A quick check on Investopedia tells you this.

A recession is a macroeconomic term that refers to a significant decline in general economic activity in a region, country, or the entire world that goes on for more than a few months.

It is visible in industrial production, employment, real income, and wholesale-retail trade. The technical definition of a recession is two consecutive quarters of negative economic growth as measured by a country’s gross domestic product (GDP), although the National Bureau of Economic Research (NBER) does not necessarily need to see this occur to call a recession.

An easier way to explain would be for these to occur:-

- Negative GDP growth for two quarters

- NBER acknowledge that a recession is happening

- Recession is official

In a way, you can already feel it that everything is slowing to the extent of stopping but it is only a recession when NBER calls it a recession. By that time the market would already declined 10-15% depending on the severity that they are expecting.

The current market is anticipating that a risk of a recession is higher than ever. This is why you hear it a lot on the news and TV about this matter.

A Little History Lesson

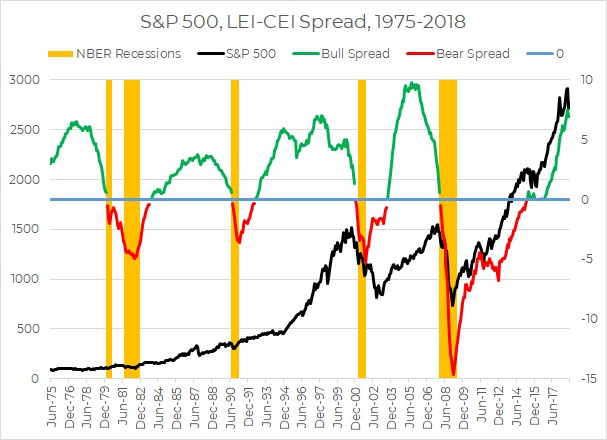

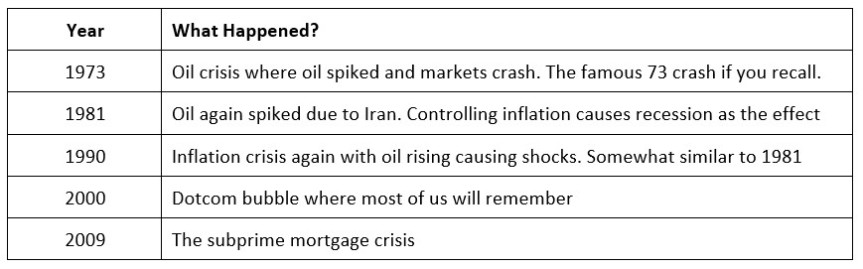

Since 1970, there are only 6 official recessions in America or you could say 5 major ones that have a major impact. Other nations might have their own recession such as the Asian Financial Crisis in 1997 but the American GDP being the largest in the world, a small move on their side shakes the world!

So, how is it that in almost 50 years, we only see 6 times of negative growth in GDP? Simple as it is, the government play a crucial role by pulling a lot of strings behind the scene to abate the likelihood of falling into recession.

History proves that although plenty can be done behind the scenes situation such as an oil shock inflation is not something that can be stopped leading to a recession in the end. Today, we are looking at price below the long-term average of $70 and there shouldn’t be any major inflationary pressures from oil or any other commodity.

In fact, became clear that oil has lost its glory to move the world and the new millennium crisis started with a crazy money chasing unknown technology followed by a disgracefully fraud system in 2009.

Is A Recession Coming Then?

We honestly felt less optimistic for the first time since 2012 for markets to go up. Back in 2012, the Greece bond turn into rubbish and the whole of Europe looks like another case of fraud that could bleed the world and luckily it was contained.

This time around, we believe that the government is not doing to lower the risk of a recession. The President’s plan had seen a divergence from the house that votes on the approval of a spending.

The Fed isn’t cooperating much with the government and somewhat every single person has an interest of their own running behind the scenes. Collectively everyone talks about recession and nobody does anything trying to avoid it.

This round’s recession could originate from bad politics and it is definitely unprecedented in the history of economics or America. This is what happens when the people who manages the country doesn’t have a clear path on how things should work out.

Take for example, the Chinese government could easily avoid a recession by spending more or even literally building bridges to nowhere. But the American check and balance system has some weakness in tackling this issue.

The ‘wall’ that President Trump is talking about isn’t going to come but in fact this wall is actually a strong government spending that could buff up some industry.

In conclusion, the US economy is starting to get sick and the medication administered is the wrong one to treat or avoid this illness. But just for the sake of politics, we think that a recession should hit until the next US election.

Trump wouldn’t want to be labelled the President that caused a recession.

natalie321

There are a number of indicators that economists use to identify a recession including a decline in GDP for two consecutive quarters, a decline in consumer spending, etc. https://buildnowgg.co/

2023-04-11 17:28