FKLI & FCPO: FKLI - A Reversal Is Likely

rhboskres

Publish date: Fri, 01 Jun 2018, 06:22 PM

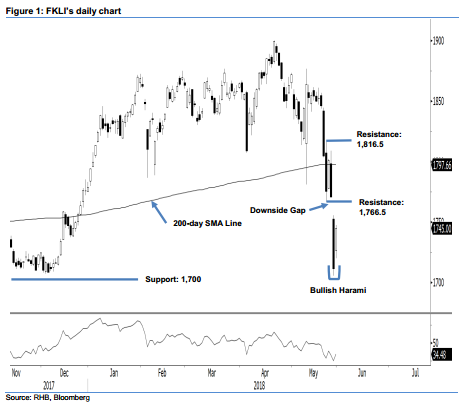

Maintain to short positions until the “Bullish Harami” formation is confirmed. The FKLI charted a white candle yesterday. Together with the prior candle, this made for a “Bullish Harami” formation. The session’s low and high were 1,720 pts and 1,747.5 pts respectively, and the index closed at 1,745 pts to reflect a gain of 35.5 pts. The “Bullish Harami” appeared after the index came close to testing the 1,700-pt immediate support level in the prior session and the RSI reached the oversold level of 25 in the previous session. This points to the possibility of a deeper rebound – if not, a total price reversal may be developing. However, to confirm this, the index has to break above the 1,766.5-pt immediate resistance. Until that happens, we maintain our near-term negative trading bias.

We still recommend that traders keep to short positions. This was initiated at 1,804.5 pts, or the closing level of 23 May. To manage risks, investors can now set the trailing-stop at 1,766.5 pts.

The immediate support is expected at 1,700 pts. Breaking this may see the market test 1,661 pts, the low of 19 Jan 2017. On the other hand, the immediate resistance is now set at 1,766.5 pts, the low of 24 May. This is followed by 1,816.5 pts, the high of 24 May.

Source: RHB Securities Research - 1 Jun 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024