Opinion: How Would the Airport REIT Look Like?

omightycap

Publish date: Mon, 05 Nov 2018, 02:15 PM

See it here first!

There are definitely many ways that the government could split the structure of Malaysian Airports Holdings Berhad (MAHB) but with the government saying that it would be the first of its kind, we think that it is not as simple as divesting commercial floor space.

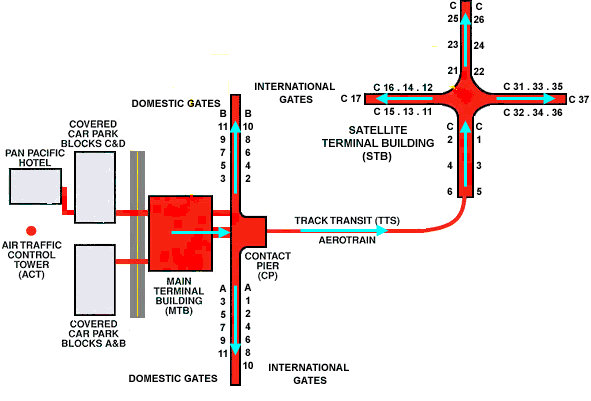

We think that they could actually ‘REIT’ real airport specific facilities such as runways, terminal buildings and cargo facility. These facilities are actually owned by the government and sort of provided to MAHB just to operate.

A Deep Dive into the Assets of MAHB

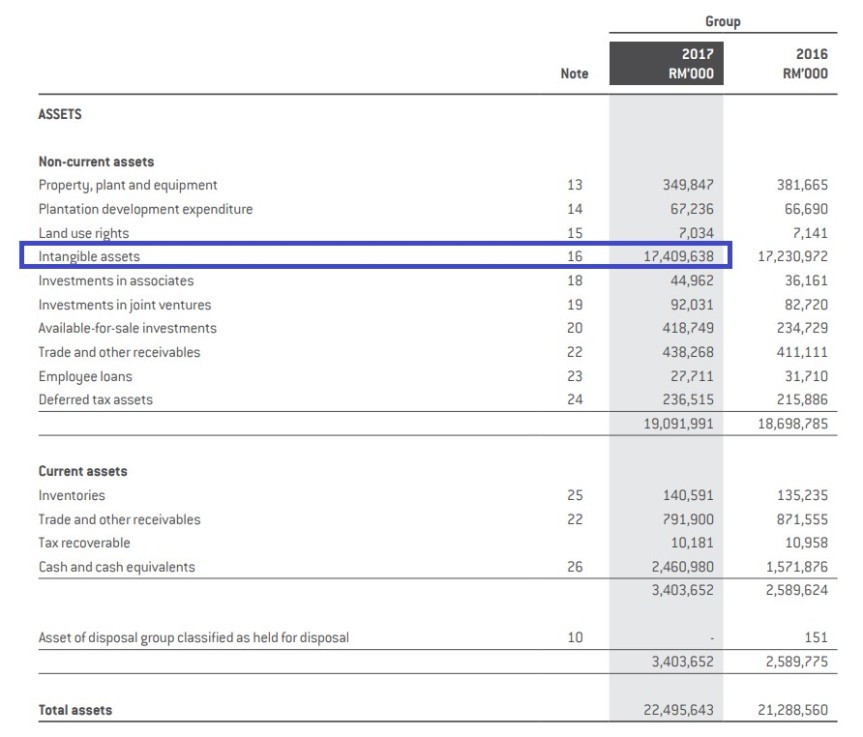

Ever wondered why the intangible assets of MAHB is so high?

For MAHB, the biggest portion of asset lies in the intangible asset but why is it intangible? Does intangible really mean that they don’t quite own it? Let’s see…

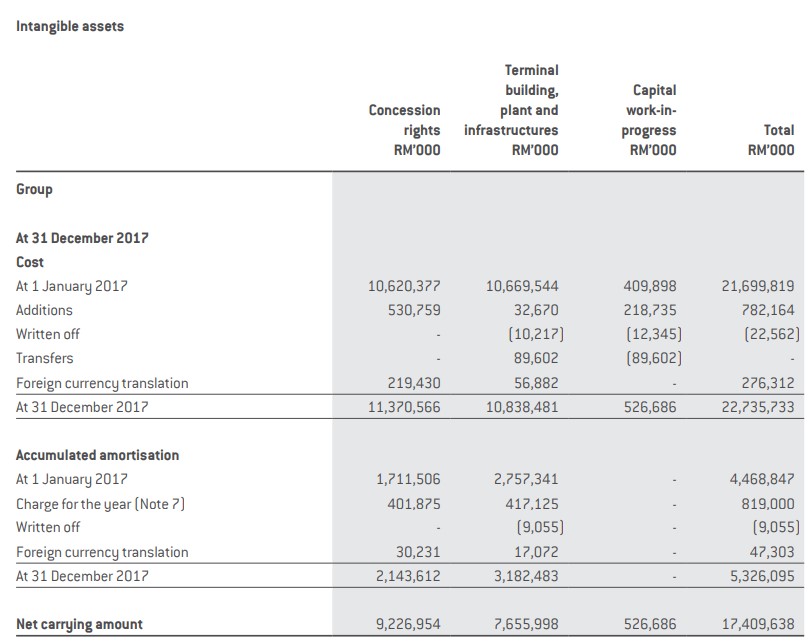

Extracted from the annual report, intangible assets come in the form of concession rights and terminal building, plant and infrastructure. It would seem odd as terminal building isn’t quite an intangible, but a very straight forward asset where could literally make money from it instantly.

A check further revealed how they define concession rights.

- MAHB signed operating agreement on 12 Feb 2009 for a 25-year period and likely to extend to 35 years ending 2069 with the government of Malaysia. The asset on concession rights up would be impaired as the time goes by up till the end of the agreement.

- Similar concession rights in Turkey’s airport

Due to their special agreement with the government, the concession rights asset is an allocation of penalty payment if any of the party terminates this agreement.

So as the contract nears the end the value becomes smaller. Obviously before the agreement ends a new agreement would be set out. Indeed, this is high value intangible asset as no other corporate body can operate an airport.

How about infrastructure considered as intangible asset?

Technically MAHB builds those terminal buildings, runways, etc are built by MAHB but it is still considered a public service infrastructure. MAHB doesn’t own those infrastructure as mainly some of the progression are funded by the government such as new terminal, runway extension, etc.

But MAHB is allowed to charge the public and make a profit with those assets. In the end, the government gets nothing from it except airport facilities for its people. That sure made it clear that it should always be in the intangible asset section.

This is why in order to liquidate some assets in return for cash, the government would try out the REIT structure to free up more cash to buff up the country’s cash pile.

New Airport REIT

We think that the government would expect to withdraw the assets such as terminal building and infrastructure (column 2 of intangible assets) and inject it into a REIT. MAHB would continue to operate the airport and the current revenue generated by MAHB would be shared with the REIT.

Likely Revenue for the REIT

- landing fees

- parking fees

- cargo facilities

- airline hub fees

- passenger service fee

Likely operating cost for the REIT paid to MAHB

- security fees (auxiliary police hired by MAHB)

- operations personnel (plane turnaround, control tower, engineering, etc)

- maintenance

Specifically, all rental related revenue would go to the new REIT company while MAHB would be operator/manager for this REIT and receive a service fee. MAHB could still operate its other non airport related operations ie. duty free, agriculture and hotel.

Share Price Reaction

We see a massive drop in AIRPORT share price which we can justify because MAHB might lose its pricing power on what to charge for those facilities. We might also see the removal of those intangible assets which covers terminal buildings.

The government will sell its ownership of those ‘public infrastructure’ to investors and gain some cash for doing that. It is expected that the government can raise RM 4 billion cash from this event.

Following that, MAHB can make more solid profits rather than having to minus cost from amortization of terminal buildings. Furthermore, the new REIT can benefit investors especially our local retail investors and the government does have some cash to turn things around.

Like our page to get more these https://www.facebook.com/omightycap/

Make the next post easily visible from your Facebook!

You can visit us at http://omightycap.wordpress.com

More articles on O'Mighty Capital Articles Archive

Discussions

but , under the right terms, this REIT sure looks better than shopping mall reit......

conclusion: sell shopping mall REITS , buy this REIT.......monopoly.

2018-11-05 14:53

We think that government will own part of the REIT together with MAHB just some portion to sell to public. End product, government divesting assets to raise cash. A better way compared to selling whole power plant.

2018-11-05 15:53

MAHB as operator pays leases to the government for use of those assets....I guess those leases are also the income for the REITS.....

2018-11-05 17:35

qqq3

they say it will be user financed.........now, user fees go to MAHB as operator.....now, government owns the land and no income.....in future, the land becomes REIT.....and users finance MAHB and REIT...means what?

means users will have to pay more la.......

2018-11-05 14:51