Trading Stocks - CIMB Group Holdings

rhbinvest

Publish date: Fri, 08 Apr 2022, 09:34 AM

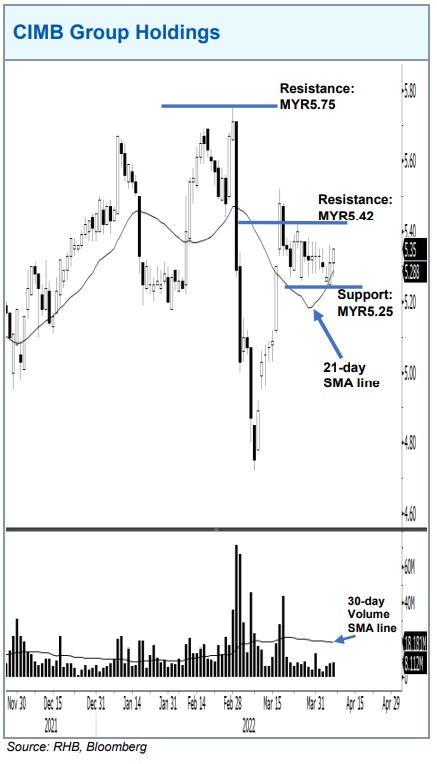

CIMB Group Holdings is in the process of consolidating sideways, as it bounced off its 21-day average line yesterday while heading towards the MYR5.42 resistance level. If it manages to move past that level, buying pressure may drive the stock towards MYR5.75, which was its 52-week high, followed by the MYR6.28 resistance – its multi-year high. Meanwhile, a fall below the next support level of MYR5.25 may trigger the resumption of a downward correction, as it forms a “lower low” bearish structure beneath the 21-day average line.

Source: RHB Securities Research - 8 Apr 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2025-01-30

CIMB2025-01-28

CIMB2025-01-28

CIMB2025-01-28

CIMB2025-01-28

CIMB2025-01-28

CIMB2025-01-27

CIMB2025-01-27

CIMB2025-01-27

CIMB2025-01-24

CIMB2025-01-24

CIMB2025-01-24

CIMB2025-01-23

CIMB2025-01-23

CIMB2025-01-23

CIMB2025-01-22

CIMB2025-01-22

CIMB2025-01-22

CIMB2025-01-22

CIMB2025-01-22

CIMB2025-01-22

CIMB2025-01-21

CIMB2025-01-20

CIMB2025-01-20

CIMB2025-01-20

CIMB2025-01-20

CIMB2025-01-20

CIMB2025-01-20

CIMBMore articles on RHB Investment Research Reports

Created by rhbinvest | Jan 27, 2025