FBM Small Cap Index - Upside View Remains Intact

rhboskres

Publish date: Tue, 03 Jul 2018, 09:42 AM

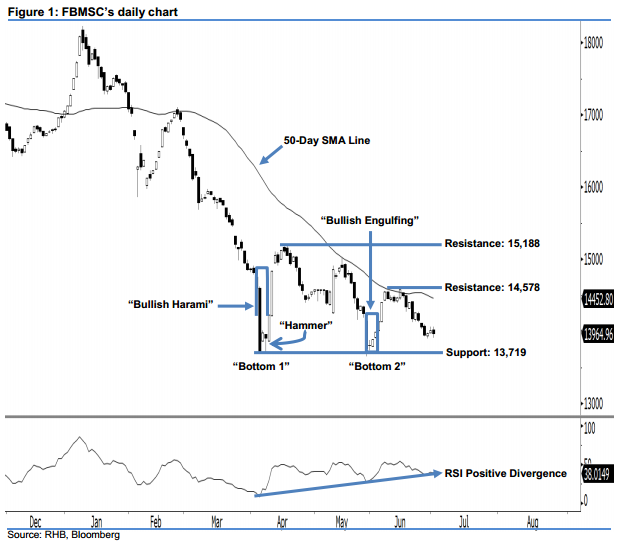

The positive view continues, given that the bullish bias remains in play above 13,719 pts. The FBMSC ended 47.54 pts lower to 13,964.96 pts on Monday. A black candle was formed after the index oscillated between a low of 13,903.94 pts and high of 14,060.45 pts. Nevertheless, as long as the FBMSC manages to stay above the 13,719-pt mark, we make no change to our positive view. At this juncture, we believe the bullish bias since early April has not been fully negated yet.

In the absence of a strong downside development, this implies that the near 3-month upside view remains in play. We initially saw an early sign that the trend may change towards the upside from downside previously. This was after the appearance of the index’s 2-year low reversal signals, ie 5 Apr’s “Bullish Harami” and 6 Apr’s “Hammer” patterns. Overall, the bulls remain in control.

To the downside, the immediate support stays at 13,719 pts. This was the low of 5 Apr’s “Bullish Harami” pattern. If this level is taken out, the following support is seen at 13,116 pts, or the low of 25 Aug 2015. Meanwhile, we set the immediate resistance at 14,578 pts, ie 14 Jun’s high. This is followed by the 15,188-pt resistance, which was the high of 17 Apr.

Source: RHB Securities Research - 3 Jul 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024