FKLI & FCPO - FKLI: Bulls Still Holding On

rhboskres

Publish date: Mon, 18 Jun 2018, 10:59 AM

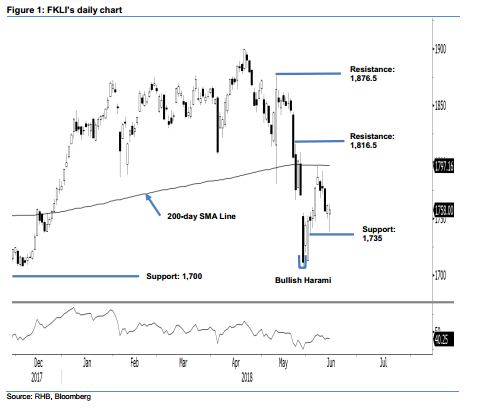

Keep to long positions. Last Thursday, the FKLI closed slightly lower despite the earlier weakness, which implies that the bulls are still making their presence felt. The index came close to the immediate support of 1,735 pts (the low and high were at 1,739 pts and 1,763 pts respectively), before closing 3.5 pts lower at 1,758 pts. As the index rebounded after came close the immediate support, this implied that the bulls were still present. As long as the support is not breached, the rebound since the low of the “Bullish Harami” on 31 May should still remain intact. Hence, we keep our positive trading bias for the near term.

We continue to advise traders to keep to their long positions, which we initiated at 1,777 pts, the closing level of 6 Jun. To manage risks, investors can set the stop-loss at 1,735 pts.

We peg the immediate support at 1,735 pts, the low of 4 Jun. The second support is at the 1,700-pt mark. On the other hand, the immediate resistance is now at 1,816.5 pts, or the high of 24 May. This is followed by 1,876.5 pts, the high of 14 May

Source: RHB Securities Research - 18 Jun 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024