WTI Crude Futures - The Bulls Remain In Control

rhboskres

Publish date: Tue, 03 Jul 2018, 09:47 AM

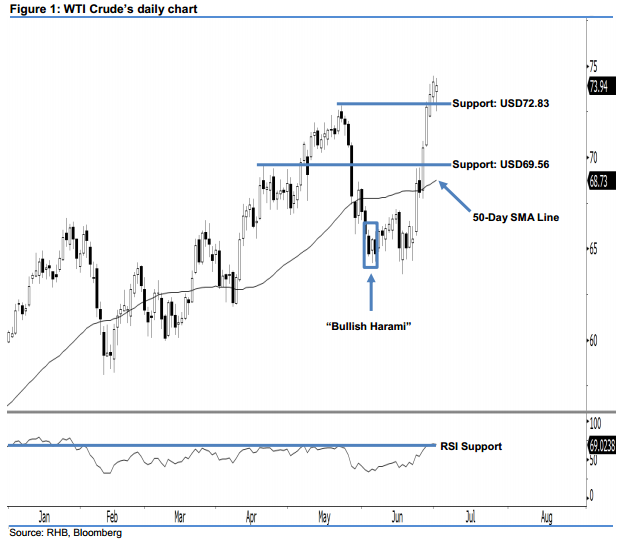

It is still safe to stay in long positions, given that no strong downside development is in sight. The WTI Crude dropped by USD0.21 to USD73.94 last night. However, this does not change our positive view, as no strong bearish development has been sighted yet. From our technical perspective, this breather is viewed as a normal reaction, especially after the commodity successfully breached above the previous USD72.83 resistance mark last week. At this juncture, we believe that the bullish bias highlighted in 5 Jun’s “Bullish Harami” candlestick pattern has not been fully negated yet. Overall, market sentiment remains bullish.

As we do not see any strong bearish activities, this indicates that it is still safe to stay in long positions. Traders are advised to set a trailing-stop below the USD69.56 threshold. This is in order to secure part of the trading profits. Recall that our long call was triggered on 25 Jun, following a strong upside development above the USD67.16 threshold.

The immediate support is maintained at USD72.83, located at the high of 22 May. If this level is taken out, the next support is pegged at the USD69.56 mark, which was the high of 17 Apr. Conversely, our immediate resistance is set at USD75.84, or the low of 4 Nov 2014. This is followed by the USD77.83 resistance mark, obtained from the high of 21 Nov 2014.

Source: RHB Securities Research - 3 Jul 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024