E-mini Dow Futures - Creates Seventh Consecutive Positive Candle

rhboskres

Publish date: Tue, 12 Jun 2018, 09:43 AM

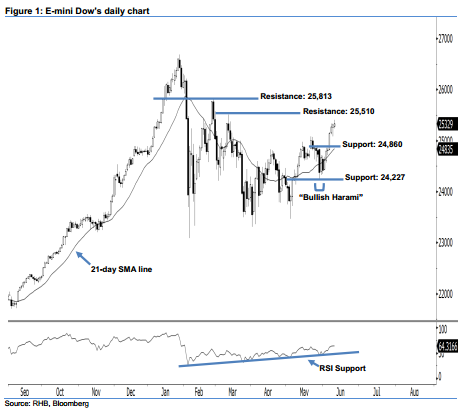

Maintain long positions. The E-mini Dow’s upside strength continued as expected as another positive candle was formed last night. It rose 22 pts to close at 25,329 pts, after oscillating between a high of 25,400 pts and low of 25,232 pts. As the index has successfully recorded a higher close vis-à-vis the previous sessions since 1 June - posting a seventh consecutive positive candle in the process – this points to persistent upward momentum. Yesterday’s positive candle can be regarded as a continuation of the bulls expanding the rebound from 30 May’s “Bullish Harami” pattern. Overall, we remain bullish on the index’s near-term outlook.

Based on the daily chart, the immediate support level is maintained at 24,860 pts, which was near the highs of 29 May and 4 Jun. Meanwhile, the next support is seen at 24,227 pts, ie the low of 30 May’s “Bullish Harami” pattern. Towards the upside, the near-term resistance level is anticipated at 25,510 pts and 25,813 pts, determined from the previous highs of 12 Mar and 27 Feb respectively.

Therefore, we advise traders to maintain long positions, following our recommendation of initiating long above the 24,860-pt level on 7 Jun. At the same time, a stop-loss can be set below the 24,227-pt threshold in order to limit the risk per trade.

Source: RHB Securities Research - 12 Jun 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024