Hang Seng Index Futures - Plunged To 6-Month Low

rhboskres

Publish date: Tue, 26 Jun 2018, 09:23 AM

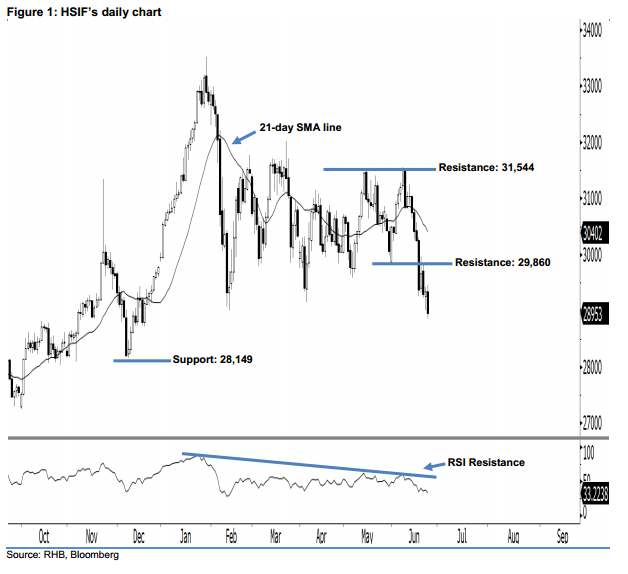

Stay short. Selling momentum in the HSIF continued as expected, as a black candle was formed yesterday. This points to a continuation of the downside move. The index declined to a low of 28,864 pts during the intraday session, before ending at 28,953 pts for the day. Technically, yesterday’s closing has taken out the previouslyindicated 29,000-pt support – and also sent the HSIF to its lowest point in more than six months. This indicates that the selling momentum has extended. Overall, we believe the downside swing that started off 8 June’s long black candle may continue.

As seen in the chart, the immediate resistance is seen at 29,860 pts, set near the midpoint of 19 Jun’s long black candle. Meanwhile, the next resistance is anticipated at 31,544 pts, determined from 7 Jun’s high. To the downside, we are eyeing the near-term support at 28,149 pts, which was the previous low of 7 Dec 2017. This is followed by the 28,000-pt psychological mark.

Therefore, we advise traders to stay short, since we previously recommended initiating short below 30,800 pts on 18 Jun. In the meantime, a trailing-stop can be set above the 29,860-pt threshold in order to secure part of the gains.

Source: RHB Securities Research - 26 Jun 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024