SGX FTSE China A50 - Short Call Remains Valid

rhboskres

Publish date: Mon, 18 Jun 2018, 11:03 AM

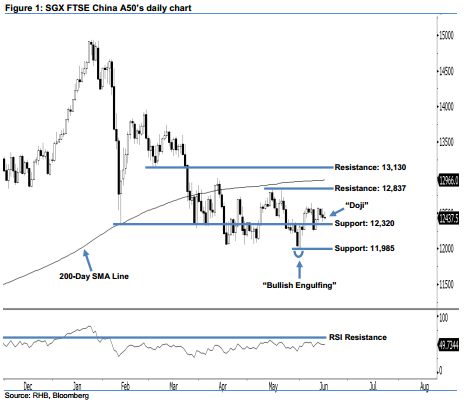

Maintain short positions, as the bulls are dominating market sentiment. The SGX FTSE China A50 ended 92.50 pts lower last Friday at 12,437.50 pts. The index left a “Doji” candlestick pattern after it hovered between the low of 12,405 pts and high of 12,525 pts. This shows that both bears and bulls were unable to take firm control at the end of the day. Overall, despite the appearance of a positive momentum in 31 May’s “Bullish Engulfing” candlestick pattern, there was no strong upside movement sighted. Technically speaking, market sentiment was weak, thereby enhancing our short call.

Based on the current technical landscape, we believe the opportunities are still leaning more towards the sellers. Thus, traders are advised to maintain short positions, with a stop-loss set above 12,837 pts. This is in order to minimise the upside risk. Our short call was initially triggered on 31 May, after the SGX FTSE China A50 dropped below the 12,060-pt threshold.

The immediate support is maintained at 12,320 pts, or the low of 12 Feb’s “Bullish Harami” pattern. If this level is taken out, the next support is seen at 11,985 pts, which was the low of 31 May’s Bullish Engulfing” pattern. Conversely, we set the immediate resistance at 12,837 pts, ie 15 May’s high. This is followed by the 13,130-pt resistance – this is located at 5 Mar’s low.

Source: RHB Securities Research - 18 Jun 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024