WTI Crude Futures - Extending The Correction

rhboskres

Publish date: Mon, 04 Jun 2018, 09:48 AM

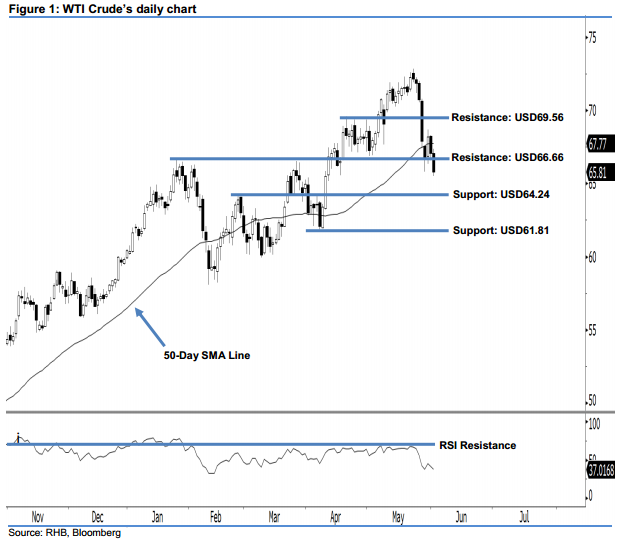

Keep in short positions, in line with the ongoing bearish bias. Last Friday, the WTI Crude dropped by USD1.23 to close at USD65.81. The commodity breached below the previous USD66.66 resistance, and dipped to its newest low since April – which indicates that the bearish bias we detected in the prior session is still in effect Chances are high that the correction may still be extended further. The fact that the WTI Crude is now trading below the 50-day SMA Line points towards a weak outlook. We also highlight that the 14-day RSI indicator is currently situated firmly below the 50-pt neutral level, at 37.02 pts – an indication that market sentiment is led by the bears. These bearish indicators support our downside view.

In line with the ongoing bearish bias, traders are advised to maintain short positions, with a new stop-loss pegged above the USD69.56 threshold to minimise the upside risk. We initially made the short recommendation on 28 May, following a strong downside development beneath the USD69.56 mark.

Our immediate support is now at the USD64.24 support threshold, obtained from the high of 27 Feb’s “Bearish Engulfing” pattern. The following support is at USD61.81, the low of 6 Apr 2018. Conversely, we set the immediate resistance at USD66.66 mark, obtained from the high of 25 Jan’s high. For the next resistance, look to USD69.56, or 17 Apr’s high

Source: RHB Securities Research - 4 Jun 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024