Record Breaking Revenue for Meta Bright Group, Time to Invest?

KhilaalAmir

Publish date: Fri, 30 Aug 2024, 03:14 AM

For Q4 FY2024, Meta Bright Group Berhad (MBGB) has posted its best ever Profit After Tax (PAT) since FY2014, showcasing a remarkable turnaround and growth in its diverse business segments for Q4 2024. For the current quarter, MBGB recorded RM48.6 million in revenue, and PAT of RM8.6 million, which is very substantial and deserved a re-rating in terms of valuation.

Robust Building Materials Business in Sabah

One of the standout performers in MBGB’s portfolio is its building materials business, which generated a solid RM36.5 million in revenue for the quarter. This segment is particularly well-positioned for growth, thanks to the ongoing development initiatives in Sabah.

Based on our research, the Sabah state government, under the Fourth Rolling Plan (RP4) of the 12th Malaysia Plan (12MP), has allocated RM6.6 billion for various development projects in 2024. These include infrastructure upgrades, flood mitigation efforts, and the construction of new schools and clinics.

With 97.01% of the previous allocation already utilised, the commitment to ensuring these projects are completed promptly is strong. This creates a supportive environment for MBGB’s building materials segment, as these projects will likely drive continued demand for construction materials.

Revenue Segmentation Breakdown

MBGB’s revenue for Q4 2024 is well-diversified across several key segments:

●Building Materials: Contributed RM36.5 million, supported by the strong demand in Sabah’s ongoing development projects.

●Leasing & Financing: Brought in RM2.6 million, driven by higher demand from new borrowers and increased rental income from leasing vehicles and equipment in Australia.

●Hospitality: Recorded RM0.6 million in revenue, a slight decline due to slower room sales.

●Property Development: Generated RM0.8 million, primarily from the Damai Suites project, indicating steady progress in this area.

●Energy-Related Segment: Added RM0.4 million to the revenue, reflecting a smaller but stable contribution to the company’s overall income.

Record-Breaking Profits Since 2014

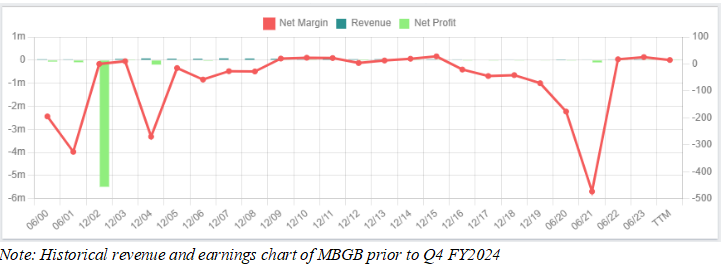

Note: Historical revenue and earnings chart of MBGB prior to Q4 FY2024

What’s truly impressive is that MBGB has achieved record profits not seen since 2014. This performance is a testament to the company’s effective strategies, focusing on high-growth areas while managing operational efficiencies across its segments.

Looking Ahead

As MBGB continues to leverage government initiatives in regions like Sabah and expand its diversified revenue streams, the company is well-positioned for sustained growth. With a record-breaking quarter under its belt, the outlook for MBGB remains highly positive, making it a company to watch in the coming quarters.

Investors should take note of MBGB’s strong performance, particularly in the building materials segment, which stands to benefit significantly from ongoing and future development projects in Sabah. With the company’s strategic approach and robust financial health, MBGB is on a solid growth trajectory that promises continued success.

.png)