FBM Small Cap Index - Climbing Towards North

rhboskres

Publish date: Tue, 12 Jun 2018, 09:44 AM

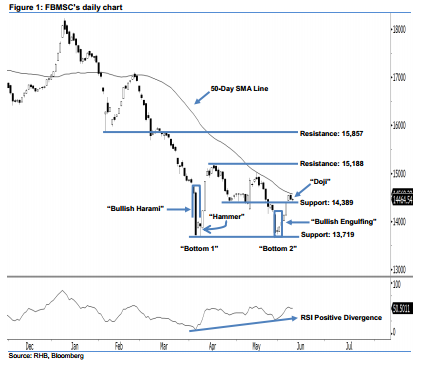

Our positive view remains in play above the 13,719-pt level. The FBMSC ended yesterday’s session at 14,464.54 pts and posted a 5.64-pt increase. A “Doji” candlestick pattern was formed, after the index oscillated between a low of 14,414.86 pts and high of 14,494.41 pts. This shows that both the bulls and bears were unable to take firm control at the end of the day. As long as the FBMSC is able to stay above the 13,719-pt support, we believe the 2-month bullish bias remains in play.

Our positive view was initially supported by the appearance of 5 Apr’s “Bullish Harami” and 6 Apr’s “Hammer” patterns, which were at the index’s 2-year lows. In addition, we also detected significant “Double Bottom” and “Positive Divergence” reversal patterns this month, which suggests the recent correction during Jan-Mar 2018 was at the limit of the retracement. Technically speaking, the FBMSC is in the process of shifting towards the upside from being in the downside previously.

Our immediate support stays at 14,389 pts, which was the low of 26 Apr’s “Bullish Harami” pattern. If this level is taken out, the following support is pegged at the 13,719-pt mark, or the low of 5 Apr’s “Bullish Harami” pattern. Conversely, the immediate resistance is at 15,188 pts, which is located at 17 Apr’s high. This is followed by the 15,857-pt resistance mark, or the low of 6 Feb’s “Hammer” pattern.

Source: RHB Securities Research - 12 Jun 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024