WTI Crude Futures - Short Call Remains Intact

rhboskres

Publish date: Wed, 20 Jun 2018, 05:20 PM

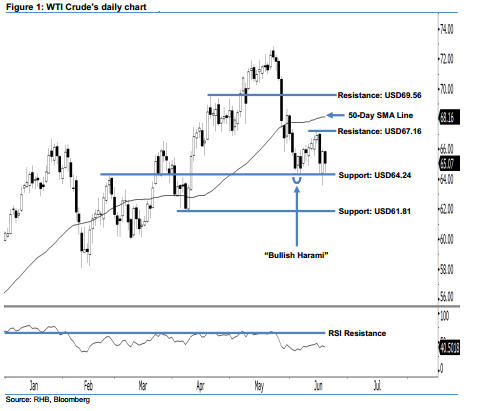

Maintain short positions. Last night, the WTI Crude dropped USD0.78 to USD65.07, and formed a black candle. This shows that the session was led by the sellers. Presently, there is no strong upside follow-through that confirms the momentum we observed in 5 Jun’s reversal “Bullish Harami” candlestick pattern. From our technical perspective, the bulls are still lacking strength to take the control from the bears. In addition, the fact that the 14- day RSI indicator is fluctuating below the 50-pt neutral level at 40.50 pts implies weak sentiment. This enhances our bearish view.

In the absence of a strong upside development, this indicates that market sentiment is still bearish. As such, traders are advised to maintain short positions. In order to secure part of the trading profits, we recommend setting a trailing-stop above the USD67.16 threshold. This is in line with our short call on 28 May, following a firm breach below the USD69.56 level.

The immediate support remains at USD64.24, located at the high of 27 Feb’s “Bearish Engulfing” pattern. Should the price dip below this level, the following support is set at USD61.81, ie 6 Apr ’low. On the flip side, the immediate resistance remains at USD67.16, or the high of 14 Jan. The next resistance is pegged at the USD69.56 threshold, located at the high of 17 Apr.

Source: RHB Securities Research - 20 Jun 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024