WTI Crude Futures - Best To Stay Short

rhboskres

Publish date: Mon, 11 Jun 2018, 09:49 AM

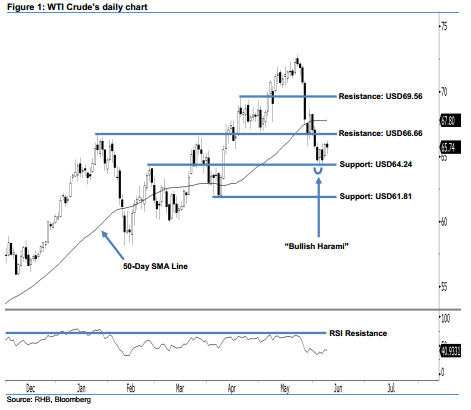

Stay short in line with the ongoing correction. The WTI Crude posted a USD0.21 loss to USD65.74 last Friday. It left a black candle after oscillating between a low of USD65.15 and high of USD66.24. This shows that the session was led by the sellers. Presently, opportunities are still leaning towards the sellers. This is because no strong upside development has been sighted yet. In addition, the fact that the 14-day RSI indicator is situating below the 50-pt neutral level at 40.93 pts implies that market sentiment is bearish. Hence, our downside view is enhanced.

Based on the daily chart above, we think that the bears that are in control of market sentiment. As such, it is best that traders maintain short positions. For risk-control purposes, we advise setting a stop-loss above the USD69.56 threshold. For the record, we made the short recommendation on 28 May, after a strong correction below the USD69.56 level.

Presently, our immediate support is maintained at USD64.24, located at the high of 27 Feb’s “Bearish Engulfing” pattern. The next support is set at USD61.81, which was the low of 6 Apr 2018. Towards the upside, we set the immediate resistance at USD66.66, or the high of 25 Jan’s high. This is followed by the USD69.56 resistance mark, or 17 Apr’s high.

Source: RHB Securities Research - 11 Jun 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024