Offshore companies riding on tax haven

benhctan

Publish date: Sun, 12 May 2013, 04:51 PM

There are a number of countries with banks offering secrecy and "tax havens." The most common ones include:

Anguilla

Anguilla is a British territory in the Eastern Caribbean. It's considered an offshore business center and a tax-free zone.

Belize

Belize has offered offshore banking since 1995. Accounts maintained with these banks are not subject to local taxes and their customers are given privacy concerning their account. If the Belize courts find that funds are coming from criminal activity, however, the banks are required to release the identity of the account owner.

Bahamas

Banking secrecy in the Bahamas is not as strong as other countries that offer it. New banking legislation allows banks in the Bahamas to divulge the fact that a particular person or company has an account with that bank.

British Virgin Islands(BVI)

The British Virgin Islands is one of the major tourist hubs of the Caribbean.

BVI tax havens have no taxes in place for BVI offshore companies who do no business in the jurisdiction. International business companies will pay zero taxes on the profits, interests, dividends and other types of incomes earned outside of the jurisdiction.

Cayman Islands

The Cayman Islands have extensive privacy laws related to banking, and, like Switzerland, officials that break the secrecy law face imprisonment.

Panama

Panama is seen by many as a very stable country offering bank privacy.

Tax Haven exposed: youtube

An OFFSHORE BANK is a bank located outside the country of residence of the depositor,typically in a low tax jurisdiction that provides financial and legal advantages.

- greater privacy, low or no tax,easy access to deposits

- protection against local, political, or financial instability

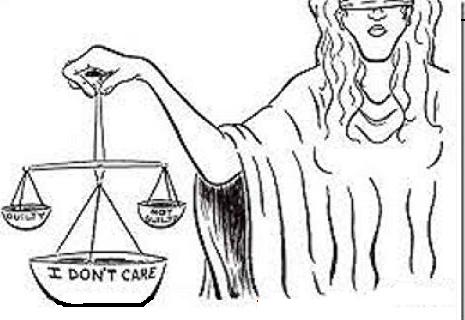

Offshore banking has often been associated with the underground economy and organized crime, via tax evasion and money laundering.

According to Merill Lynch and Gemini Consulting “World Wealth Report” for 2000, one third of the wealth of the world's “high net-worth individuals”—nearly $6 trillion out of $17.5 trillion—may now be held offshore.

The IMF has said that between $600 billion and $1.5 trillion of illicit money is laundered annually, equal to 2% to 5% of global economic output.

Today, offshore is where most of the world's drug money is allegedly laundered, estimated at up to $500 billion a year, more than the total income of the world's poorest 20%. Add the proceeds of tax evasion and the figure skyrockets to $1 trillion. Another few hundred billion come from fraud and corruption.

These offshore centers awash in money are the hub of a colossal, underground network of crime, fraud, and corruption.

Interesting Reading HERE.