COMEX Gold - Safe To Stay Short

rhboskres

Publish date: Tue, 19 Jun 2018, 10:58 AM

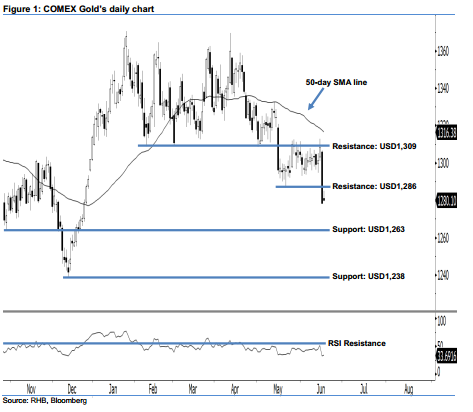

Opportunities are leaning more towards the sellers, stay short. The COMEX Gold rebounded by USD1.60 to USD1,280.10 on Monday. Nevertheless, this increase does not affect our bearish view. As long as no strong upside development is in sight, we believe the bears will continue to dominate market sentiment. From our technical viewpoint, the commodity is merely taking breather – a normal reaction after the COMEX Gold posted an almost USD30 loss and breached below the USD1,286 level on 15 Jun. Overall, opportunities are still leaning more towards the sellers. This is supported by the 14-day RSI indicator still being situated below the 50-pt neutral level at 33.69 pts – an indication that market sentiment is weak.

The daily chart suggests the current correction is still firmly in play. Hence, we recommend traders to maintain short positions, with a stop-loss pegged above the USD1,309 threshold – this is so that the trading risk is kept at a minimum. Recall that our long recommendation was initially triggered on 16 May, following a firm downside movement below the aforementioned USD1,309 level.

The immediate support is maintained at USD1,263, or the low of 27 Nov 2017. For the next support, look to USD1,238, ie 12 Dec 2017’s low. On the flip side, we set the immediate resistance at USD1,286, which was obtained from the low of 21 May. Should the commodity breach above this level, the next resistance is pegged at USD1,309, or the low of 8 Feb.

Source: RHB Securities Research - 19 Jun 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024