WTI Crude Futures - Bearish View Continues

rhboskres

Publish date: Fri, 01 Jun 2018, 06:24 PM

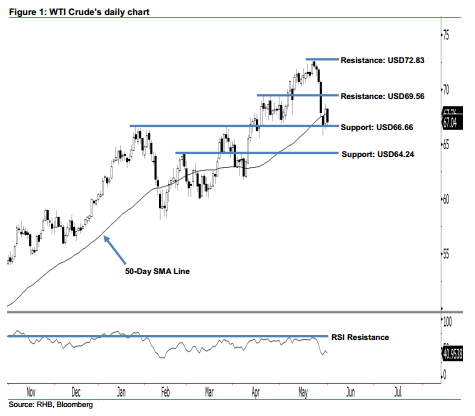

Maintain short positions. The WTI Crude closed yesterday’s session at USD67.04 and posted a USD1.17 loss. It formed a black candle, which implies that the session was led by the sellers. This indicates that market sentiment is still weak. The current technical landscape suggests that the 1-week correction has not reached its limit yet. This is supported by the fact that the 14-day RSI indicator is still hovering above the 30-pt oversold level at 40.95 pts – an indication that there is still room for the retracement.

As long as the commodity is unable to break above the USD72.83 resistance threshold, we believe that the bears are still in control over the bulls. Hence, traders are advised to maintain short positions with a stop-loss pegged above the aforementioned USD72.83 resistance. This is in order to minimise upside risk. Recall that our short call was triggered on 28 May after a firm breach below the USD69.56 mark.

The USD66.66 mark, ie 25 Jan’s high, is maintained as the immediate support. This is followed by the next support at USD64.24, or the high of 27 Feb’s “Bearish Engulfing” pattern. Conversely, we set the immediate resistance at USD69.56, obtained from the high of 17 Apr. The following resistance is maintained at USD72.83, which was the high of 22 May.

Source: RHB Securities Research - 1 Jun 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024