FBM Small Cap Index - Holding Above 13,719 Pts

rhboskres

Publish date: Thu, 31 May 2018, 09:22 AM

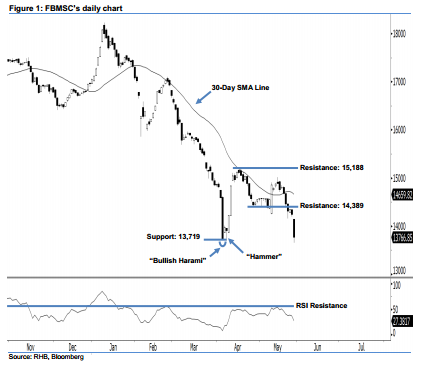

Bulls are still controlling market sentiment above 13,719 pts; bullish view continues. Yesterday was a weak session for the FBMSC as it plunged 479.99 pts to 13,766.85 pts. A black candle was formed and the index dipped near the 13,719-pt support. Nevertheless, as long as this support is not taken out, we believe that the 7- week bullish bias is still in play. Technically speaking, the aforementioned support is currently used as a benchmark that the FBMSC has reached its bottom. This is because of the appearance of two significant reversal patterns at the FBMSC’s 2-year low, ie 5 Apr’s “Bullish Harami” and 6 Apr’s “Hammer”.

We believe that the bulls are still controlling market sentiment. Meanwhile, we see that the 14-day RSI indicator has dropped below the 30-pt oversold mark at 27.37 pts. Although there is no guarantee, this oversold situation could be an early signal that a rebound may occur later. At this juncture, our positive view remains intact.

There is no change to our immediate support at 13,719 pts, ie the low of 5 Apr’s “Bullish Harami” pattern. The following support is pegged at the 13,116-pt threshold, which was the low of 25 Aug 2015. Conversely, we set the immediate resistance at 14,389 pts, or the low of 26 Apr’s “Bullish Harami” pattern. This is followed by the 15,188- pt resistance level, located at 17 Apr’s high.

Source: RHB Securities Research - 31 May 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024