Indonesia very tricky unlike income tax in Malaysia. On and off prior years tax liabilities may suddenly pop up.

What is the status of KM Resources, Inc. operation ?

Anyway.... the balance of investment value as stated was only RM49.78mil left... unless MSC is committed to inject more fund.

2016-11-17 08:06

Recent quarter the management argue lower production, it actually trigger my worry also. If price good but nothing to sell also useless. I will closely monitor this stock to ensure no negative surprise.

Nowadays... hardly see lombong bijih timah in Malaysia... where the bijih timah come from ?

2016-11-17 08:09

haha. the tax liability a bit tricky really. I wonder why majority write off still appearing.........now I understand after rMoi explain. Hopefully this year will be last. Anyway share of loss in associate no impact right? Unless they want to continue pump money to help, else maximum loss just the amount they invest into associates.

2016-11-17 09:05

Dear Moneysifu and plane, I admired you guys to invest in all these high risk stock..... imagine this scenario, u owned this counter, and the market crash..... and the company is also losing a lot of money......which during the market crash, u can't sell your shares because it has dropped 30%, but at the same time the company is turning bad, like it always do, losing money, what will you do?

Bcos as u all know the tin price very very unstable, this has high probability of happening.

2016-11-17 09:42

aiyo, think positive lah, why always market crash, why not bull market coming......

2016-11-17 09:45

problem is not market crash u know, if the company very good then crash will do nothing else, just in case, when it crash, the company turn lousy.... MRapolo, if u can't understand then just ignore my question, not asking you :)

2016-11-17 10:18

The only way to make money in stock market is to understand the business, management & company, knowing the financial details of the industry & companies, think as a business owner, understand own financial capacity how far we can go & what returns we can expect. Most important is to control the emotion.

2016-11-17 10:30

Some like apple while others like orange, some prefer wait for musangking durian to drop once a year.

I like watermelon :)

2016-11-17 10:34

high risk high return. MSC is high cash, high yield, low risk, super good high return. haha

2016-11-17 10:43

his question is "market crash company turn lousy??", which i really dont understand...

2016-11-17 10:46

To be fair, Market crash all die, even public bank also could not avoid. I was cheated by someone since 2010 for market crash was in the corner. So my money was earning less than FD since then. Luckily i woke up last year & do it myself. Far superior returns than so called self proclaimed M warren.

2016-11-17 11:07

A lot more to learn from you guys.....I will follow you guys and learn along the way, not using money thou XD

2016-11-17 11:27

Buy some cartons of sardines, luncheon meat, and preserved veggies in case something goes wrong in '17 and newbie didn't make it out the arena. Won't risk this.

2016-11-17 11:31

I hope everyone can make money here also. Just monitor closely on its progress........

2016-11-17 12:28

Posted by RUOutOfUrMind > Nov 17, 2016 07:55 AM | Report Abuse

Q: Ezra_Investor, I don't judge people whether they know or don't know, not even judging them that they don't know what they don't know. Don't think you are so superior to think other people don't know & you are the only one to know.

A: I've never claimed to be superior to anyone, since when?

Which word, which statement did I tell everyone I'm more superior than them? C'mon, tell me.

I don't claim to know everything, but when I write, I must make sure I KNOW something.

The reason why I judged you is because your arrogant yet ignorant attitude.

As they say "Empty can makes the most noise".

As KC would say “Empty tong, pong, pong, pong”.

Q: I am here to look for investment opportunity to make money, not here to teach people. You go ahead with your life purpose but don't ever think all others are stupid. You are also kind of stupid to think you are clever than above all.

A: That's your problem. Don't mix me with you.

I'm here to make money, but also doing my part of the social responsibility towards the investing community.

At least when I make something I give back to the society, ask yourself, what have you contributed back?

I never thought others is stupid, I only think you ARE stupid.

Q: Ezra_Investor, you are so right, don't try to teach people when people never ask you to teach, or else you make yourself looked stupid OR too ego.

A: Whether I teach others or not is up to me. Whether people listen or not is up to them.

I cannot force others to accept my opinion, but I can choose whether to at least try or not.

Plus I wasn't even teaching you in the first place, I was talking to MoneySIFU.

If MoneySIFU didn't complain anything, so what what basis do you campur your mouth?

As they say "Mind your own business".

Q: Posted by RUOutOfUrMind > Nov 17, 2016 08:02 AM | Report Abuse

Ezra_Investor, I will be so pleased to see you to remove your posts, you are making right move to rectify yourself. If you really want to teach people, do like what KC do, write more article to teach people, let those interested to be taught to read your articles(s).

A: You're wrong. I'm only removing it because I'm dishearten by people like you, not because I've made a mistake.

The reason why I never write an article is exactly because of people like you.

When you give people something good for free, they will never appreciate. So why should I?

I only like to teach selective and potential people who I like, just like moneySIFU.

Please stop talking. I'll stop here as well.

It's a waste of time to talk to you, as you keep on twisting my words and intentions.

And time is money. Time wasted is money wasted.

2016-11-17 13:23

Ezra bro,

Don't get dishearten and continue your great work. I find your writing and sharing one of the best in i3 without prejudice and not trying to promote stockpick. :D

2016-11-17 13:44

http://www.mtpma.org.my/index.php/statistic/2014-07-07-04-56-57

I monitor this closely

2016-11-17 14:45

I was not the one who started to calling people stupid, please check all comments.

You have said what you wanted to say & me too. Thank you.

2016-11-17 15:41

Ya... amount that can be written off is upto the cost of investment... unless MSC has given big loans and advances to the associate... or if MSC as lead shareholder is contractually obliged to provide financial support as in AirAsia

2016-11-17 16:42

Hi paperplane, do you know what is the meaning of turnover as indicated in the table?

------------------------------------------------

paperplane2016 http://www.mtpma.org.my/index.php/statistic/2014-07-07-04-56-57

I monitor this closely

17/11/2016 14:45

2016-11-17 17:10

now, RM400mil in value, if you to takeover whole company, and this company can give you cashflows 120mil, are you willing to takeover?

2016-11-18 08:39

The movement of tin price in the past has largely determined the results of MSC. Please view my working below for clearer picture

If the tin price was moving up, the company were making profit

If the tin price was moving down more than 4%, the company would likely make loss

http://klse.i3investor.com/files/my/blog/img/bl2510_msc_results_vs_tin_price_movement.jpg

2016-11-19 11:40

Tin Bull Market Extends Into Q4, Good News to MALAYSIA SMELTING CORPORATION?

http://klse.i3investor.com/blogs/moneymoney/109542.jsp

2016-11-22 15:25

Haha. Moneysifu, when you write this what was tHe price?? Is there near 20% gain Liao?

2016-11-25 22:06

ronnietan

Latest Q 17 sen EPS. If it can sustain this level, or even higher, next couple of quarters, you'd have another winner in your portfolio.

Helpful if it'll re-instate a dividend this year.

2016-11-17 00:29