FKLI & FCPO: FKLI - Stick To Short Positions

rhboskres

Publish date: Mon, 04 Jun 2018, 09:50 AM

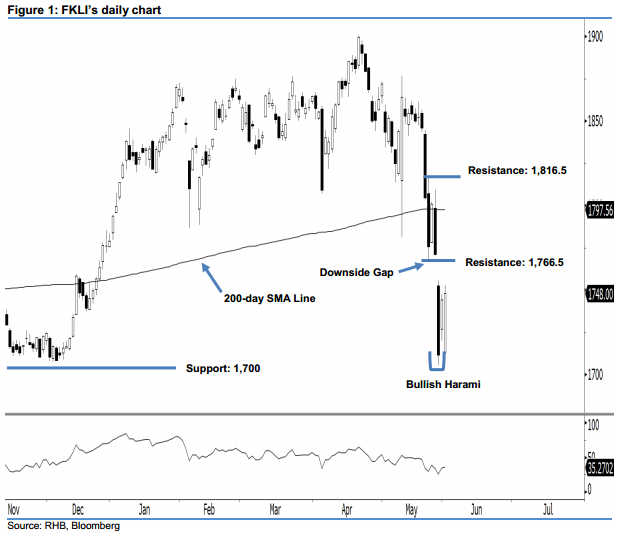

Remain in short positions as correction is still in effect. Last Friday’s session was led by the buyers, as the FKLI registered a 3.5-pt increase to close at 1,748 pts. A white candle was formed after it hovered between a low of 1,713 pts and high of 1,753 pts. However, this does not negate our bearish view, as no strong upside movement has been sighted yet. Although we highlighted that a reversal “Bullish Harami” candlestick pattern was formed on 31 May, a strong upside follow-through is needed to confirm that the bullish bias has returned. Meanwhile, the fact that the 14-day RSI indicator is hovering below the 50-pt neutral level implies that market strength is still weak. This suggests that the correction is not at its limit yet.

As long as there is no strong upside movement, opportunities would still lean more towards the sellers. Thus, traders are advised to stay in short positions, with a trailing-stop set at 1,766.5 pts to keep some of the trading profits. The short call was initiated at 1,804.5 pts, or the closing level of 23 May.

We set the immediate support at 1,700 pts. If this level is taken out, the next support is pegged at 1,661 pts, obtained from the low of 19 Jan 2017. Towards the upside, our immediate resistance remains at 1,766.5 pts, the low of 24 May. The following resistance is set at the 1,816.5-pt mark, which was the high of 24 May.

Source: RHB Securities Research - 4 Jun 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024