E-mini Dow Futures - Selling Momentum Pauses To Digest

rhboskres

Publish date: Tue, 03 Jul 2018, 09:40 AM

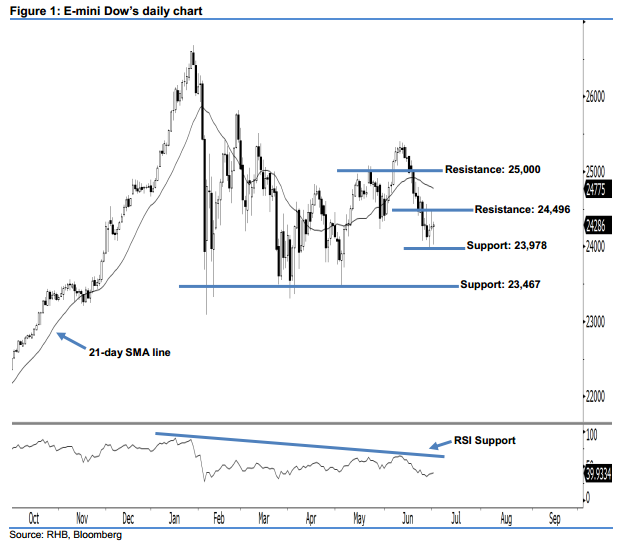

Near-term negative sentiment stays intact; stay short. The E-mini Dow formed another “Doji” candle last night. It settled at 24,286 pts, after oscillating between a high of 24,324 pts and low of 24,026 pts. Still, based on the current outlook, we note that the index is still trading below the 21-day SMA line and the previously-indicated 24,496-pt resistance, which signals that the near-term negative sentiment remains unchanged. Technically, the downside momentum is likely to continue, as long as the E-mini Dow fails to recoup more than 50% of the losses from 25 Jun’s long black candle. Overall, we maintain our negative view on the E-mini Dow’s near-term outlook.

Currently, we are eyeing the immediate resistance level at 24,496 pts, situated near the midpoint of 25 Jun’s long black candle. If this level taken out, the next resistance is seen at the 25,000-pt psychological spot. Towards the downside, the immediate support level is anticipated at 23,978 pts, which was the low of 28 Jun. The next support is maintained at 23,467 pts, obtained from the previous low of 3 May.

Hence, we advise traders to maintain short positions, given that we previously recommended initiating short below the 24,283-pt level on 28 Jun. For now, a trailing-stop is preferably set above the 24,496-pt threshold to minimise the risk per trade.

Source: RHB Securities Research - 3 Jul 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024