WTI Crude Futures - Long Call Remains Intact

rhboskres

Publish date: Tue, 26 Jun 2018, 09:33 AM

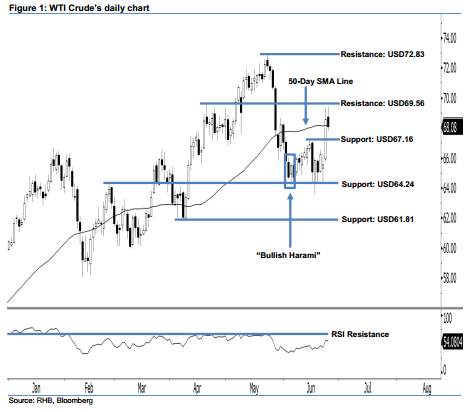

Long positions remain intact as the bulls still drive the market. The WTI Crude inched down USD0.50 to close at USD68.08 last night. It left a black candle after oscillating between a low of USD67.78 and high of USD69.44, which implies that the session was led by the sellers. However, as long as no strong downside development is in sight, we believe that the bullish bias is still in play. Technically speaking, the weak performance is viewed as the commodity merely taking a breather. This is a normal reaction, especially after the WTI Crude breached firmly above the previous USD67.16 resistance mark and the 50-day SMA line on 22 Jun. At this juncture, the bulls are still dominating the market.

It is best that traders maintain long positions, with a stop-loss pegged below the USD64.24 mark to minimise the downside risk. Recall that we initially made the long recommendation on 25 Jun, after a firm rebound that breached above the USD67.16 threshold.

To the downside, we set the immediate support at USD67.16, the high of 14 Jan. For the next support, look to USD61.81, or 6 Apr’s low. Conversely, the immediate resistance is maintained at USD69.56, located at the high of 17 Apr. Should the WTI Crude’s price climb higher above this level, the next resistance is pegged at the USD72.83 mark, or the high of 22 May.

Source: RHB Securities Research - 26 Jun 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024