E-mini Dow Futures - Near-Term Trend Remains Negative

rhboskres

Publish date: Thu, 31 May 2018, 06:46 PM

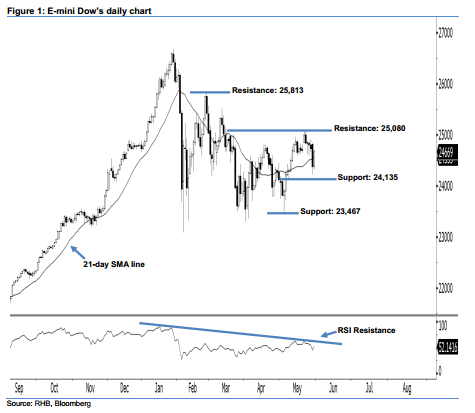

Stay short, with stop-loss set above the 25,080-pt resistance. The E-mini Dow formed a white candle last night. It rose 292 pts to close at 24,669 pts, after oscillating between a high of 24,715 pts and low of 24,325 pts. Still, technically speaking, yesterday’s white candle can be viewed as a technical rebound following the recent decline. We think the bears may continue to control the market in the near-term. This is as long as the E-mini Dow does not recoup losses from 22-29 May’s candles. As the index is still trading below the recent high at the 25,080-pt resistance, this suggests that the near-term negative sentiment stays intact.

As seen in the chart, we are now eyeing the immediate resistance at 25,080 pts, which was the recent high of 21 May. If this level is taken out, look to 25,813 pts – ie the high of 27 Feb – as the next resistance. To the downside, we anticipate the immediate support level at 24,135 pts, obtained from the low of 8 May. The next support would likely be at 23,467 pts, ie the previous low of 3 May.

Thus, we advise traders to stay short, following our recommendation to initiate short below the 24,600-pt level on 30 May. Meanwhile, a stop-loss can be set above the 25,080-pt threshold in order to limit the risk per trade.

Source: RHB Securities Research - 31 May 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024