FKLI & FCPO - FKLI: Extending The Downtrend

rhboskres

Publish date: Fri, 22 Jun 2018, 05:01 PM

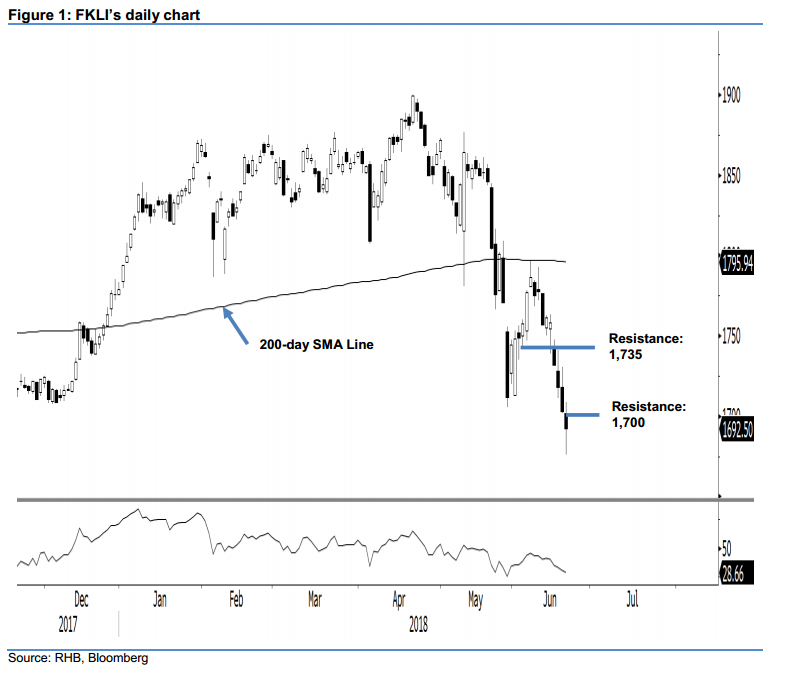

Maintain short positions, as it failed to stay above 1,700 pts. Yesterday, the FKLI closed negatively, ie below the 1,700-pt previous immediate support. The session’s low and high were registered at 1,676 pts and 1,708.5 pts respectively, before it closed at 1,692.5 pts – marking a decline of 10.5 pts. The breakdown from the said previous immediate support suggests that the retracement which started after the failed attempt to break above the 200-day SMA line on 7 Jun is still in effect. The 200-day SMA line, which has started to show early signs of edging lower, is also pointing towards a weak medium-term bias. On this, we keep to our near-term negative trading bias.

While the daily RSI has reached the oversold level of 28.7, we have not seen any clear sign of a price rebound. As such, we still recommend that traders keep to short positions – which we initiated at 1,732 pts (the closing level of 18 June). To manage risks, a trailing-stop can be set at the breakeven level.

We revise the immediate support to 1,661 pts, which is the low of 19 Jan 2017. This is followed by 1,600 pts, the next round figure. Towards the upside, immediate resistance is now expected at the 1,700-pt mark. The following resistance is at 1,735 pts, the low of 4 Jun.

Source: RHB Securities Research - 22 Jun 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024