Hang Seng Index Futures: Persistent Upward Momentum

rhboskres

Publish date: Fri, 08 Jun 2018, 04:52 PM

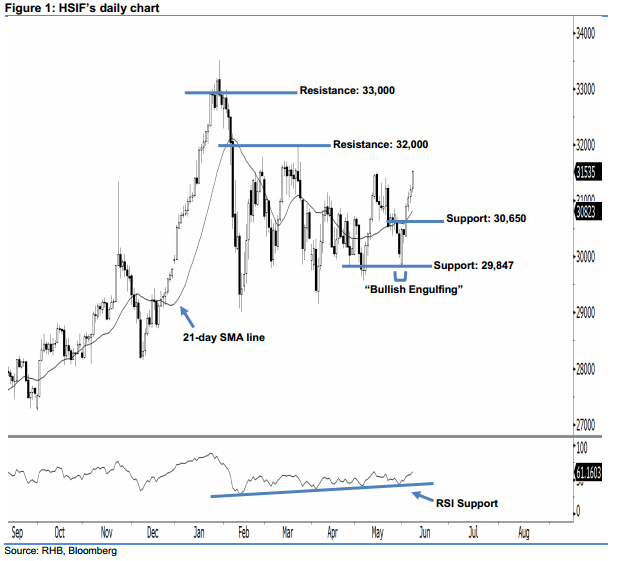

Stay long while setting a new trailing-stop below the 30,650-pt support. Yesterday, the HSIF’s upward momentum continued as expected after it formed another white candle. It rose to a high of 31,544 pts during the intraday session, before ending at 31,535 pts for the day. Based on the current technical landscape, the nearterm upside move remains intact, as the index has taken out the immediate 31,499-pt resistance mentioned previously. As the HSIF recorded its highest point in more than two months, this indicates that the rebound that started from 31 May’s “Bullish Engulfing” pattern may be continuing. Overall, we keep our bullish view on the HSIF’s near-term outlook.

Currently, we anticipate the immediate support at 30,650 pts, situated near the midpoint of 4 June’s long white candle. The crucial support is maintained at 29,847 pts, determined from the low of 31 May’s “Bullish Engulfing” pattern. To the upside, the immediate resistance is now seen at the 32,000-pt round figure, also set near the high of 21 Mar. Meanwhile, the next resistance would likely be at the 33,000-pt psychological spot.

Hence, we advise traders to stay long, following our recommendation to initiate long above the 30,650-pt level on 5 June. For now, a new trailing-stop can be set below the 30,650-pt threshold as well in order to minimise the risk per trade.

Source: RHB Securities Research - 8 Jun 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024