FBM Small Cap Index - The Bullish Bias Resume

rhboskres

Publish date: Mon, 18 Jun 2018, 11:04 AM

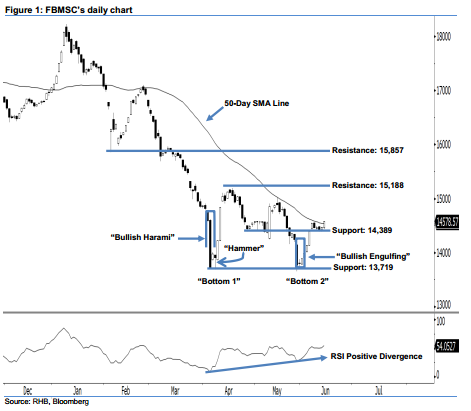

Expect more upside follow-throughs above the 50-day SMA line. The FBMSC ended at 14,578.57 pts last Thursday and posted a 109.34-pt increase. A white candle that breached above the 50-day SMA line was formed, which implied the session was led by the bulls. Note that we saw a positive continuation of the bullish bias in January after the index successfully breached above the 50-day SMA line. Using this historical upside movement as a leading indicator, we think more bullish follow-throughs will occur in the coming sessions.

As we see it, the FBMSC is in the process of changing direction – from a downside trend towards the upside. The earliest bullish signals were detected when 5 Apr’s “Bullish Harami” and 6 Apr’s “Hammer” patters appeared at the FBMSC’s 2-year low. Our upside view is also supported by this month’s significant “Double Bottom” and “Bullish Divergence” patterns – an indication that the bulls are taking control of market sentiment from the bears.

We keep the immediate support at 14,389 pts, which is located at the low of 26 Apr’s “Bullish Harami” pattern. This is followed by the 13,719-pt support, or the low of 5 Apr’s “Bullish Harami” pattern. On the flip side, our immediate resistance is set at 15,188 pts, which was the high of 17 Apr. This is followed by the next resistance at 15,857 pts, or the low of 6 Feb’s “Hammer” pattern.

Source: RHB Securities Research - 18 Jun 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024