Rakuten Trade Research Reports

Technical View - Uzma Bhd

rakutentrade

Publish date: Fri, 16 Feb 2024, 12:11 PM

Uzma Bhd (UZMA, 7250)

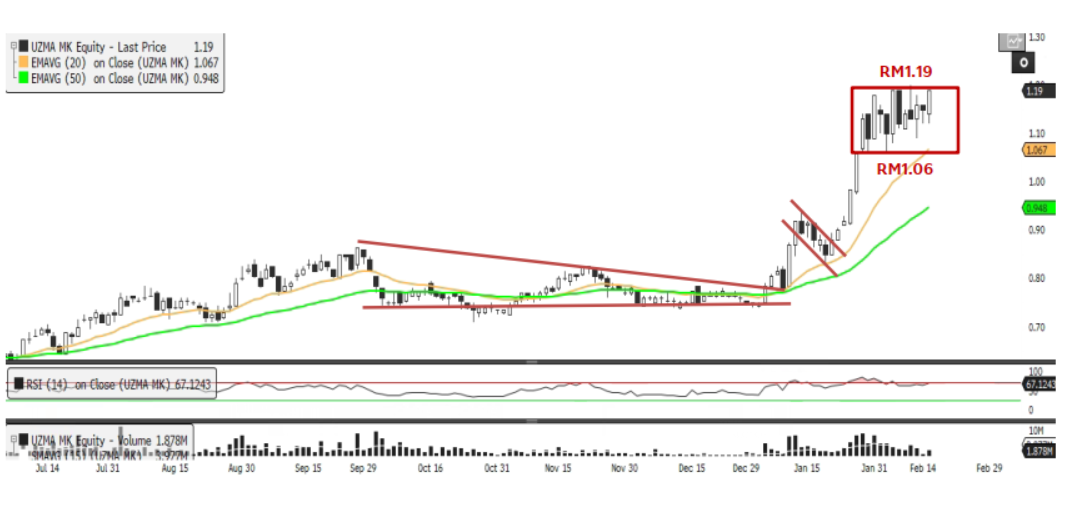

- Share price has surged 47.8% since our last technical buy call on 8 Jan 2024.

- UZMA is poised for a potential bullish breakout from its two-week rectangular pattern, surpassingthe immediate resistance at RM1.19. In view of the stock hitting a new 52 week high coupled with the stock pulling further away from all the EMAs, a positive outlook is expected.

- In the event it breaks above the RM1.19 neckline, this will improve market sentiment and should liftthe stock towards the subsequent level of RM1.25 (R1), followed by RM1.30 (R2).

- On the downside, stop-loss is set at RM1.05, below the 20 days EMA.

- Fundamentally, we like UZMA for its competitive edge as an innovative solutions provider, benefitingfrom the Petronas Activity Outlook and ongoing energy transition efforts, which promises to generate recurring income streams. UZMA has recently secured two contracts from Hibiscus Oil & Gas Malaysia for the Supply of Chemicals and Related Services for PM3, along with a term contract from Petronas Carigali Sdn Bhd for supplying a portable water injection module (PWIM) for the Sepat platform in Terengganu. We expect these contracts to be earnings accretive.

Source: Rakuten Research - 16 Feb 2024

To sign up for an account: http://bit.ly/40BNqKI

[Youtube Tutorial] Account Opening & Enable Foreign Equity: http://bit.ly/3I5Jzxo

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Rakuten Trade Research Reports

CBH Engineering Holdings Berhad - Shaping the Homes of Big Data

Created by rakutentrade | Jan 16, 2025

Discussions

Be the first to like this. Showing 0 of 0 comments