RHB Investment Research Reports

Market Strategy - FBM KLCI Semi-Annual Review

rhbinvest

Publish date: Mon, 13 May 2024, 11:20 AM

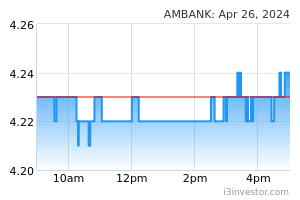

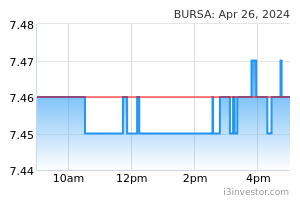

- Sunway in, AmBank out. The forthcoming semi-annual review of the FBM KLCI component stocks will be announced on 6 Jun based on ranking by market cap at the close of business on 27 May. The changes will take effect from 24 Jun. Based on the latest market cap rankings of eligible stocks, we note that Sunway is ranked at 24 and will be eligible for inclusion into the list of component stocks if the ranking remains at the cut-off date. This will be at the expense of AmBank – the lowest ranked composite index stock.

- Sunway – this is the way. According to the ground rules of the FTSE Bursa Malaysia Index Series, a security would be deleted if its market cap ranking among eligible securities drops to 26 or lower. A security would be inserted into the FBM KLCI at the periodic review if its ranking by full market value rises to 25 or higher. Based on the latest market cap rankings of eligible stocks, we note that Sunway, which ranks at 24 by full market capitalisation, is eligible for inclusion into the benchmark index and will likely replace the lowest ranked constituent stock, AmBank. However, the market capitalisation gap between Sunway and the 26th ranked stock (Sime Darby) is only about MYR0.8bn, which could easily alter the predicted constituent stock changes with some share price volatility in the coming fortnight. If AmBank stays at 35 or higher and Sunway falls to 26 or lower, then there will be no change to the index constituent stock list.

- Reserve list. The reserve list comprises stocks that would be used if one or more constituents are deleted from the FTSE Bursa Malaysia KLCI during the period until the next semi-annual review. We expect the revised FBM KLCI reserve list – comprising the five highest-ranking eligible non-constituents of the index by market capitalisation – to be Malaysia Airports, Gamuda, Dialog, AmBank, and Westports.

- Strategy. We keep our positive stance on the outlook for equity markets on the back of our house view for a resilient US economy, gradual recovery in China’s macroeconomic fundamentals, the prospect for easing interest rates from peaking inflationary pressures, better domestic political stability, and a gradual roll out of economic and fiscal reform initiatives. Foreign equity ownership has troughed, raising the prospects for a pick-up in foreign interest, coupled with a greater quantum of trapped liquidity from local funds switching into a more domestic-centric investment strategy. Key risks include geopolitical eruptions, and stubborn inflation leading to fewer and delayed US rate cuts. Focus on beneficiaries of the key growth hubs in Johor, Penang and Sarawak with a trading slant. We have OVERWEIGHT calls on the property, construction, technology, healthcare, transport, oil & gas, utilities, and rubber products sectors.

Source: RHB Securities Research - 13 May 2024

Related Stocks

Market Buzz

2025-01-03

AMBANK2025-01-03

AMBANK2025-01-03

BURSA2025-01-02

AMBANK2025-01-02

AMBANK2024-12-31

AMBANK2024-12-31

AMBANK2024-12-31

AMBANK2024-12-27

AMBANK2024-12-27

AMBANK2024-12-27

BURSA2024-12-26

AMBANK2024-12-26

AMBANK2024-12-26

AMBANK2024-12-26

AMBANK2024-12-26

BURSA2024-12-24

AMBANK2024-12-24

AMBANK2024-12-24

BURSA2024-12-24

BURSAMore articles on RHB Investment Research Reports

Discussions

Be the first to like this. Showing 0 of 0 comments