WTI Crude Futures - Stay Short For Now

rhboskres

Publish date: Mon, 18 Jun 2018, 11:01 AM

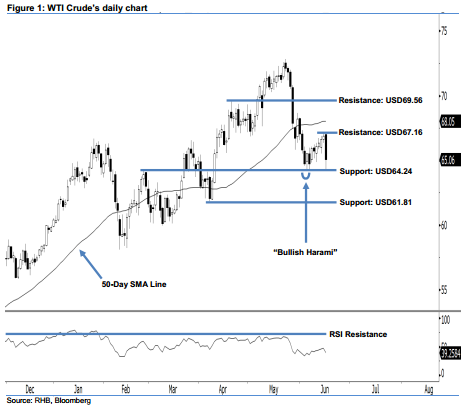

Maintain short positions as the bears are still in control. The WTI Crude ended last week’s session at USD65.06, posting a USD1.83 loss. A black candle was formed after oscillating between a low of USD64.29 and high of USD67.09, which implies that the session was led by the bears. Presently, we do not see a strong upside development occurring. This indicates that the bears are still in control of market sentiment. We also highlight that the commodity is still trading below the 50-day SMA line. Technically speaking, the bearish bias is still in effect – which enhances our downside view.

In line with the ongoing correction, it is best that traders maintain short positions. For risk-minimisation purposes, we advise that investors set a new trailing-stop above the USD67.16 threshold. For the record, we initially made the short recommendation on 28 May. This was after strong selling activities that led the WTI Crude’s price to drop below the USD69.56 mark.

The immediate support stays at the USD64.24 mark, located at the high of 27 Feb’s “Bearish Engulfing” pattern. For the next support, look to USD61.81, ie the 6 Apr ’low. On the flip side, we set the immediate resistance at USD67.16, the high of 14 Jan. If this level is taken out, the following resistance is seen at USD69.56, which was the high of 17 Apr.

Source: RHB Securities Research - 18 Jun 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024