FTSE Singapore Straits Times Index - Strong Bearish Bias

rhboskres

Publish date: Wed, 20 Jun 2018, 05:19 PM

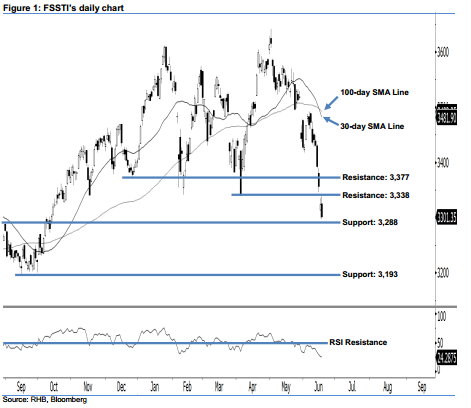

The downside movement has not reached its limit yet, bearish view continues. Yesterday was a weak session, as the FSSTI registered a 22.69-pt loss to 3,301.35 pts. It formed a black candle after oscillating between a low of 3,297.25 pts and high of 3,341.64 pts. This weak performance has extended the correction, which led the index to more than a 6-month low. Presently, we believe that that the bears are in firm control of market sentiment. Although the 14-day RSI indicator is in the oversold condition below the 30-pt level, there is no rebound sighted so far. Overall, our bearish view remains intact.

Based on the daily chart above, we think that the correction is not at its limit. We highlight that the 30-day SMA line has crossed below the 100-day SMA line. Technically speaking, market sentiment is pointing towards a weak outlook, thereby enhancing our downside view.

Presently, the immediate support stays at 3,288 pts, which was the high of 31 Aug 2017. This is followed by the next support at the 3,193-pt threshold, located at the low of 15 Sep 2017. Towards the upside, we set the immediate resistance at 3,338 pts, obtained from the low of 4 Apr. Our next resistance is maintained at 3,377 pts, or the low of 7 Dec 2017.

Source: RHB Securities Research - 20 Jun 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024