The Research Hive - Media Chinese International Ltd (MEDIAC, 5090)

rakutentrade

Publish date: Tue, 21 Apr 2020, 03:50 PM

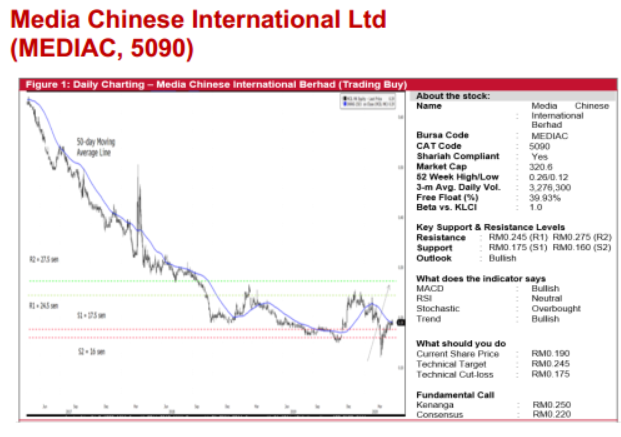

Media Chinese International Ltd (Trading Buy, TP:RM0.245, SL: RM0.175)

• Media Chinese International Ltd (MCIL) is expected to turn around in FY Mar 2020 after posting a reported net loss of RM46.1m in FY19. 9MFY20 net profit came in at RM36.2m.

• The improved performance will be lifted by cost trimming initiatives and tax incentives (for its travel and travel related services). MCIL, which derives roughly half of its revenue from overseas, is also a net beneficiary of a stronger USD versus MYR.

• More interestingly, the Group is currently sitting on net cash of RM265.8m as of end-Dec 2019, which translates to 16 sen per share or 84% of its current share price.

• MCIL is projected to pay net DPS of 1.5 sen, translating to an attractive dividend yield of 7.9% based on its current share price.

• Technically speaking, the stock has been trending south since May 2013, sliding from a peak of RM1.35 to an all-time low of RM0.12 on 17 Mar 2020.

• After bouncing up from the low, the stock is now testing its 50-day moving average line. Riding on the positive momentum, its share price could recover to our first resistance (R1) threshold of 24.5 sen (representing a 29% potential upside). This also coincides with our research team’s fundamentally derived target price (which is based on 0.6x FY21E NTA).

• Beyond which, the next resistance level (R2) is set at 27.5 sen (+45% potential upside).

• On the downside, our support lines are seen at 17.5 sen (R1) and 16.0 sen (R2), translating to downside risks of 8% and 16%, respectively.

Source: Rakuten Research - 21 Apr 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Rakuten Trade Research Reports

Created by rakutentrade | Nov 11, 2024