This article first appeared in The Edge Financial Daily, on May 30, 2016.

KUALA LUMPUR: EG Industries Bhd, which is in the midst of preparing the listing application for its wholly-owned Thai unit SMT Industries Co Ltd (SMTI), sees opportunities in the Thai automotive industry to further expand its presence there.

The electronic manufacturing services (EMS) provider in March announced that it is planning to undertake the listing of SMTI on the Stock Exchange of Thailand’s Market for Alternative Investment, which is expected to happen by 2018.

EG Industries group chief executive officer cum executive director Alex Kang said the company hopes to raise 300 million baht (RM34.34 million) from the listing, mainly to expand the capacity of its manufacturing plant in Thailand, which has seven production lines for printed circuit board assembly (PCBA), to 15 lines.

“We think it’s time for our Thai subsidiary to be independent. Most of the funds we are raising from the listing will be to expand the plant there,” Kang told The Edge Financial Daily in a recent interview.

SMTI’s production facility is located in Pranchiburi, Thailand. With a land area of 171,716 sq ft and a built-up area of 65,560 sq ft, there is ample room for expansion.

Incorporated in 2006 in Thailand, SMTI has been principally involved in the provision of EMS for computer peripherals, consumer electronics and electrical products, and automotive industrial products.

SMTI contributes 15% to 20% of the group’s overall revenue. For the financial year ended June 30, 2015 (FY15), EG Industries’ revenue stood at RM636.1 million.

“We plan to further expand our business in Thailand as we see a lot of business opportunities there, especially in the automotive industry,” said Kang.

“As there are more digital components used in our cars, demand for printed circuit board will grow. [For] anything digital, you would need PCBA,” he said, adding that there will be more cars installed with cameras and GPS systems moving forward.

In 2015, Thailand produced 1.9 million cars and 1.8 million motorcycles. Domestic car sales stood at 800,000 that year, while domestic motorcycle sales were at 1.6 million, statistics from the Thai Automotive Industry Association show.

According to Kang, SMTI is only seeing a less than 5% revenue contribution from the automotive industry presently, and that mainly comes from the sale of vehicle sensors.

He said SMTI had the technology and operational efficiency to expand further in the automotive industry, which would also mean a better margin for its PCBA business there.

“We are in the midst of preparing the [IPO] (initial public offering) application. I think we will be able to convene an extraordinary general meeting by end-2017 or early-2018. The listing is expected in 2018,” EG Industries group financial controller Cheryl Ng shared.

She said SMTI had appointed AIRA Securities Public Co Ltd as its principal adviser in Thailand for the proposed listing. While details of the listing are still being worked out, it is understood that some 30% of SMTI’s stake will be offered for sale, with EG Industries keeping the remainder.

As for how its current shareholders will benefit from the listing, Ng said: “They will be able to enjoy the potential profit growth of SMTI without forking out more money.”

EG Industries, which also has manufacturing plants in Sungai Petani, Kedah, has seen its margins and earnings improve after expanding its customer base and started to turn its attention to box-build from a predominantly sub-assembly-centric business model that focused on PCBA.

Its overall net margin improved to 4.16% in FY15, from 0.29%. For FY15, its net profit jumped to RM26.5 million, compared with RM2 million a year ago, despite a lower revenue of RM636.1 million, compared with RM700.5 million in FY14. Netting off a RM15.4 million gain on disposal from other investments, its net profit grew about 5.5 times to RM11.1 million — a record-high for the company.

The share of box-build revenue stood at 10% in FY15, and is expected to grow to 20% in FY16, said Kang.

“The strategy [of adding more box-build businesses] works well for our business in Malaysia, so we are replicating this in Thailand,” he shared.

The news of its upcoming Thai unit’s IPO seems to have had little impact on EG Industries’ share price, which has been trading between 95 sen and 83 sen since March.

However, its recent win of a two-year contract worth US$36 million (RM147.24 million) from Sweden-based Shortcut Labs AB to be the sole manufacturer of smart wireless button Flic that creates a shortcut to favourite actions on mobile devices, which it will also be distributing in Asia, may put the counter on investors’ radar again.

Its shares closed at 90 sen last Friday, with a market capitalisation of RM189.09 million.

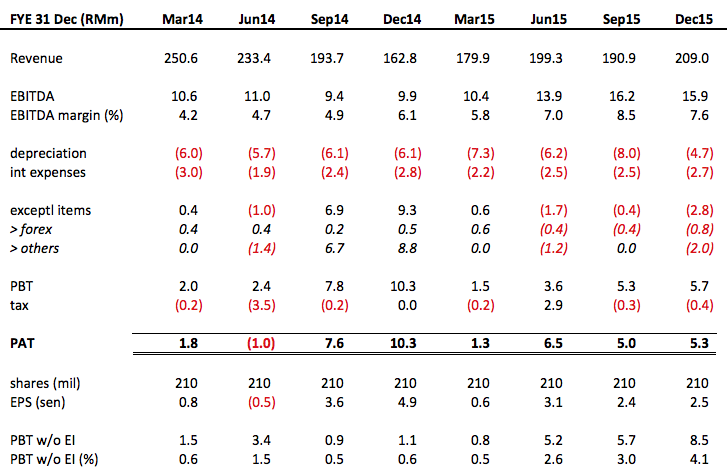

Quarterly results

(Icon) EG Industries (2) - Good Results, Beats Expectation

Author: Icon8888 | Publish date: Fri, 26 Feb 2016, 09:29 PM

Today, EG announced December 2015 quarterly results. For me, the result is satisfactory and above expectation.

Icon8888

Wah so good... Huat....

2016-05-31 06:40