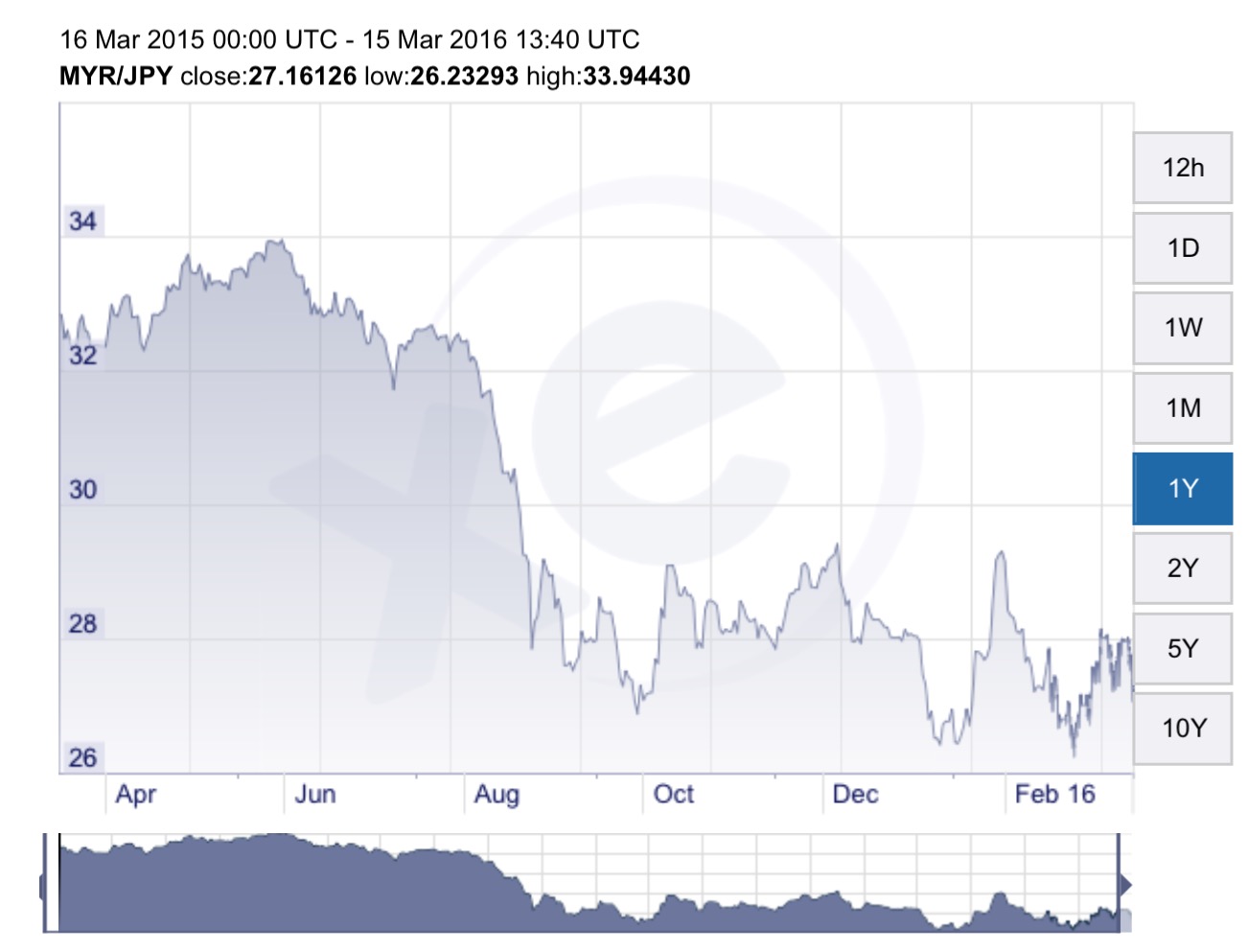

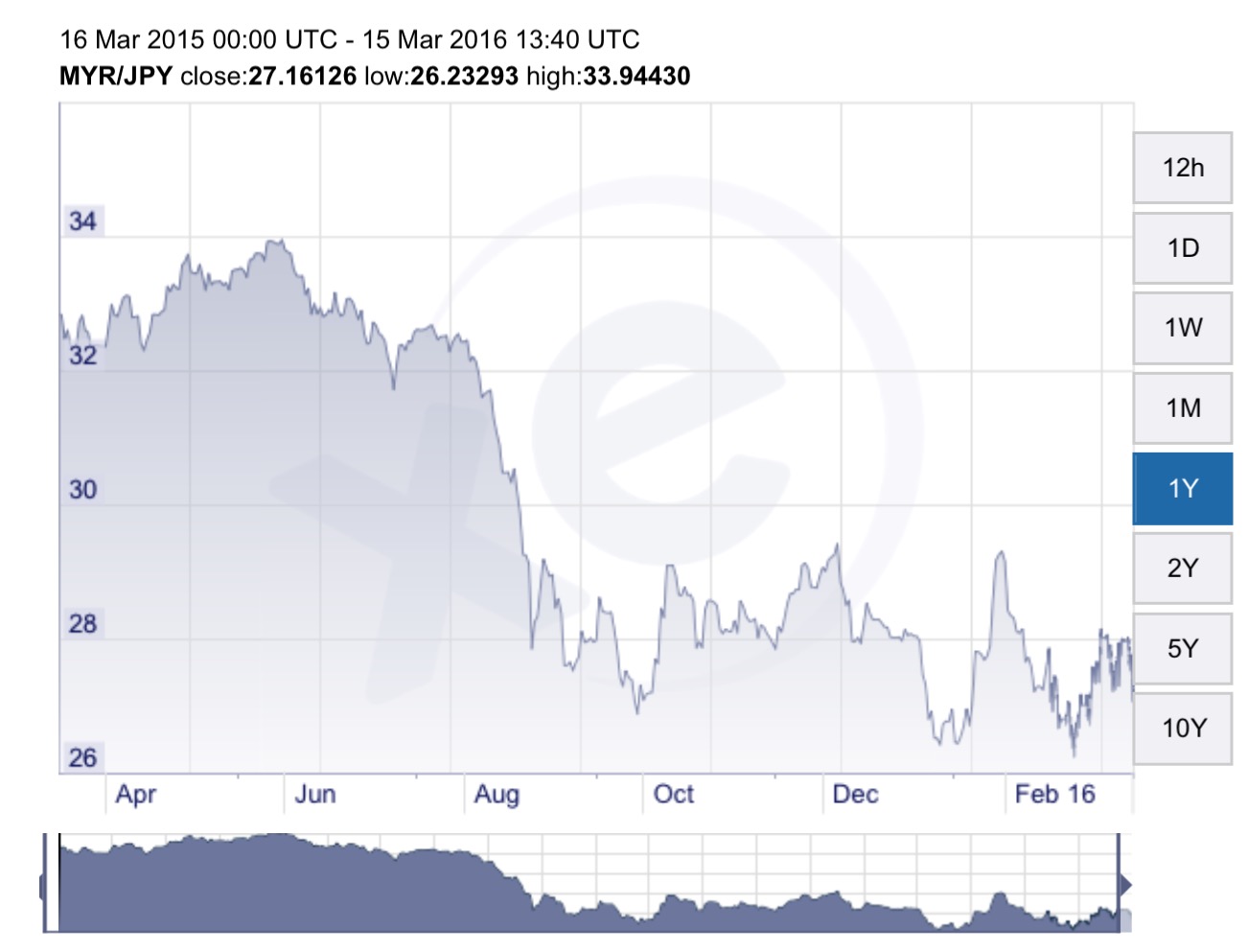

The depreciation of ringgit against US Dollar and Japanese Yen, weaker consumer spending and fierce competition are triple whammy for the auto industry. Many automakers are forced to hike selling prices for cars since last year due to higher import costs, which will further pressure sales in current challenging time for consumers. The ringgit has free fall by 25% from its high in June.

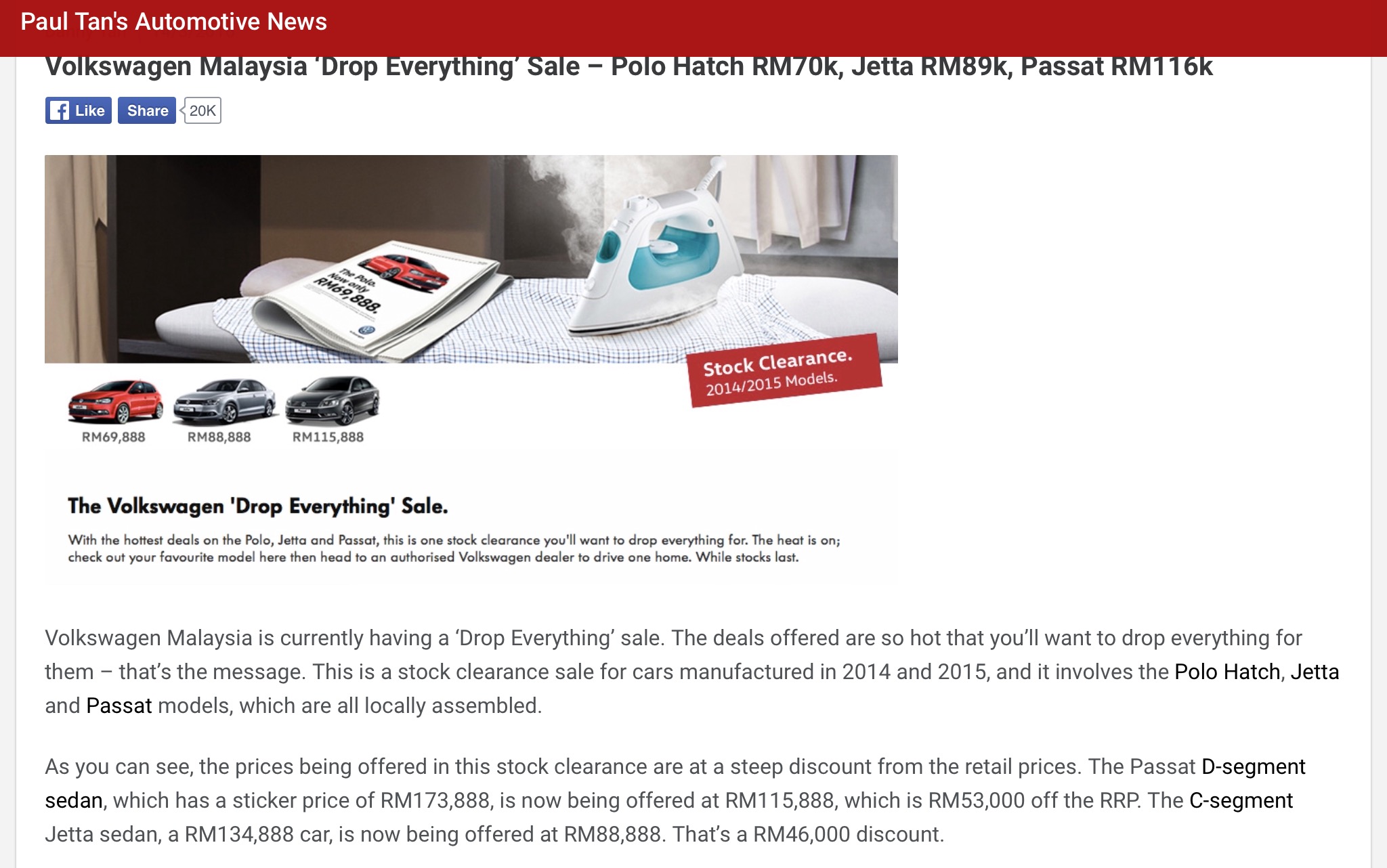

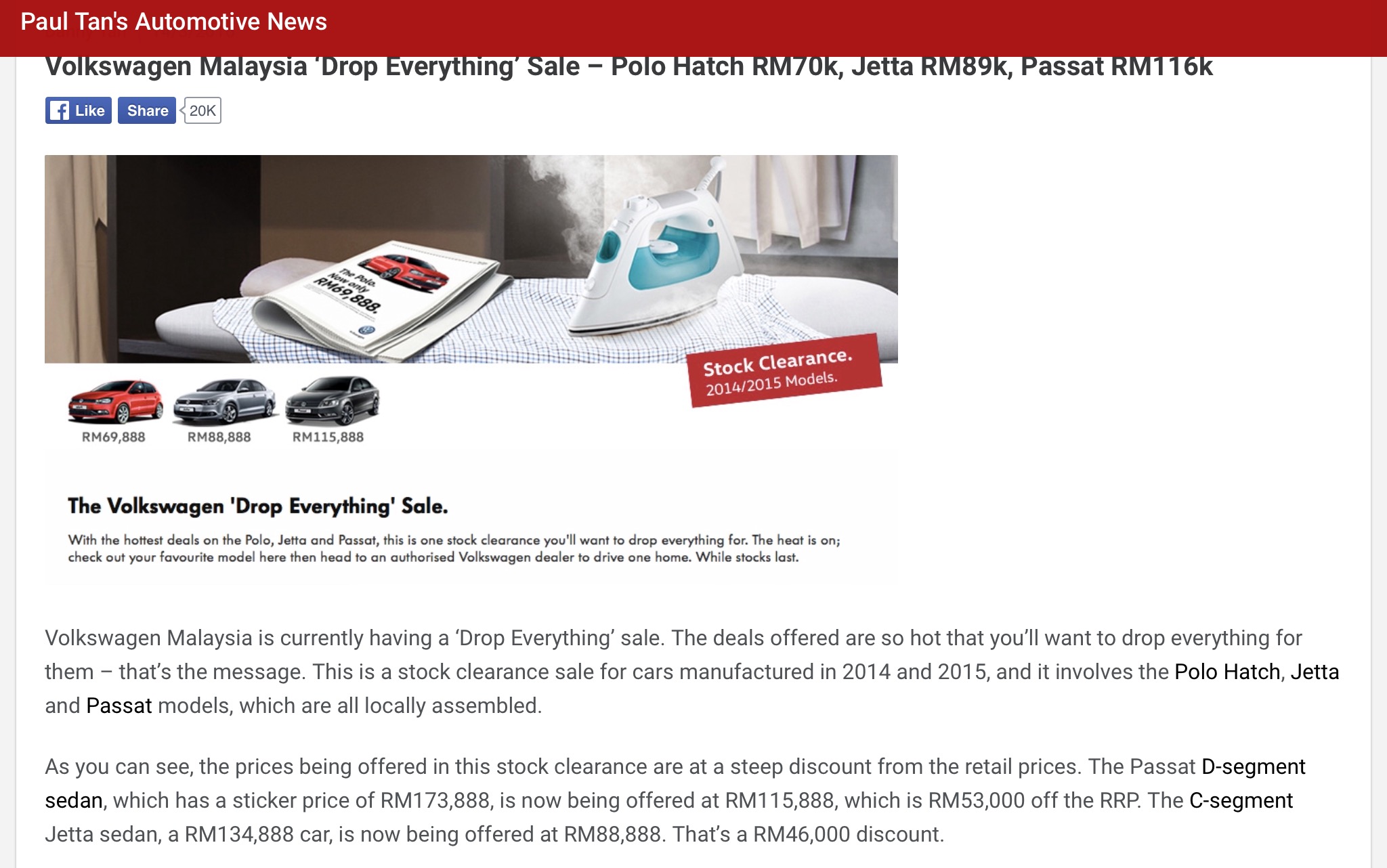

Fierce competition to win market share through aggressive promotions and discounts would cause profit margins for automakers to slump.

MAA also projected a fall in total industry volume for the first time in the last 20 years. This year could well be the WORST year for the auto industry in decades.

Today, Berjaya Auto announced its latest quarter results. BAuto suffered a slump in net profit even though It has entered into hedging for the quarter.

Profit margin are expected to fall more in the next few quarters. BAuto hedging of Japanese Yen expired in December last year. Their import costs will definitely go up from the 20% appreciation of Japanese Yen against ringgit and further cut profit margin.

Even Major shareholder Vincent Tan sold hundred millions of shares recently. He reduced his stake in BAuto to 23.65% from 34.29% last year.

Analysts are too optimistic on BAuto and perhaps forgot about the expiry of its hedging!

KUALA LUMPUR (March 11): Berjaya Auto Bhd (BAuto) saw its third quarter ended Jan 31, 2016 (3QFY16) net profit fell by 11.6% to RM41.13 million or 3.6 sen per share, from RM46.52 million or 4.1 sen per share a year ago, mainly due to margin contraction.The group declared a third interim dividend of 2.15 sen, with ex-date on March 30.

In its explanatory note to Bursa Malaysia today, BAuto said the slower financial performance was attributable to the drop in profit from local operations, as well as mitigated by improved performance from Philippine operations, higher profit contribution from associated companies, and lower Employees' Share Option Scheme (ESOS) expense.

“Although revenue for Malaysia's operations increased by RM88 million or 27.5%, gross profit margin contraction and higher operating expenses have caused pre-tax profit from local operations to drop by RM15.3 million or 25.8%,” it said.

BAuto further explained that its gross profit margin in local operations was impacted by price pressure arising from stiff competition, unfavourable sales mix and higher vehicle cost, as the Japanese yen continued to appreciate against our ringgit.

http://www.theedgemarkets.com/my/article/berjaya-autos-3q-net-profit-falls-116-margin-contraction

kakashit

wow, when is the turn for property market? lol

2016-03-16 08:37