MQ Trader – How to pick a stock?

MQTrader Jesse

Publish date: Wed, 01 Aug 2018, 11:42 AM

Introduction

Investment is known to have the potential to help us in accumulating wealth like a snowball effect. This goal is possible to be achieved when we invest in the right company. In the past blogs that we shared, we have mentioned the criteria on how to identify when to sell or buy a counter. You may visit Introduction to MQ Trader Trading Strategies to understand more.

Finally, you decided to start investing after you have mastered the knowledges on when to sell or buy a stock. However, the challenge of choosing a stock arises – How can we pick a stock from the numerous stocks available in the stocks market? Are we going to study their fundamental and technical analysis one by one?

In this topic, MQ Trader is going to introduce our newly launched feature, MQ Trader Stock Screener.

What is Stock Screener?

A stock screener is a tool that investors and traders can utilize to filter the stocks based on user-defined metrics. This tool allows users to set a series of criteria based on users’ standards and trading strategy, so as to identify a list of stocks that can fit their requirement and interest.

It is a kind of mechanical investing which allows a model to make investment decisions for the traders. This tool can be pretty useful to help us on making investment decisions based on important facts, as a successful investment requires a lot of discipline.

How does MQ Trader Stock Screener work?

MQ Trader stock screener is an effective filter designed to fit the key requirements of investors in the Malaysia stocks market. There are hundreds of stocks listed in Bursa Malaysia and it is not feasible for us to track all of them on our own.

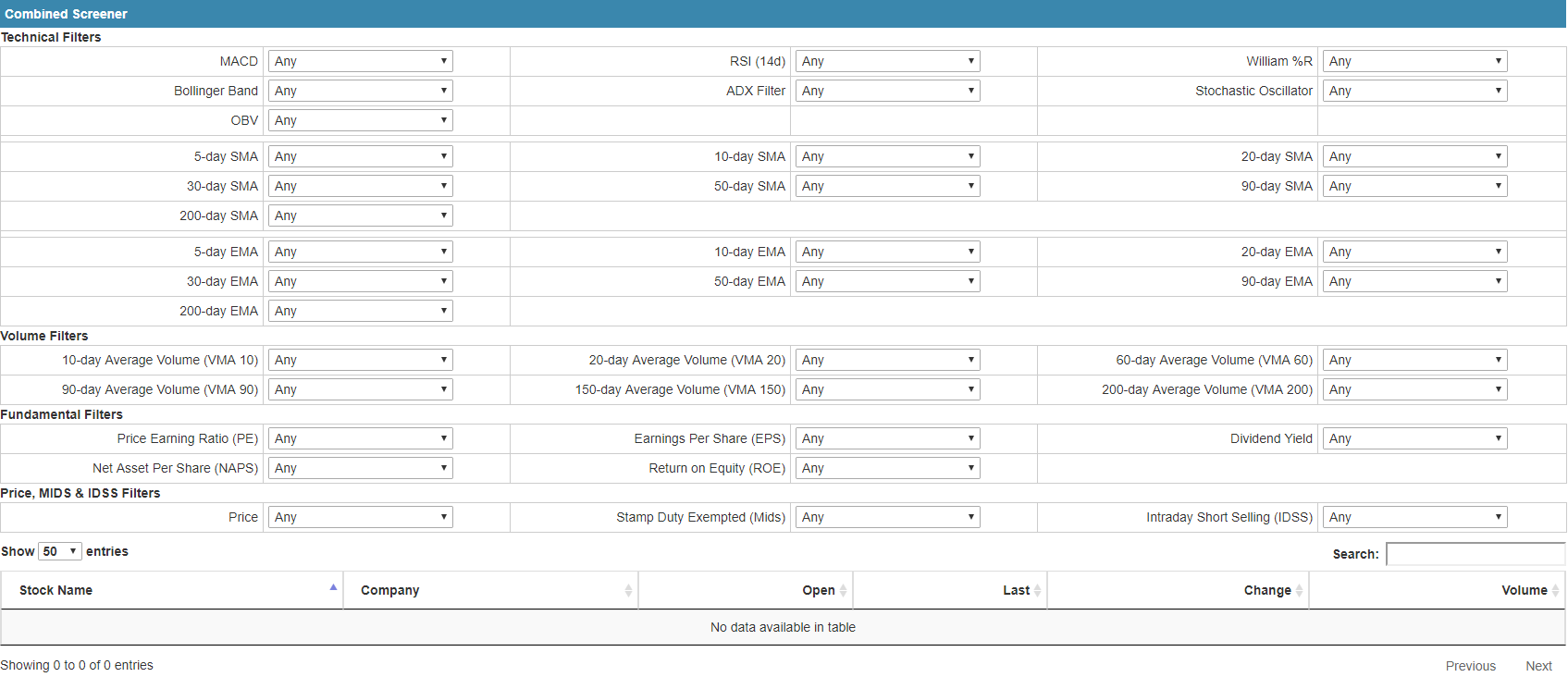

MQ Trader system comprises 3 types of screeners including Technical, Fundamental and Volume together with a combined screener which can combine all the financial criteria in a single screener.

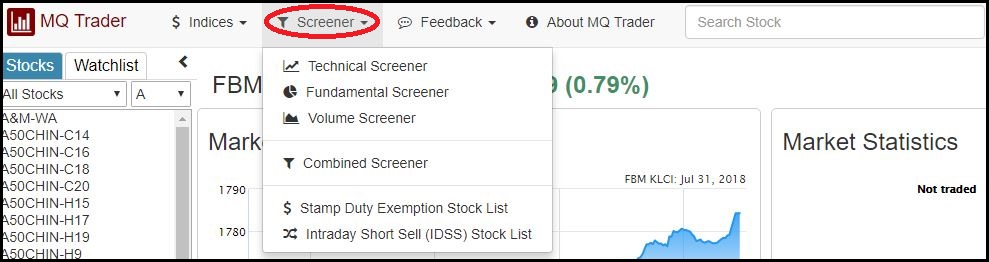

MQ Trader Stock Screener can be found in MQ Trader Stock Analysis System as shown below:

Source: MQ Trader Stock Analysis System

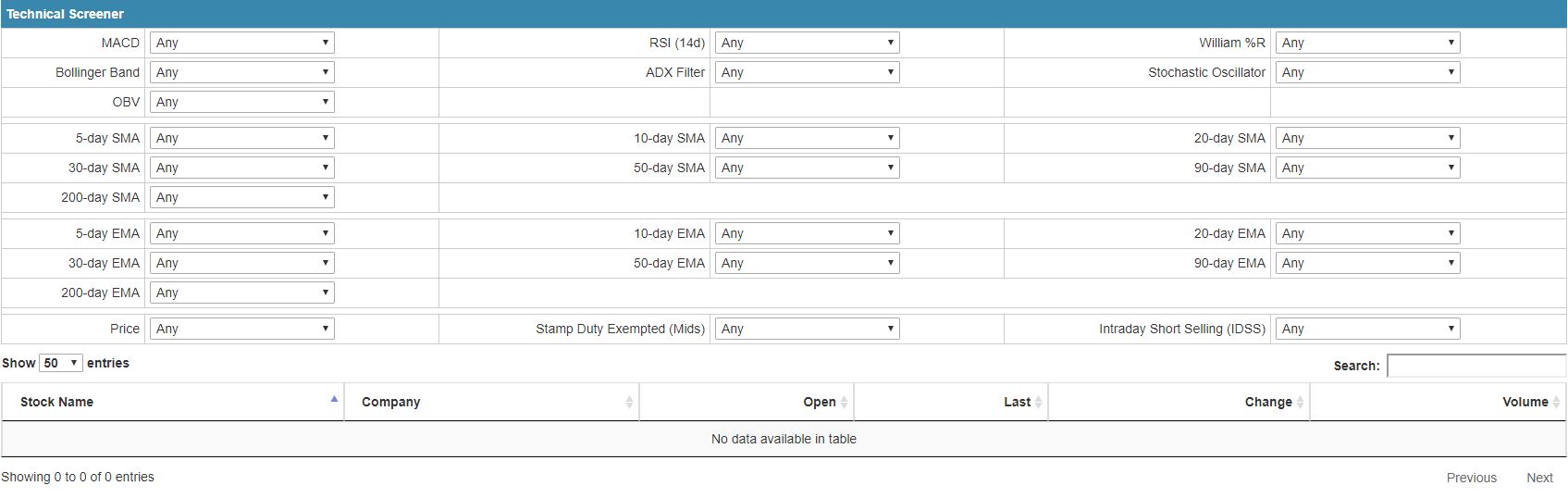

Figure 1: Technical Screener

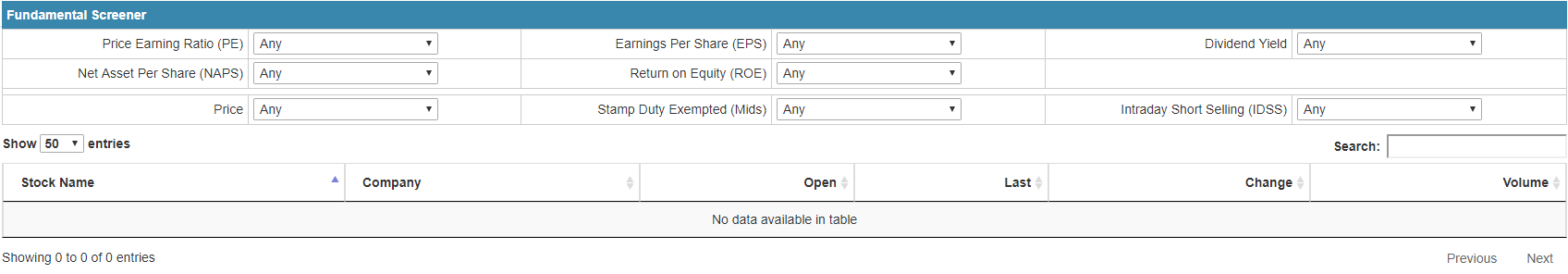

Figure 2: Fundamental Screener

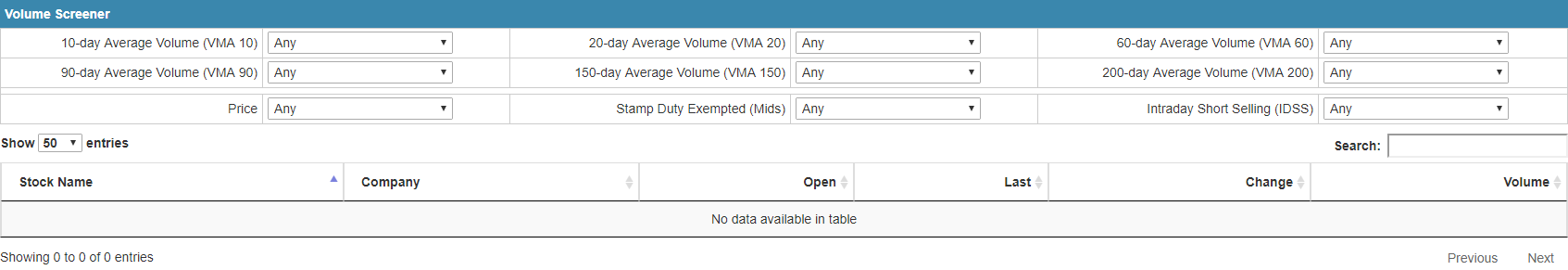

Figure 3: Volume Screener

Figure 4: Combined Screener

Pros of MQ Trader Stock Screener

- Provide a stock lists with multiple financial criteria

- Able to narrow down numerous shares within a few seconds

- Assisting traders to diversify portfolio across multiple sectors

- Long Term and Short Term Triggers

What to Screen for?

The financial criteria setting of a stock screener is not only meant for providing up-trending stocks list but it can be customized according to the trading strategy and standards of traders. There are more than 30 variables available in MQ Trader stock screener and different combination of the variables can be formed endlessly.

Screeners are extremely versatile but it will be unable to show its power if traders are unsure with what they are looking for.

To know how to use MQ Trader Stock Screener in details, please proceed to MQ Trader –Technical Screener for Up-trending Stocks, MQ Trader - Technical Screener for Down-trending Stocks, MQ Trader - Fundamental Screener, MQ Trader - Volume Screener.

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedbacks coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

More articles on MQTrader Education Series

Created by MQTrader Jesse | Apr 13, 2023

Created by MQTrader Jesse | Aug 06, 2021

Created by MQTrader Jesse | Nov 01, 2019