COMEX Gold - Best Stay Short

rhboskres

Publish date: Mon, 04 Jun 2018, 09:46 AM

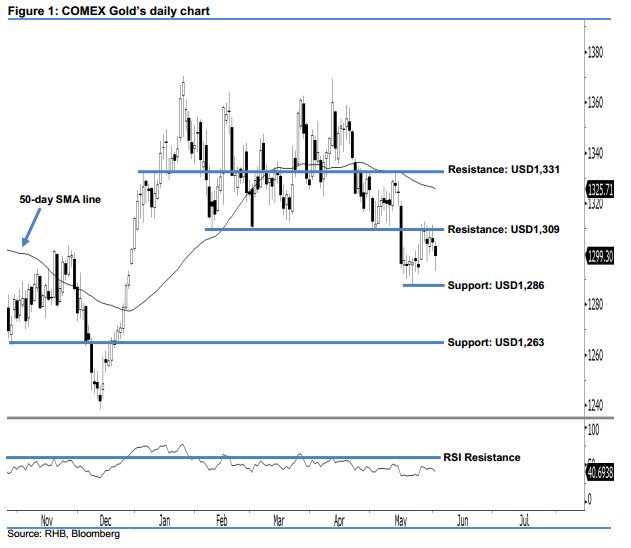

In line with the ongoing correction, it is best for traders to stay short. The COMEX Gold ended last Friday’s session at USD1,299.30 and registered a USD5.40 loss. This has sent the commodity to its newest 1-week low. Judging from the current technical landscape, we believe the retracement may still extend once the breather above the USD1,286 mark ends. We highlight that the 14-day RSI indicator is currently situated below the 50-pt neutral level at 40.69 pts. This implies that market sentiment remains weak, thereby enhancing our downside view.

In line with the ongoing correction, we believe it best for traders to maintain short positions. We advise setting a stop-loss above the USD1,331 threshold, so that the upside risk is kept at minimum. For the record, we made the short recommendation on 16 May. This was after a strong downside movement that led the COMEX Gold to plunge firmly below the USD1,309 threshold.

Our immediate support stays at USD1,286, which was derived from the low of 21 May. This is followed by the next support at USD1,263 – this is located at the low of 27 Nov 2017. Towards the upside, we set the immediate resistance at USD1,309, or the low of 8 Feb. The next resistance is pegged at the USD1,331 threshold, ie the high of 4 Jan.

Source: RHB Securities Research - 4 Jun 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024