COMEX Gold - Strong Bearish Bias

rhboskres

Publish date: Mon, 18 Jun 2018, 11:02 AM

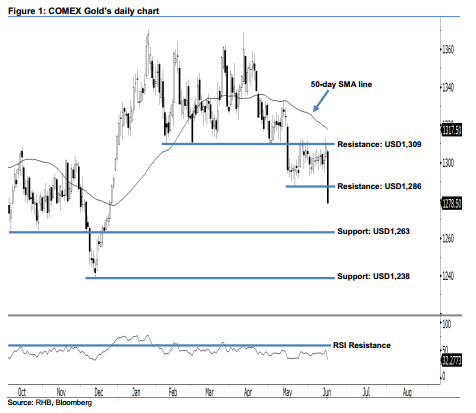

Stay short, in line with the negative expectation. The COMEX Gold registered a USD29.80 loss at the end of last Friday’s session to USD1,278.50 – the newest low YTD. This resulted in a long black candle, which breached below the previous USD1,286 support and implied the session was led firmly by the sellers. Technically speaking, the bears are strong, thus more corrections ahead are likely. We highlight that the 50-day SMA line has also dived USD1.63 to USD1,317.50, which points towards a negative outlook. This enhances our bearish view.

In line with the strong bearish bias, we believe the COMEX Gold may slip further. As such, we maintain our short recommendation, with a new stop-loss set above the USD1,309 mark. This is in order to minimise the trading risk. For the record, we initially made the long recommendation on 16 May after a firm breach below the aforementioned USD1,309.

We revise the immediate support to USD1,263, which was the low of 27 Nov 2017. This is followed by the USD1,238 support, or the low of 12 Dec 2017. On the flip side, the immediate resistance is now at USD1,286, which is located at the low of 21 May. The following resistance is pegged at the USD1,309 mark, which was obtained from 8 Feb’s low.

Source: RHB Securities Research - 18 Jun 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024